Venture Debt Explained: What It Is, Key Terms & When Startups Should Use It

Venture debt is a flexible, non-dilutive financing option designed to complement equity rounds—without giving up ownership. Often used by startups after raising VC funding, venture debt can extend runway, finance equipment, or support acquisitions. In this guide, you'll learn how venture debt works, the key terms and structures involved, and when it’s the right move for your company in 2025’s evolving funding landscape.

KEY TAKEAWAYS

- Venture debt is non-dilutive financing that typically provides 20-35% of your last equity round, preserving founder ownership while extending runway

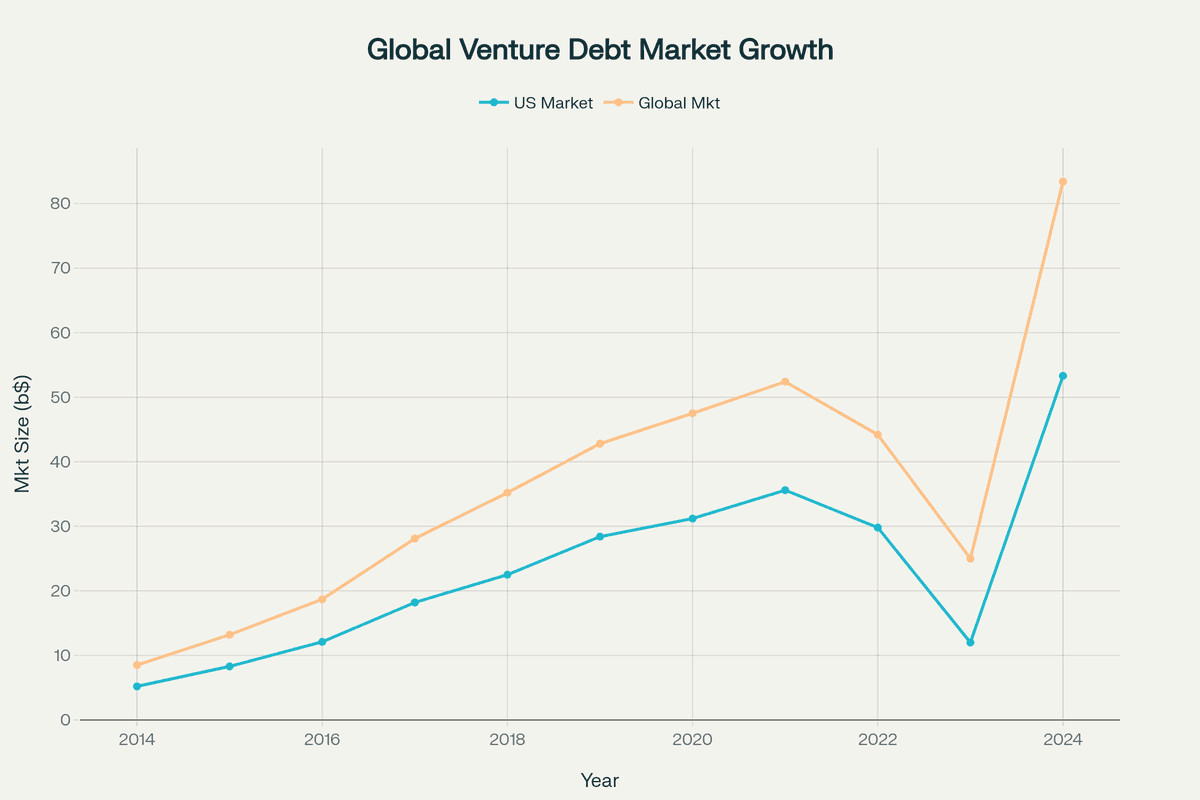

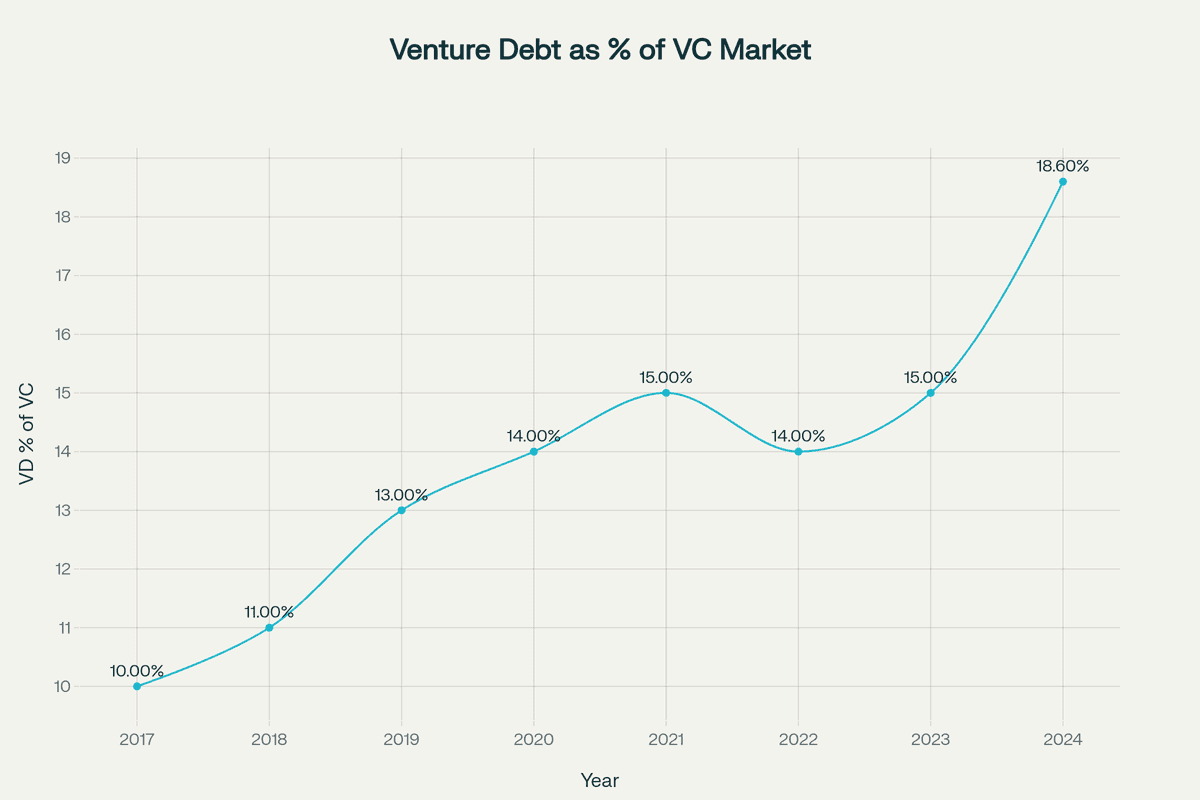

- The global venture debt market reached $83.4 billion in 2024, with U.S. deals averaging $46 million—a 125% increase from previous years

- Optimal timing is immediately post-equity round when you have maximum negotiating leverage and 9-12 months of runway

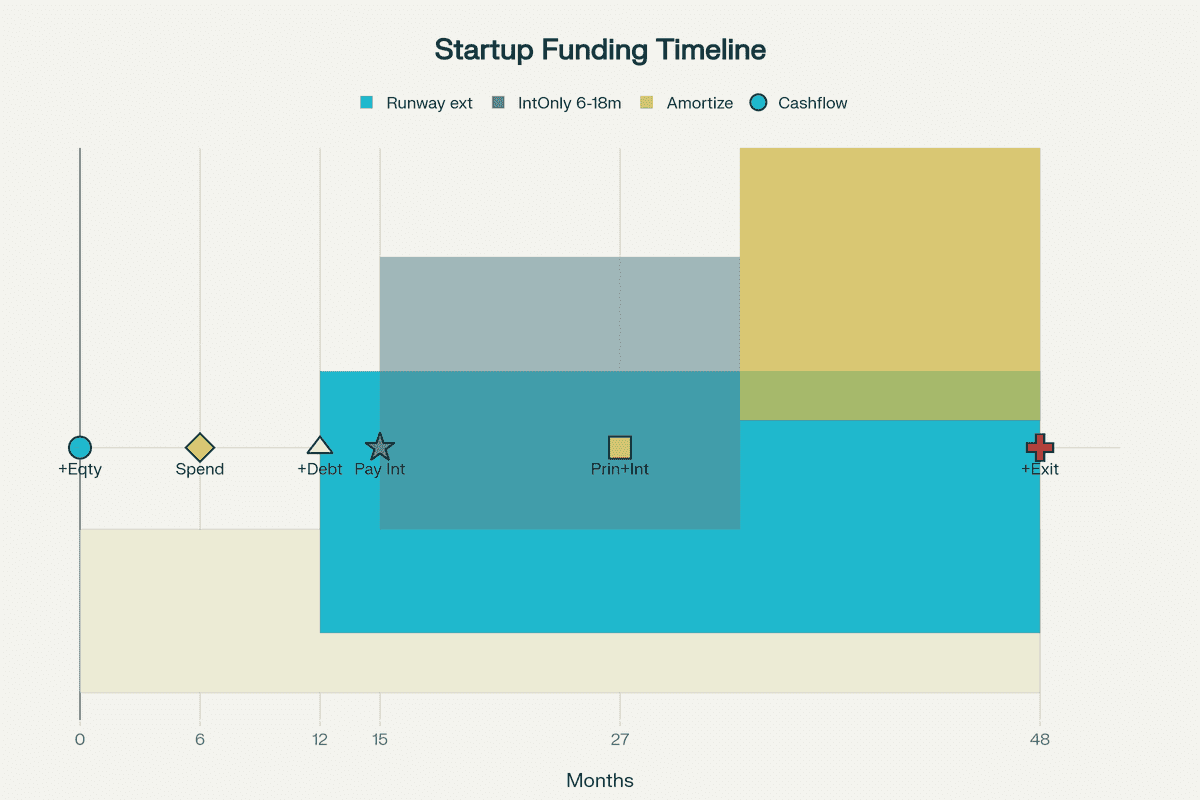

- Interest rates range from 7-15% with 24-48 month terms, often including 6-18 months of interest-only payments

