What Is Venture Capital? How VC Funding Works, Stages & Startup Benefits

Venture capital (VC) is a form of financing that provides startups with the capital they need to grow—often in exchange for equity and long-term upside. Backed by institutional funds or high-net-worth investors, VC firms invest in early-stage companies with high growth potential. This guide breaks down how venture capital works, the different funding stages, and what founders should know before raising from VC investors.

KEY TAKEAWAYS

- Venture capital is a specialized form of private equity that funds startups with high growth potential in exchange for equity ownership, operating on a high-risk, high-reward model

- VC firms operate through limited partnerships with a "2 and 20" fee structure—2% annual management fees and 20% carried interest on profits

- Funding progresses through distinct stages from pre-seed to Series C+, with each round serving specific business needs and attracting different investor types

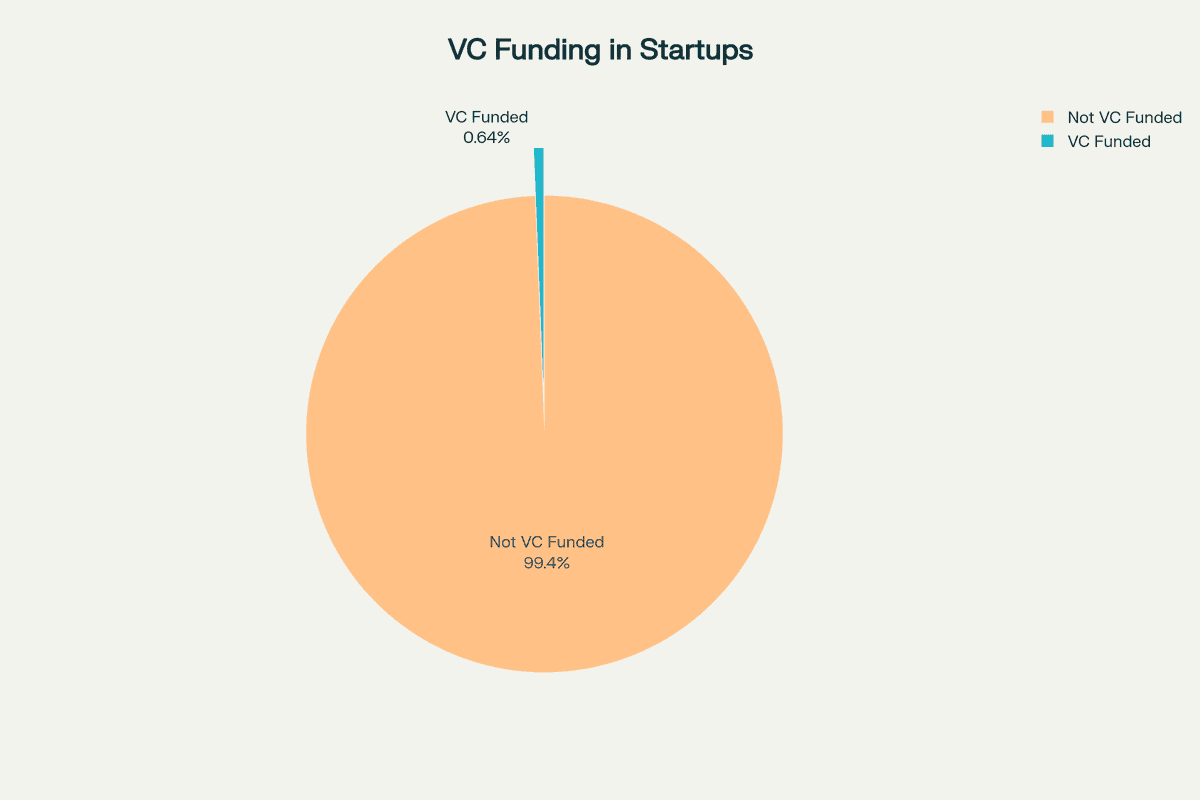

- Only 0.05% to 0.91% of startups receive VC funding, with VCs expecting minimum 10x returns within 7-10 years

- While VCs provide capital, expertise, and networks, founders must weigh benefits against equity dilution (often leaving founders with less than 5% ownership) and loss of control

What is Venture Capital?

Venture capital (VC) represents a specialized form of private equity financing that provides capital to startups and early-stage companies with exceptional growth potential in exchange for equity ownership. At its core, venture capital is risk capital that fuels innovation by investing in companies traditional financial institutions consider too risky to fund.

The Risk-Reward Dynamic

Venture capital operates on a power law distribution where the best investment in a successful fund equals or outperforms the entire rest of the fund combined. This creates a unique investment model where:

- 80% of VC investments fail to return the initial capital

- 5-7% of investments generate the majority of returns

- A single successful investment can return 100x or more, compensating for numerous failures

This skewed distribution means VCs must identify companies capable of achieving massive scale—typically targeting businesses that can reach $100 million in revenue within 5-10 years.

How Venture Capital Differs from Other Funding

Unlike traditional financing methods, venture capital provides:

- Equity investment rather than debt—no monthly repayments or personal guarantees

- Active partnership—VCs take board seats and provide strategic guidance

- Patient capital—investment horizons of 7-10 years for liquidity events

- Value-added services—access to networks, expertise, and follow-on funding

The venture capital industry has demonstrated remarkable economic impact, with VC-backed companies accounting for 20% of U.S. public company market capitalization and 44% of R&D spending. Since 1974, 42% of companies that went public had venture capital backing, including today's tech giants like Apple, Google, Amazon, and Microsoft.

How Does Venture Capital Work?

The venture capital ecosystem operates through a sophisticated structure designed to align interests between fund managers, investors, and entrepreneurs. Understanding this process is crucial for startups seeking funding and for comprehending the broader innovation economy.

The VC Fund Structure

Venture capital funds are predominantly structured as limited partnerships, consisting of:

General Partners (GPs)

- Manage the fund and make investment decisions

- Assume unlimited liability for fund operations

- Typically contribute 1-2% of fund capital

- Earn management fees and carried interest

Limited Partners (LPs)

- Provide 98-99% of fund capital

- Include pension funds, endowments, insurance companies, and high-net-worth individuals

- Have limited liability (can only lose their invested capital)

- Cannot participate in fund management without losing liability protection

The Investment Process

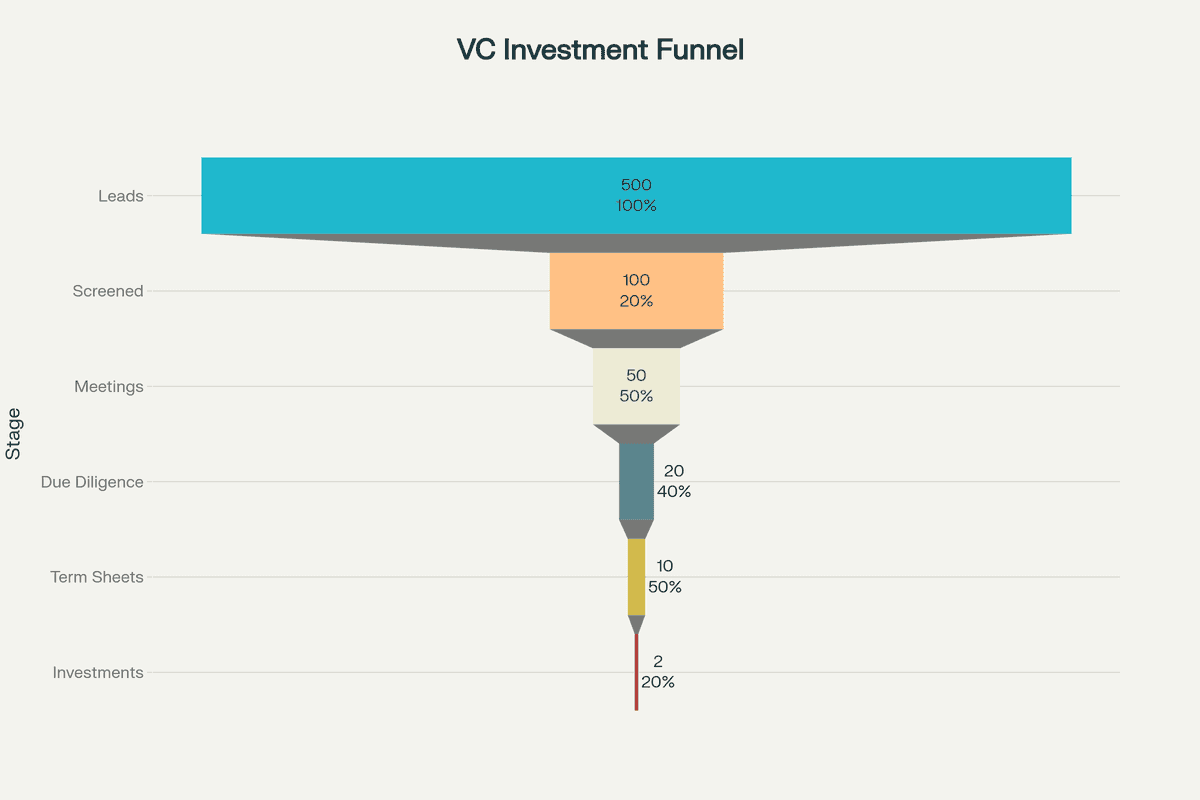

The venture capital investment process follows a systematic funnel approach:

-

Deal Sourcing and Screening

- VCs review approximately 100 opportunities for every investment made

- Initial screening evaluates market size, team strength, and business model viability

- Most deals come through warm introductions and professional networks

-

Due Diligence

- Phase I: Fundamental business assessment (management team, market potential, product viability)

- Phase II: Deep investigation requiring 20+ hours per investment, including:

- Financial analysis and revenue model validation

- Technical evaluation and IP assessment

- Legal review and compliance verification

- Market sizing and competitive analysis

-

Term Sheet Negotiation

- Non-binding agreement outlining investment terms

- Key components include valuation, ownership percentage, board seats, liquidation preferences