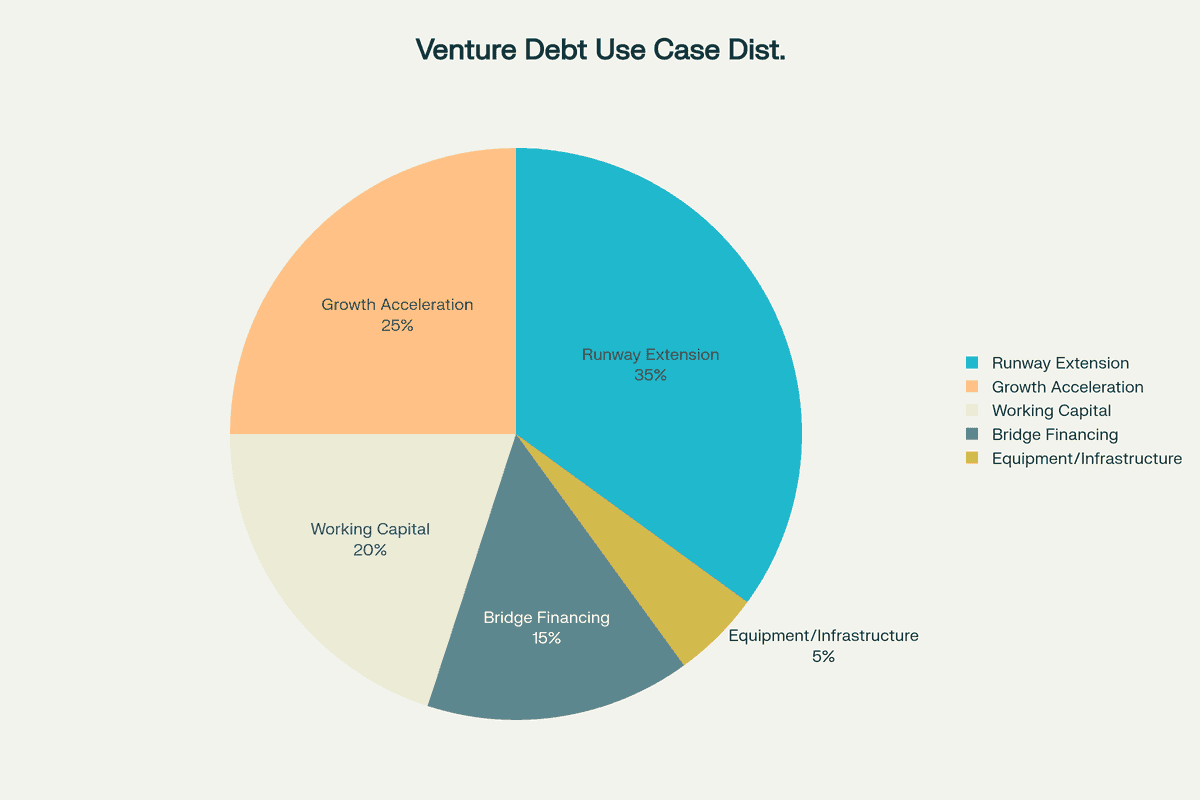

- Strategic applications include runway extension (3-9 months), growth acceleration, M&A financing, and equipment purchases

What Is Venture Debt?

Venture debt is a specialized form of debt financing designed specifically for early-stage, high-growth companies that have already secured venture capital backing. Unlike traditional bank loans that focus on cash flow and collateral, venture debt is underwritten based on the quality of your existing investors and future growth potential.

The fundamental premise of venture debt differs from conventional lending: instead of evaluating historical profitability or tangible assets, lenders assess your company's trajectory, investor backing, and ability to raise future equity rounds. This makes it uniquely suited for startups that are burning cash to capture market opportunities but have strong growth metrics and institutional support.

Core Characteristics of Venture Debt

Non-dilutive Capital Structure: Venture debt allows you to raise capital without giving up significant ownership stakes. While equity investors might take 20-30% of your company, venture debt typically results in only 0.5-4% dilution through warrants.

Complementary to Equity: Venture debt isn't a replacement for equity financing—it's a strategic complement. Most facilities range from 20-40% of your most recent equity round, providing additional runway without the complexity of another equity raise.

Investor Validation Required: You must have existing institutional venture capital investment to qualify. Lenders use your VC backing as third-party validation of your business model and growth potential. The reputation and track record of your investors directly impacts lending terms.