- Negotiations balance founder interests with investor protections

-

Legal Documentation and Closing

- Stock purchase agreements, investor rights, and voting agreements

- Process typically takes 30-90 days from term sheet to closing

-

Post-Investment Management

- Active board participation and strategic guidance

- Portfolio support including recruiting, partnerships, and follow-on funding

- Exit strategy preparation and execution

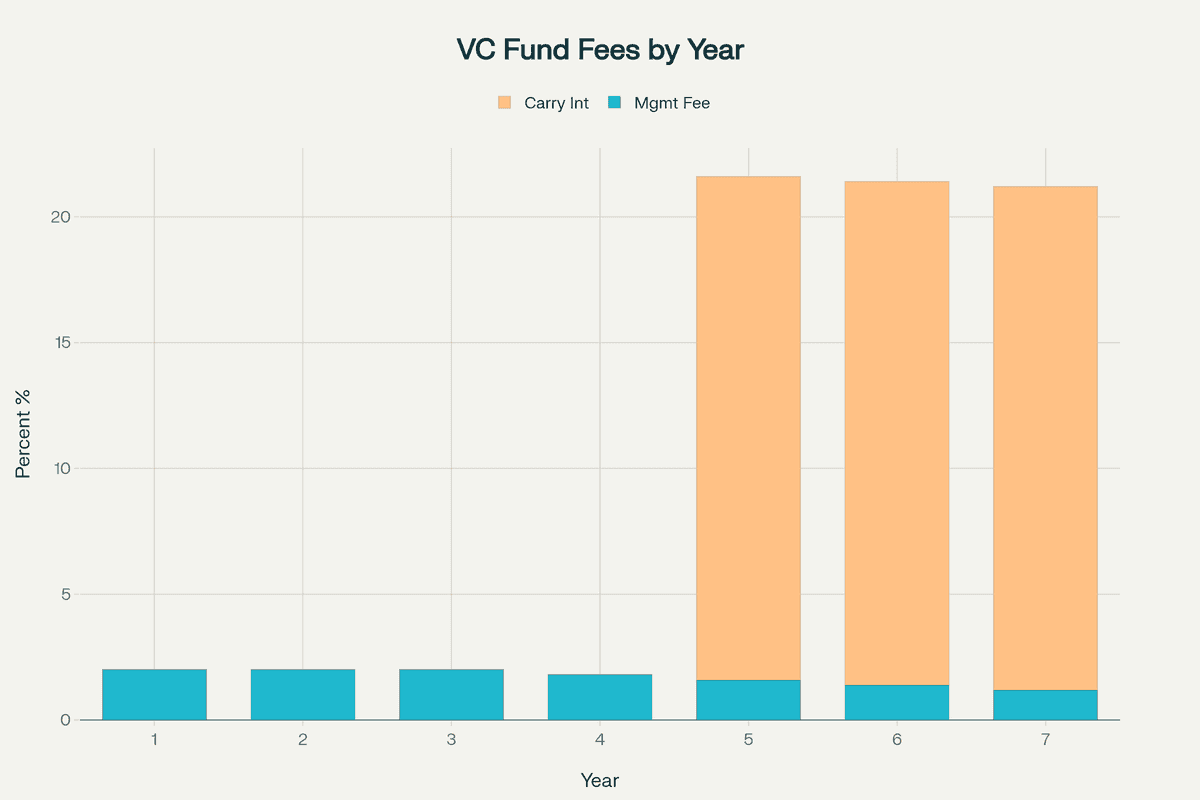

Economics of VC Funds

The "2 and 20" fee structure has become the industry standard:

- 2% annual management fee on committed capital covers operational expenses

- 20% carried interest on profits above returned capital (after any hurdle rate)

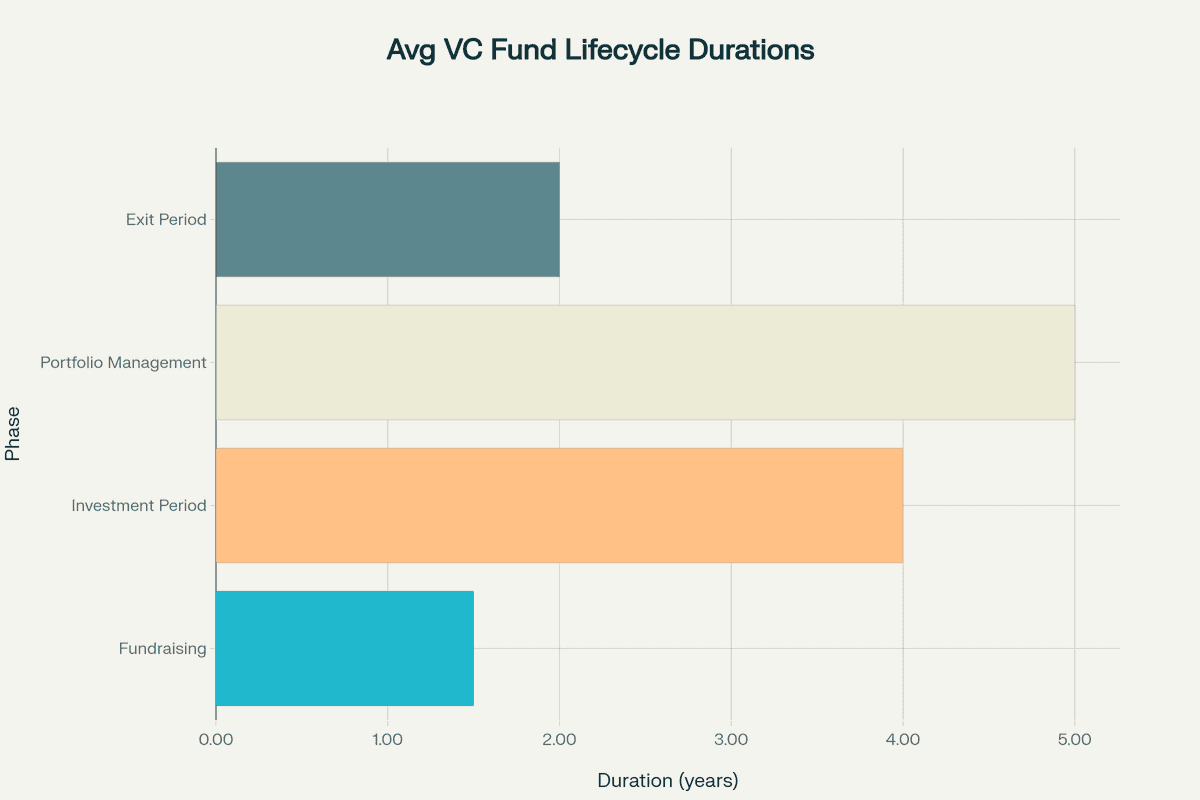

- Fund lifecycles typically span 10 years with possible 2-year extensions

This structure aligns GP compensation with fund performance, ensuring managers are incentivized to generate strong returns for their LPs.

Stages of Venture Capital Funding

Venture capital funding occurs in distinct stages, each serving different business needs and investor expectations. Understanding these stages helps entrepreneurs prepare for their funding journey.

Pre-Seed and Seed Funding

Pre-Seed Funding

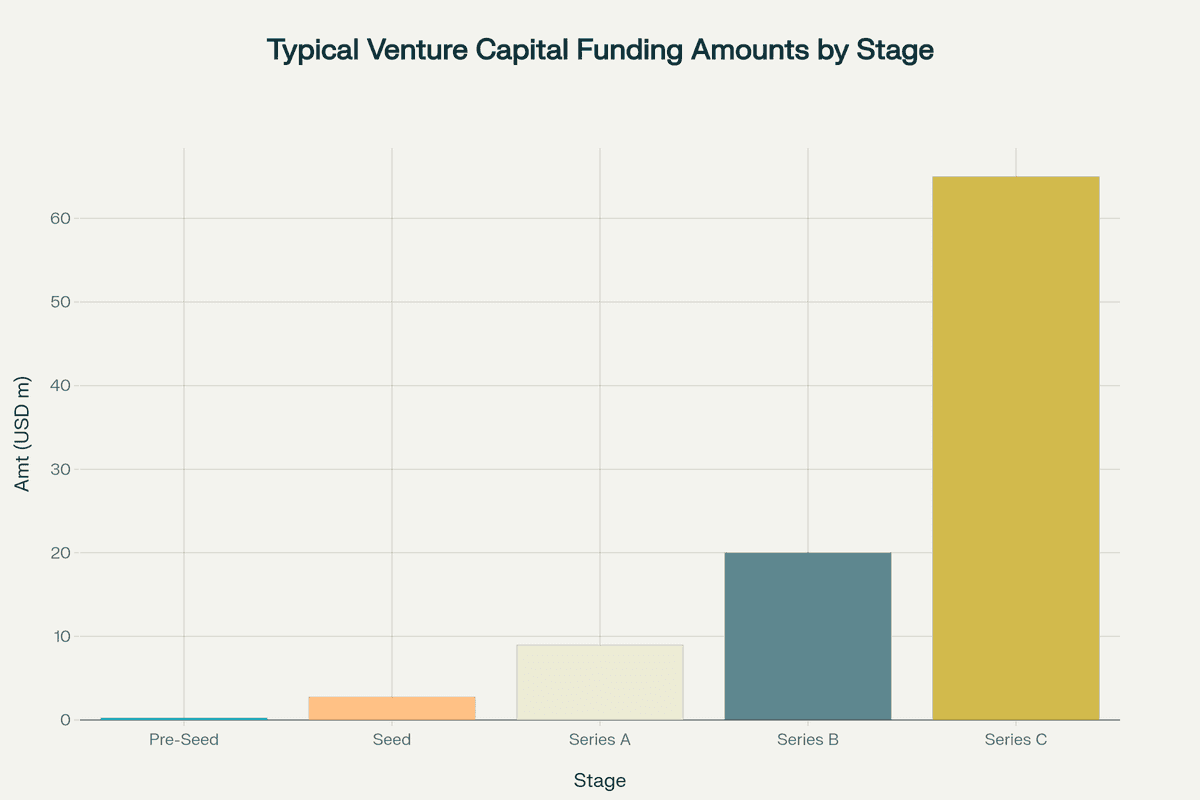

- Amount: $10,000 to $500,000

- Valuation: $10,000 to $100,000

- Purpose: Concept validation, MVP development, market research

- Investors: Friends, family, angel investors, accelerators

- Key Milestone: Proving the problem exists and solution viability

Seed Funding

- Amount: $500,000 to $5 million (median ~$3.5 million in 2024)