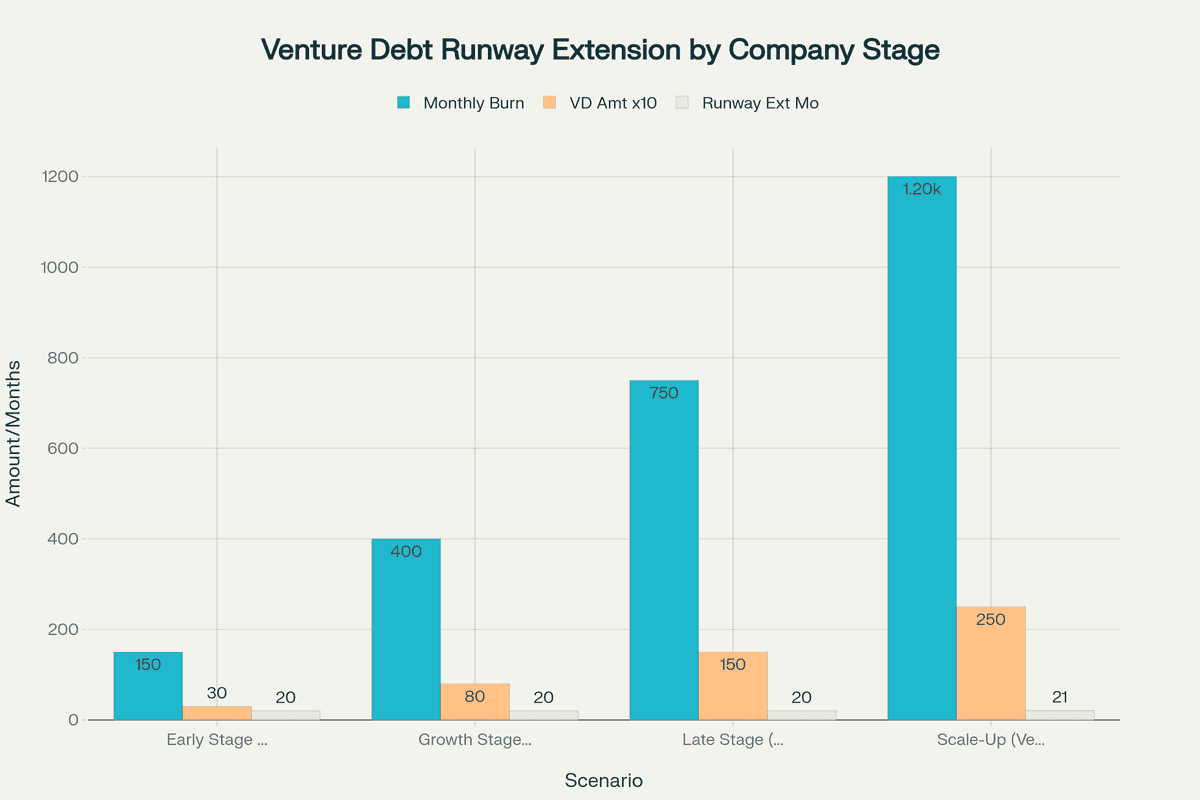

Bridge Financing Function: Venture debt serves as a financial bridge between equity rounds, typically extending runway by 3-9 months. This additional time can be the difference between hitting key milestones at your current valuation versus raising a down round.

How Venture Debt Works

Structural Components and Mechanics

Venture debt operates through a sophisticated framework designed to accommodate the unique characteristics of high-growth startups:

Principal Amounts and Facility Sizing: Loan facilities typically range from $500,000 to $100 million, with most deals falling between $2-10 million. The facility size is generally calculated as 20-35% of your most recent equity round, though companies with strong metrics may access up to 50%.

Interest Rate Architecture: Venture debt carries higher rates than traditional loans due to the elevated risk profile. Rates typically structure as:

- Base rate (Prime or SOFR): 5-8%

- Credit spread: 400-800 basis points

- Total all-in rate: 8-15% annually

Most facilities use floating rates that adjust with market conditions, creating the need for interest rate scenario planning in your financial models.

Repayment Structures: The repayment framework accommodates startup cash flow dynamics:

- Interest-only period: 6-18 months where you only pay interest, preserving cash for growth

- Amortization phase: 18-36 months of principal plus interest payments

- Bullet repayment options: Some facilities allow full repayment at maturity, particularly for later-stage companies

Draw-Down Flexibility: Many facilities provide tranched access over 6-12 months, allowing you to minimize interest costs by drawing capital only as needed. This structure requires careful planning to ensure funds are available when required.

The Warrant Component

Warrants represent the equity upside for lenders, compensating them for the risk of lending to cash-burning companies:

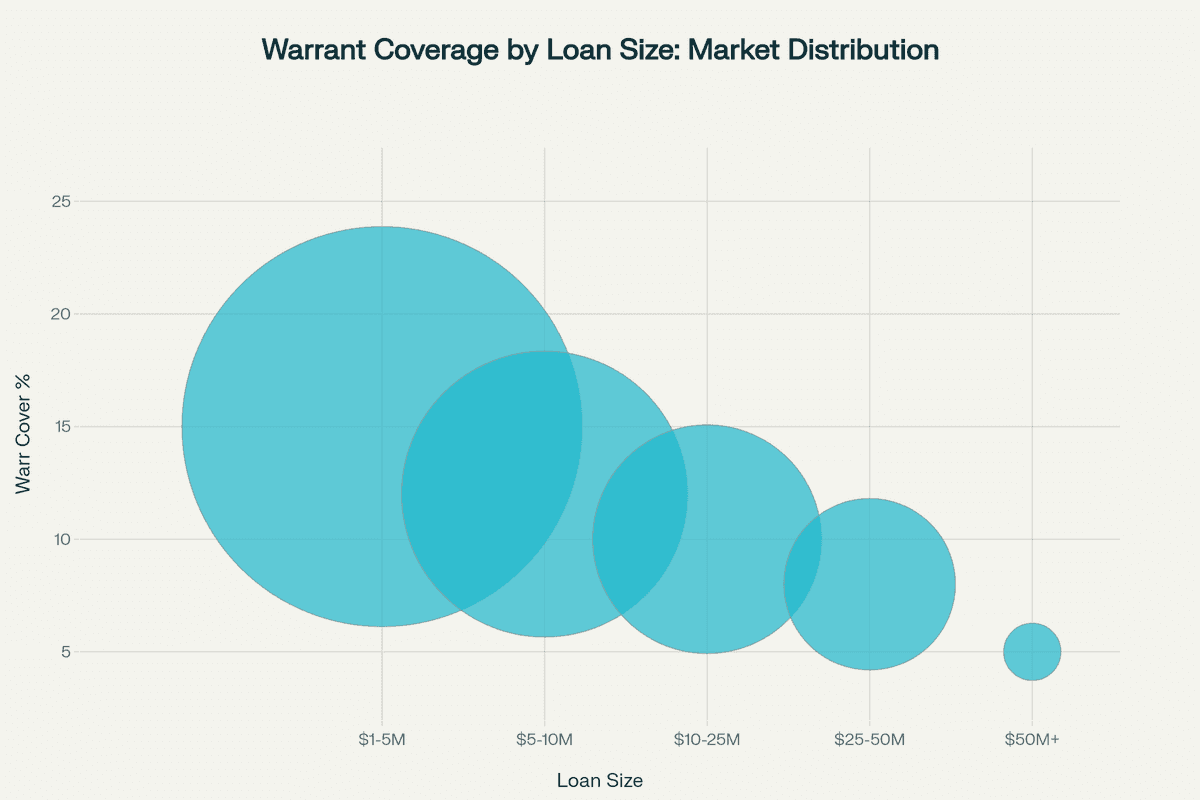

Coverage Rates: Warrant coverage typically ranges from 5-20% of the loan value, translating to 0.5-4% dilution when exercised. A $5 million loan with 10% warrant coverage would grant the lender warrants worth $500,000.

Pricing Mechanisms: Warrants are typically priced at:

- Current round valuation (most common)

- Discount to next round (10-20% discount)

- Negotiated future valuation

Exercise Periods: Warrants remain exercisable for 5-10 years, allowing lenders to participate in long-term value creation. This extended timeline means warrant dilution often occurs at exit events when the impact is less noticeable.