- Valuation: $3 million to $10 million

- Purpose: Product development, initial market entry, team building

- Investors: Angel investors, seed funds, early-stage VCs

- Key Milestone: Achieving product-market fit signals

Angel investors play a crucial role at this stage, providing not just capital but industry expertise and mentorship. They often invest $25,000 to $500,000 individually and may syndicate for larger rounds.

Series A Funding

Series A marks the transition to institutional venture capital, focusing on scaling proven concepts:

- Amount: $2 million to $15 million (median ~$7.9 million in early 2025)

- Valuation: $10 million to $50 million pre-money

- Requirements:

- Monthly growth rates of 15-20%

- Annual recurring revenue of $1-2 million

- Clear path to profitability

- Investors: Institutional VC firms

- Focus: Optimizing product, scaling customer acquisition, building operations

Series A investors conduct rigorous due diligence, expecting companies to demonstrate clear product-market fit, consistent growth metrics, and viable paths to profitability.

Series B Funding

Series B focuses on scaling established operations:

- Amount: $10 million to $60 million

- Valuation: $30 million to $200 million

- Requirements:

- Proven business model with strong unit economics

- Monthly recurring revenue of $600,000+

- Established market position

- Investors: Growth-stage VCs, late-stage funds

- Focus: Market expansion, operational scaling, competitive positioning

Series C and Beyond

Late-stage funding prepares companies for exit opportunities:

- Amount: $30 million to hundreds of millions

- Valuation: $100 million to billions (unicorn status)

- Investors: Hedge funds, private equity, investment banks, sovereign wealth funds

- Focus:

- Global expansion

- Strategic acquisitions

- IPO preparation

- Market consolidation

Companies may continue through Series D, E, and beyond, particularly when market conditions delay IPO timing or when pursuing aggressive expansion strategies. The emphasis shifts from growth at any cost to sustainable profitability and operational efficiency.

Advantages of Venture Capital

Venture capital offers comprehensive benefits beyond simple funding, creating an ecosystem that transforms innovative ideas into market-leading companies.

1. Non-Repayable Capital Structure

Unlike traditional loans, VC funding requires no monthly repayments or personal guarantees. If your startup fails, you're not obligated to repay venture capitalists. This structure allows founders to focus entirely on growth without the burden of debt service.

2. Substantial Capital Access

VCs provide access to millions in funding—far exceeding what most startups could secure through traditional financing. This capital enables:

- Rapid team scaling and top talent acquisition

- Significant R&D investments

- Comprehensive marketing campaigns

- Infrastructure development for exponential growth

3. Strategic Expertise and Mentorship

Venture capitalists bring extensive industry knowledge and entrepreneurial experience. Many VCs are former successful founders who provide:

- Strategic guidance on business models and market positioning

- Operational advice on financial and human resource management

- Crisis management and pivot strategies

- Leadership development and executive coaching

4. Powerful Network Effects

VCs provide access to extensive professional networks including:

- Industry experts and advisors

- Potential customers and strategic partners

- Follow-on investors for future rounds

- Acquisition opportunities and exit partners

This network access can be transformational, opening doors to opportunities otherwise inaccessible to early-stage companies.

5. Market Validation and Credibility

VC backing provides powerful market validation. When experienced investors fund your startup, it:

- Signals market confidence to customers and partners

- Attracts top talent through enhanced credibility

- Facilitates better terms with suppliers and vendors

- Generates media coverage and industry recognition

6. Accelerated Growth Trajectory

The combination of capital, expertise, and networks enables:

- Rapid market entry and competitive positioning

- International expansion opportunities

- Innovation support through R&D funding

- Strategic acquisitions to eliminate competition

Research shows VC-backed companies demonstrate 960% employment growth versus 40% for the broader private sector, creating high-quality jobs and economic value.

7. Clear Exit Pathways

VCs work with companies to develop comprehensive exit strategies, whether through:

- Initial Public Offerings (IPOs)

- Strategic acquisitions by larger companies

- Secondary market transactions

Their experience and relationships help maximize exit valuations, benefiting all stakeholders.

Disadvantages of Venture Capital

While VC funding can accelerate growth, entrepreneurs must carefully consider the substantial costs and risks involved.

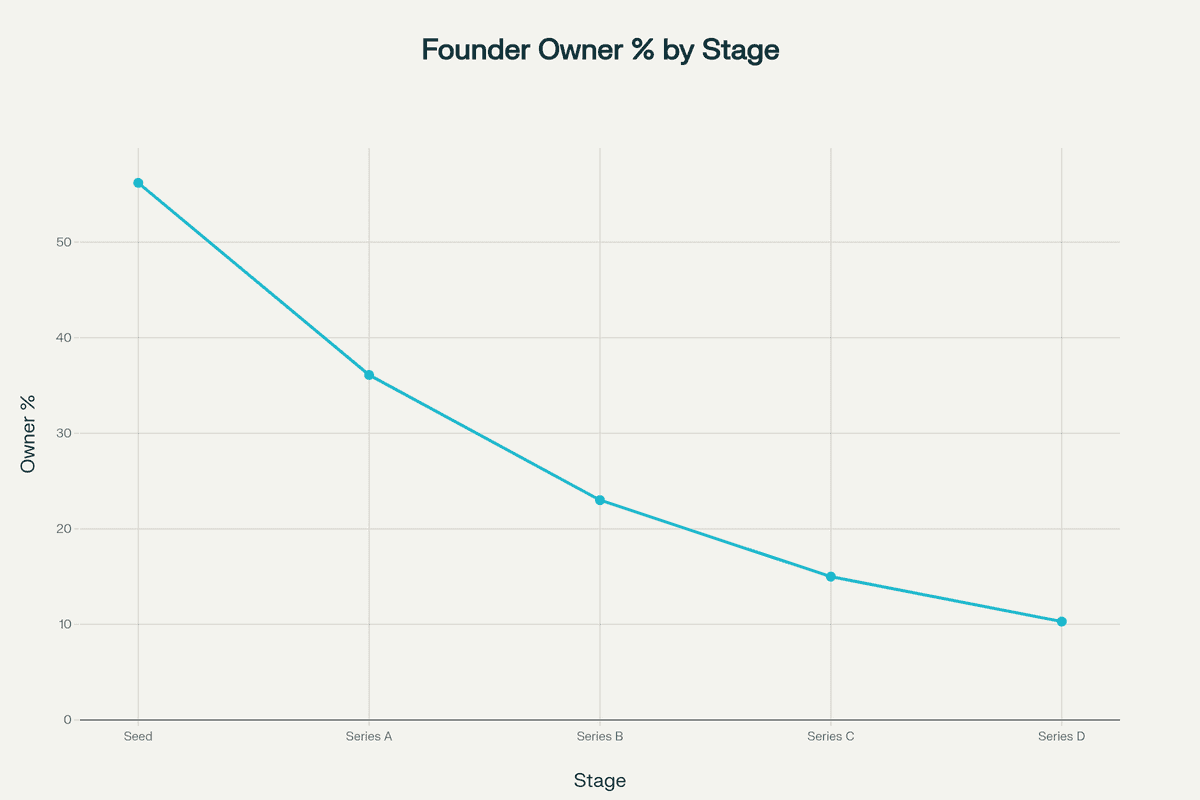

1. Significant Equity Dilution

Each funding round dilutes founder ownership. A typical progression might look like:

- Seed: Founders retain 80-85%

- Series A: Founders drop to 60-65%

- Series B: Founders hold 40-45%

- Series C+: Founders often own less than 20%

Many founders end up with less than 5% ownership in their own companies—a scenario that happens more often than most realize.

2. Loss of Control

VCs typically require:

- Board seats (lead investors receive board seats 61.5% of the time)

- Voting rights on major decisions

- Approval requirements for hiring, spending, and strategy

Research reveals that 50% of founding CEOs are replaced within 18 months of Series A funding. Even when founders remain, they face substantial constraints on decision-making authority.

3. Intense Growth Pressure

VCs target 20-30% annual returns, creating pressure for:

- Unsustainable growth rates

- Premature market expansion

- Short-term metrics over long-term sustainability

- High-risk strategies that may increase failure probability

4. Complex Legal Terms

VC term sheets include provisions heavily favoring investors:

- Liquidation preferences ensuring investors get paid first

- Anti-dilution provisions protecting investor ownership

- Drag-along rights forcing founders to accept exits

- Vesting restrictions on founder equity

5. Limited Exit Flexibility

VC funds have 10-year lifecycles, creating pressure for exits even when:

- Market conditions are unfavorable

- Companies need more time to mature

- Better opportunities might emerge later

VCs under liquidation pressure become more likely to force "fire sales" benefiting preferred shareholders while leaving little for common stockholders.

6. High Failure Rates

The venture capital model's harsh reality:

- 80% of VC-backed startups fail to return investor capital

- 75% of founders receive nothing upon exit

- Only 5-7% of investments generate significant returns

7. Time-Intensive Process

The fundraising process is exhausting:

- Due diligence requires 20+ hours per potential investment

- Fundraising can take 3-6 months of founder focus

- Ongoing investor management demands significant time

- Multiple funding rounds compound these time requirements

Is Venture Capital Right for Your Startup?

Not every business is suitable for venture capital funding. Only 0.05% to 0.91% of startups actually receive VC investment.