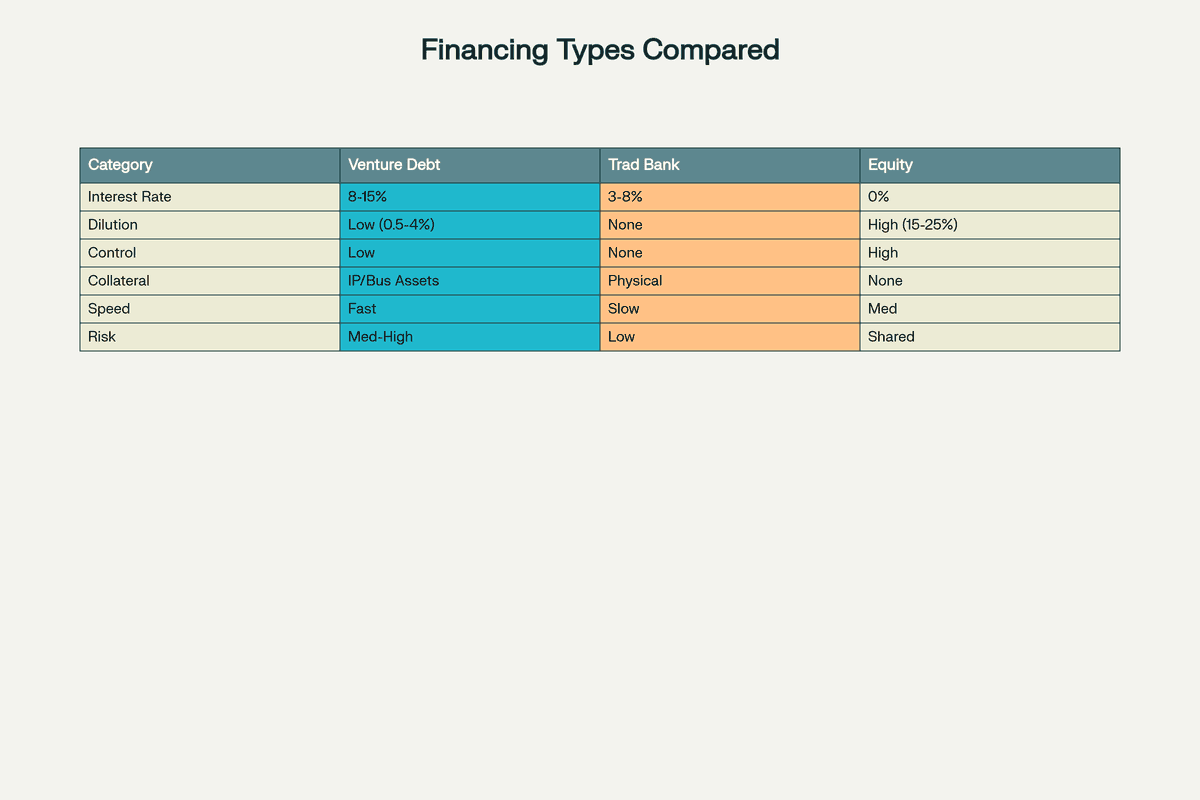

Venture Debt vs. Traditional Financing

Comparison with Bank Loans

The distinctions between venture debt and traditional bank financing reflect fundamentally different risk assessment models:

Underwriting Philosophy:

- Traditional banks: Focus on historical cash flows, profitability, and tangible collateral

- Venture lenders: Evaluate growth potential, investor quality, and future equity raise probability

Collateral Requirements:

- Traditional loans: Require hard assets like real estate, equipment, or inventory

- Venture debt: Secured by intellectual property, future revenue streams, and general business assets

Covenant Structures:

- Bank loans: Strict financial ratios, profitability requirements, and operational restrictions

- Venture debt: Growth-oriented covenants focusing on liquidity, revenue milestones, and burn rate management

Comparison with Equity Financing

Understanding when to use debt versus equity is crucial for capital structure optimization:

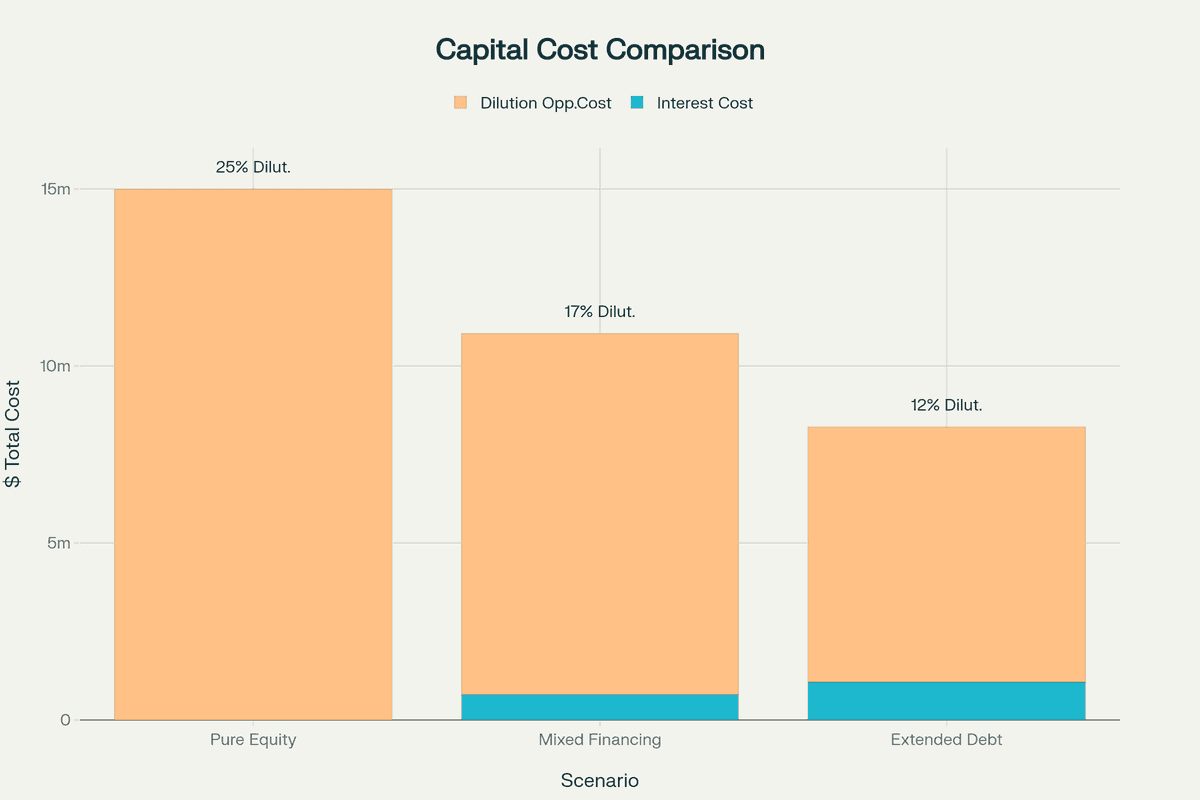

Dilution Impact:

- Equity financing: Permanent ownership transfer of 15-30% per round

- Venture debt: Minimal dilution of 0.5-4% through warrants only

Control Implications:

- Equity investors: Often receive board seats and voting rights

- Debt lenders: No board representation or operational control

Cost Analysis:

- Equity: No cash cost but permanent value sharing

- Debt: 8-15% annual interest but preserves upside

Use Case Alignment:

- Equity: Best for major pivots, long-term investments, and high-risk initiatives

- Debt: Optimal for predictable growth investments and runway extension

Strategic Applications of Venture Debt

1. Extending Runway Without Dilution

The most common venture debt application is runway extension between equity rounds. This strategy provides crucial benefits:

Milestone Achievement: An additional 3-9 months allows you to hit critical inflection points—launching products, achieving profitability, or reaching revenue milestones that justify higher valuations. A SaaS company growing from $100k to $300k MRR during the debt period could see valuation multiples increase significantly.