Ideal VC Candidates

Business Characteristics

- Large addressable markets ($1 billion+)

- Scalable, asset-light business models

- Network effects or strong competitive moats

- Potential for 10x returns within 7-10 years

- Technology-driven innovation

Financial Profile

- Monthly recurring revenue of $10,000+ with consistent growth

- Path to $100 million revenue within 5-10 years

- Capital-efficient growth model

- Clear monetization strategy

Team Attributes

- Experienced founders with relevant expertise

- Proven execution capabilities

- Openness to mentorship and guidance

- Vision balanced with practical skills

When to Avoid VC

Consider alternatives if:

- You prioritize maintaining control

- Your business can grow organically through revenue

- You're building a lifestyle business

- Your market isn't large enough for VC returns

- You can't commit to aggressive growth targets

Alternative Funding Options

If VC isn't right, consider:

Non-Dilutive Options

- Revenue-Based Financing: Pay back through revenue percentage

- Government Grants: Non-dilutive funding for qualifying businesses

- Crowdfunding: Access diverse investors while maintaining control

Alternative Equity

- Angel Investors: More flexible terms, smaller amounts

- Corporate Venture: Strategic partnerships beyond capital

- Family Offices: Longer investment horizons

Debt Financing

- Venture Debt: Extend runway without dilution

- SBA Loans: Government-backed favorable terms

- Asset-Based Lending: Leverage existing assets

The Future of Venture Capital

The venture capital landscape is evolving rapidly, with several key trends shaping its future:

Technology-Driven Transformation

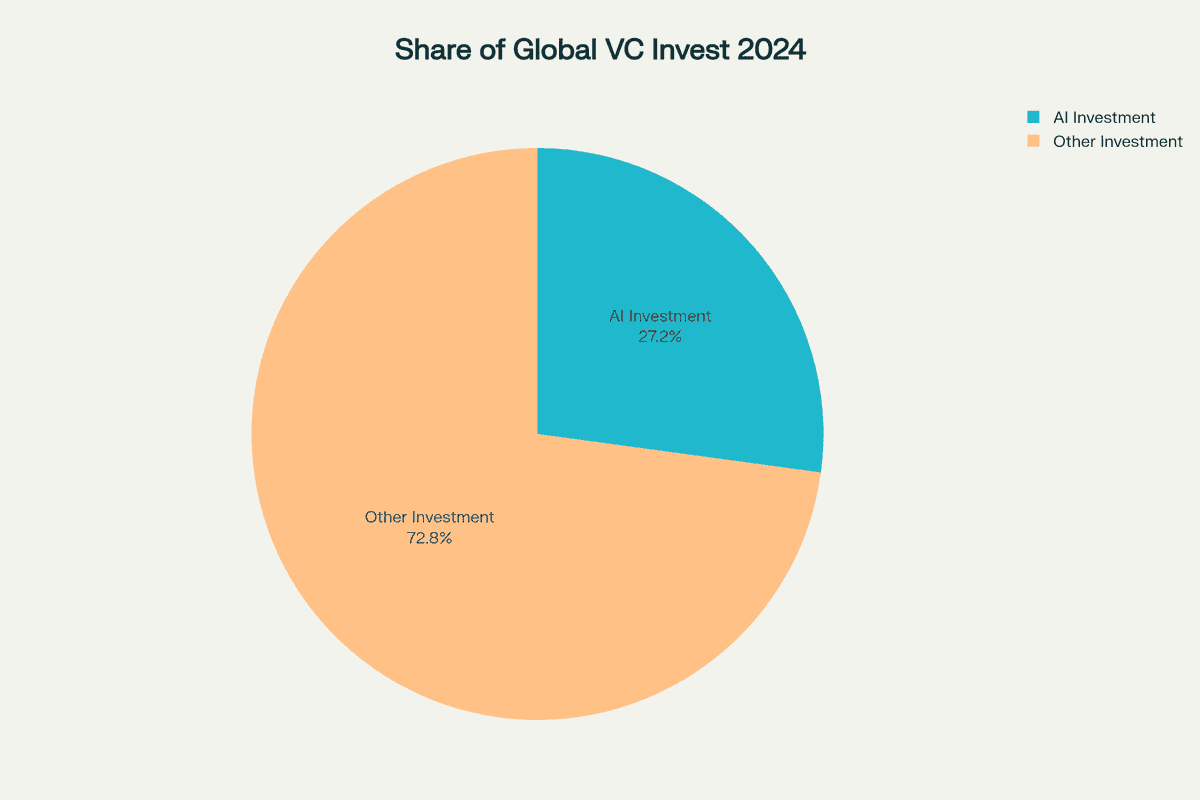

AI Integration: By 2025, AI startups captured 58% of VC deal value, with investments exceeding $131.5 billion globally. AI tools are becoming ubiquitous in VC operations, from deal sourcing to portfolio monitoring.