Market Timing Optimization: Venture debt provides flexibility to wait for favorable market conditions. During the 2022-2023 downturn, companies with venture debt could delay fundraising until valuations recovered, avoiding down rounds that would have caused significant dilution.

Negotiation Leverage: Extended runway means you're never desperate when fundraising. This leverage translates directly into better terms, higher valuations, and more investor options.

2. Funding Growth Initiatives

Venture debt enables aggressive growth investments without immediate dilution:

Customer Acquisition Acceleration: Fund sales team expansion and marketing campaigns where ROI is predictable. If your CAC payback period is under 12 months, debt financing for customer acquisition can be highly accretive.

Product Development: Accelerate feature development or new product launches that drive competitive differentiation. This is particularly effective when you have validated customer demand but need capital to deliver.

Geographic Expansion: Enter new markets or verticals without diluting ownership. The debt provides working capital for hiring local teams and establishing operations while preserving equity for long-term value creation.

3. M&A and Strategic Acquisitions

Venture debt has emerged as a powerful tool for consolidation strategies:

Speed of Execution: Debt financing closes faster than equity rounds, enabling you to move quickly on acquisition opportunities. In competitive situations, this speed can make the difference between winning and losing deals.

Valuation Efficiency: Avoid complex valuation discussions with equity investors. Using debt for acquisitions means you can focus on integration rather than negotiating your own valuation.

Market Consolidation: In downturns, venture debt enables you to acquire distressed competitors or complementary technologies at attractive prices, accelerating market share capture.

4. Equipment and Infrastructure Financing

Capital expenditure financing through venture debt preserves cash for operational needs:

Manufacturing Scale-Up: Finance production equipment and automation systems that directly drive revenue growth. Clean tech and hardware companies regularly use this strategy to achieve economies of scale.

Technology Infrastructure: SaaS companies leverage equipment financing for data centers and server capacity, matching payment terms to revenue generation from enhanced capabilities.

Laboratory Equipment: Biotech startups finance specialized research equipment, enabling cutting-edge development without massive upfront capital requirements.

Venture Debt Market Dynamics and Provider Landscape

Current Market Conditions

The venture debt market has undergone significant transformation:

Post-SVB Evolution: Silicon Valley Bank's collapse in March 2023, which controlled 60-70% of the venture debt market, created initial disruption but ultimately led to market diversification. Non-bank lenders and private credit funds filled the gap, offering more flexible terms and broader geographic coverage.

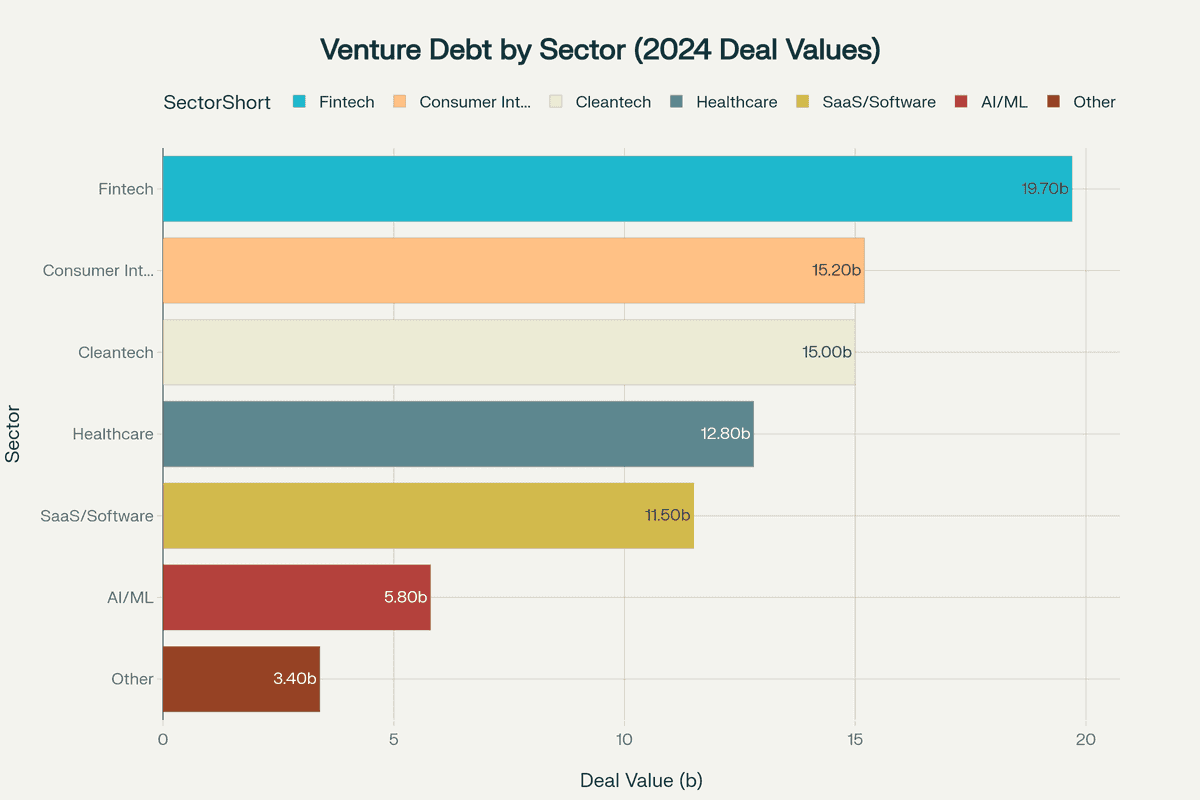

Record Growth: 2024 saw unprecedented venture debt activity:

- Global market reached $83.4 billion (46% YoY growth)

- U.S. market hit $53.3 billion (94% increase)

- Average deal sizes grew to $46 million (125% increase)

European Expansion: European venture debt reached €26.5 billion in 2024, with debt now representing 35% of total startup funding in the region.

Major Provider Categories

Specialized Venture Debt Funds:

- Hercules Capital: Largest non-bank provider with $5B+ AUM

- Trinity Capital: $4.1B in fundings across five verticals

- BlackRock (via Kreos Capital): €2.4B European focus

- TriplePoint Capital: Global platform with $10K-$100M deals

Banks with Venture Practices:

- First Citizens (formerly SVB): Continuing SVB's legacy with $2.5B deployment capacity

- HSBC Innovation Banking: Europe's most active provider

- Comerica Bank: $4B AUM in technology lending

- Western Alliance Bank: Dedicated venture debt specialists

Regional and Specialized Lenders:

- European Investment Bank: €980M deployed in 2024

- Claret Capital Partners: £132M to European tech companies

- Oxford Finance: $14B+ to healthcare companies globally

Venture Debt Risk Management and Considerations

Financial Risks and Mitigation

Repayment Obligations: Unlike equity, debt requires payment regardless of performance. Companies must model debt service under various scenarios, ensuring adequate liquidity even if growth falls short of projections.

Default Consequences: Covenant breaches can trigger defaults, potentially leading to asset seizure or forced restructuring. The probability of default for venture debt portfolios approaches 44% over typical 3-4 year terms.

Interest Rate Exposure: With floating rate structures, rising rates can significantly increase debt service costs. Companies should model rate scenarios and consider hedging strategies for larger facilities.

Covenant Management

Modern venture debt covenants focus on growth metrics rather than profitability:

Financial Covenants:

- Minimum cash balances (typically 3-6 months of burn)

- Revenue growth thresholds (often 85% of plan)

- Liquidity ratios and runway requirements

Operational Restrictions:

- Limitations on additional debt and asset sales

- Change of control provisions

- Dividend and distribution restrictions

Material Adverse Change (MAC) Clauses: These subjective provisions allow lenders to declare default based on business deterioration. Companies should negotiate specific thresholds and cure periods to limit MAC risk.

How to Secure Venture Debt

Preparation Checklist

Financial Documentation:

- Three years of audited/reviewed financials

- Detailed 2-3 year projections with monthly granularity

- Current management accounts and KPI dashboards

- Cohort analyses and unit economics

Business Positioning:

- Clear use of funds tied to specific milestones

- Demonstrated product-market fit metrics

- Competitive analysis and market positioning

- IP portfolio documentation

Process Management:

- Board approval for debt financing

- Updated legal documentation

- Clean cap table and corporate structure

- Reference list from existing portfolio companies

Optimal Process Timeline

Weeks 1-2: Initial outreach to 5-7 potential lenders Weeks 3-6: Due diligence and application submission Weeks 7-8: Term sheet negotiation and comparison Weeks 9-12: Documentation and closing

Success Factors

Timing: Raise debt when strong, not desperate. The best terms come immediately after equity rounds when you have maximum leverage.

Competition: Create competitive dynamics with multiple term sheets. Transparency about competing offers is expected and improves terms.

Partnership Approach: Evaluate lenders based on their behavior during difficult periods, not just pricing. References from companies that faced challenges are invaluable.

Conclusion

Venture debt has evolved from a niche financial instrument to a mainstream strategic tool, with 2024's record $83.4 billion in global deployments demonstrating its critical role in the startup ecosystem. When properly structured and timed, venture debt provides powerful advantages: extending runway without dilution, funding specific growth initiatives, and maintaining strategic flexibility.

Success with venture debt requires understanding it as a complement to, not replacement for, equity financing. The keys are strategic timing (raise when strong), careful preparation (professional documentation and clear use of funds), and thoughtful lender selection (partnership over price).

As the market continues to mature with new entrants and innovative structures, venture debt will remain an essential tool for capital-efficient growth. Companies that master its strategic application will maintain competitive advantages through optimized capital structures and accelerated growth trajectories.