Deep Tech Expansion: Investment focus is shifting from software to frontier technologies:

- Robotics and automation

- Biotechnology and precision medicine

- Climate tech and sustainability

- Space technology and advanced manufacturing

Democratization of Capital

- Micro-VCs proliferate, lowering barriers for new fund formation

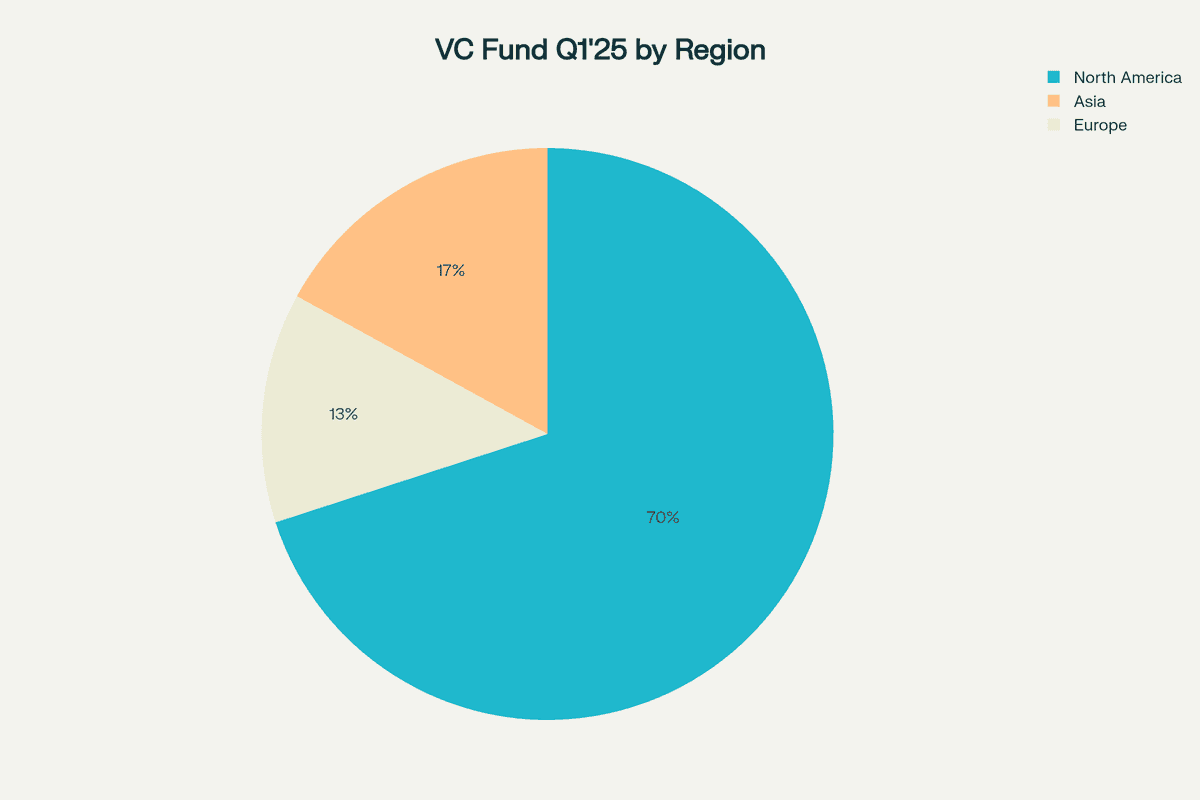

- Global expansion with 80% of new funds launching outside the US by 2030

- Diverse leadership with female and minority GPs exceeding 35% of fund managers

Evolving Fund Structures

- Longer horizons through evergreen and interval fund structures

- Secondary markets providing earlier liquidity options

- Platform services becoming standard for emerging managers

Geographic Diversification

Emerging markets are becoming core allocation regions:

- MENA: 100% YoY funding surge in H1 2025

- Africa: 56% increase in mid-stage capital deployment

- Southeast Asia: Long-term growth despite short-term corrections

- Latin America: New multi-billion funds targeting fintech and climate tech

Predictions for 2030

- At least one private company will achieve $1 trillion valuation

- ESG mandates will drive $100+ billion annual inflows

- Corporate venture capital will become core innovation channels

- Over 40% of LP commitments will originate from emerging markets

Conclusion

Venture capital represents a powerful but selective funding mechanism that has fueled countless innovations and built many of today's most valuable companies. By providing not just capital but expertise, networks, and strategic guidance, VCs help transform ambitious ideas into market-leading enterprises.

However, the path of venture capital is not for everyone. With only a tiny fraction of startups receiving VC funding, and the significant trade-offs in equity and control, entrepreneurs must carefully evaluate whether this funding model aligns with their vision and goals.

Success in the venture capital ecosystem requires:

- Realistic assessment of your business's growth potential

- Clear understanding of the equity and control trade-offs

- Preparation for intense growth pressure and scrutiny

- Alignment between founder vision and investor expectations

For those building truly scalable, high-growth businesses in large markets, venture capital can provide the rocket fuel needed to achieve ambitious goals. But it's essential to enter these partnerships with eyes wide open, understanding both the tremendous opportunities and substantial costs involved.

As the venture capital landscape continues evolving—with new technologies, fund structures, and global markets—the fundamental principle remains: venture capital is a tool best suited for a specific type of company on a specific type of journey. Understanding whether your startup fits that profile is the first crucial step in your funding journey.