Fund Lifecycle Explained: Key Stages from Fundraising to Exit

The lifecycle of a private equity or venture capital fund spans multiple phases—from raising capital to deploying it, growing portfolio companies, and ultimately exiting investments. Each stage comes with distinct strategies, timelines, and responsibilities for both fund managers and limited partners. This guide breaks down the full fund lifecycle, explaining what happens at each phase and how value is created along the way.

Key Takeaways

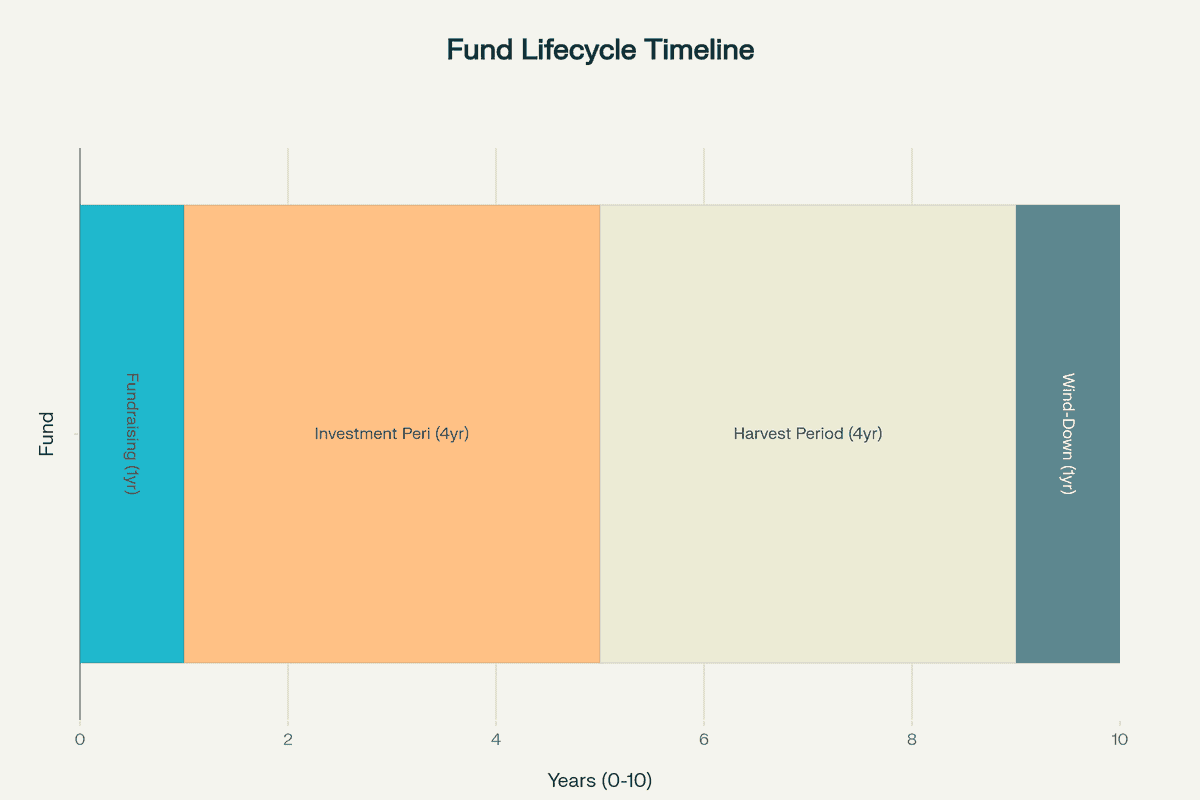

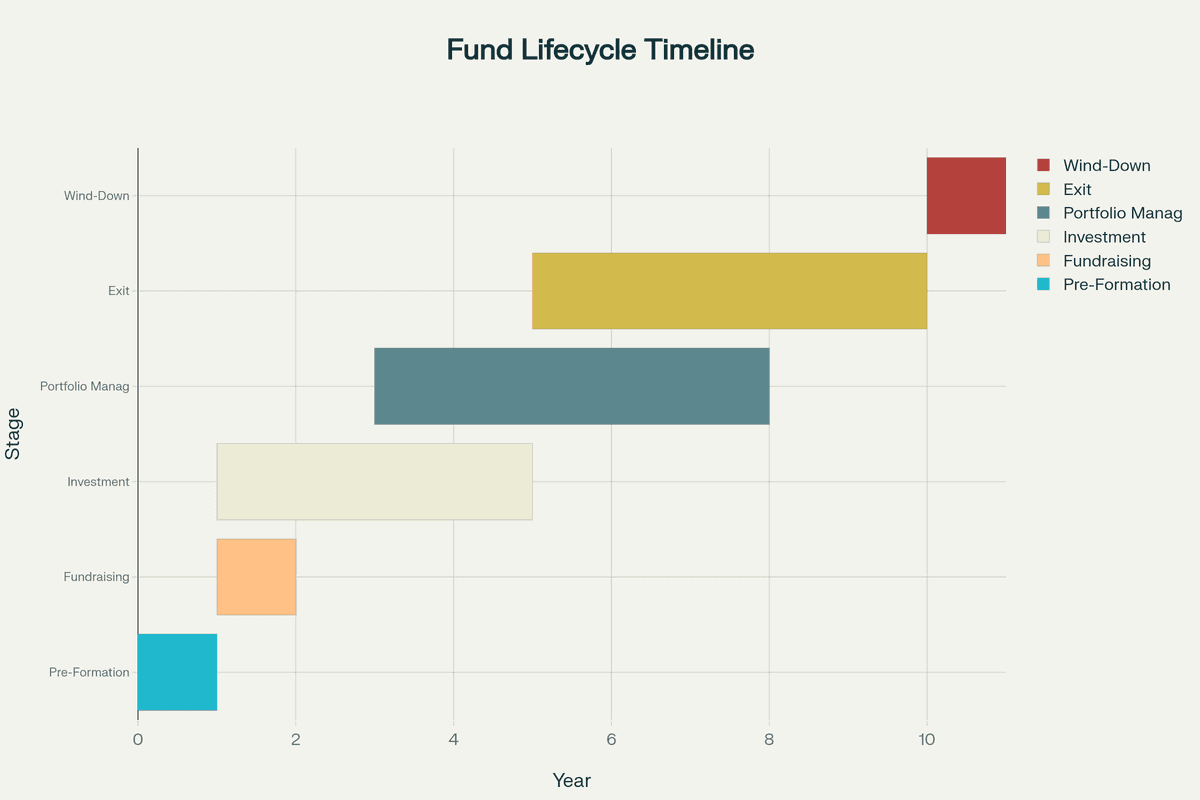

- Fund lifecycles typically span 10-15 years with distinct phases: fundraising (1-2 years), investment period (3-5 years), value creation (5-7 years), and harvest period (2-3 years)

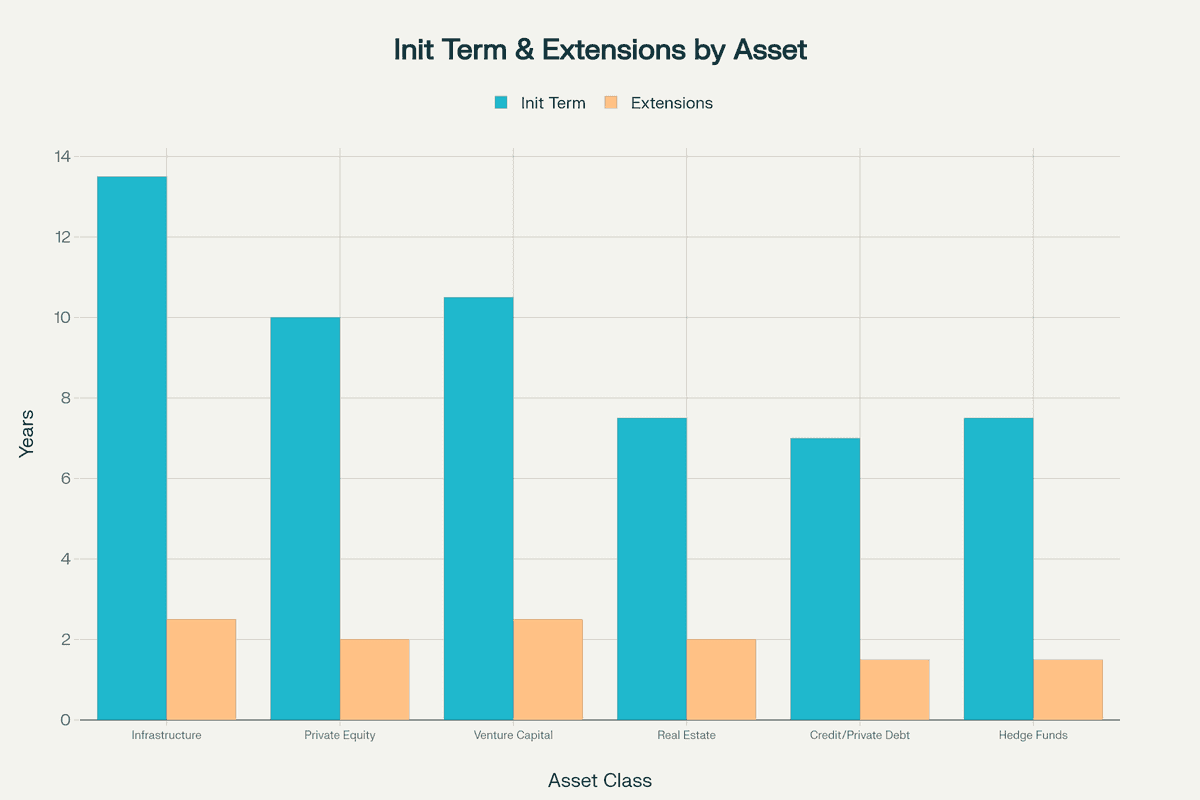

- Infrastructure funds exhibit the longest terms (12-15 years), while credit funds tend toward shorter durations (6-8 years)

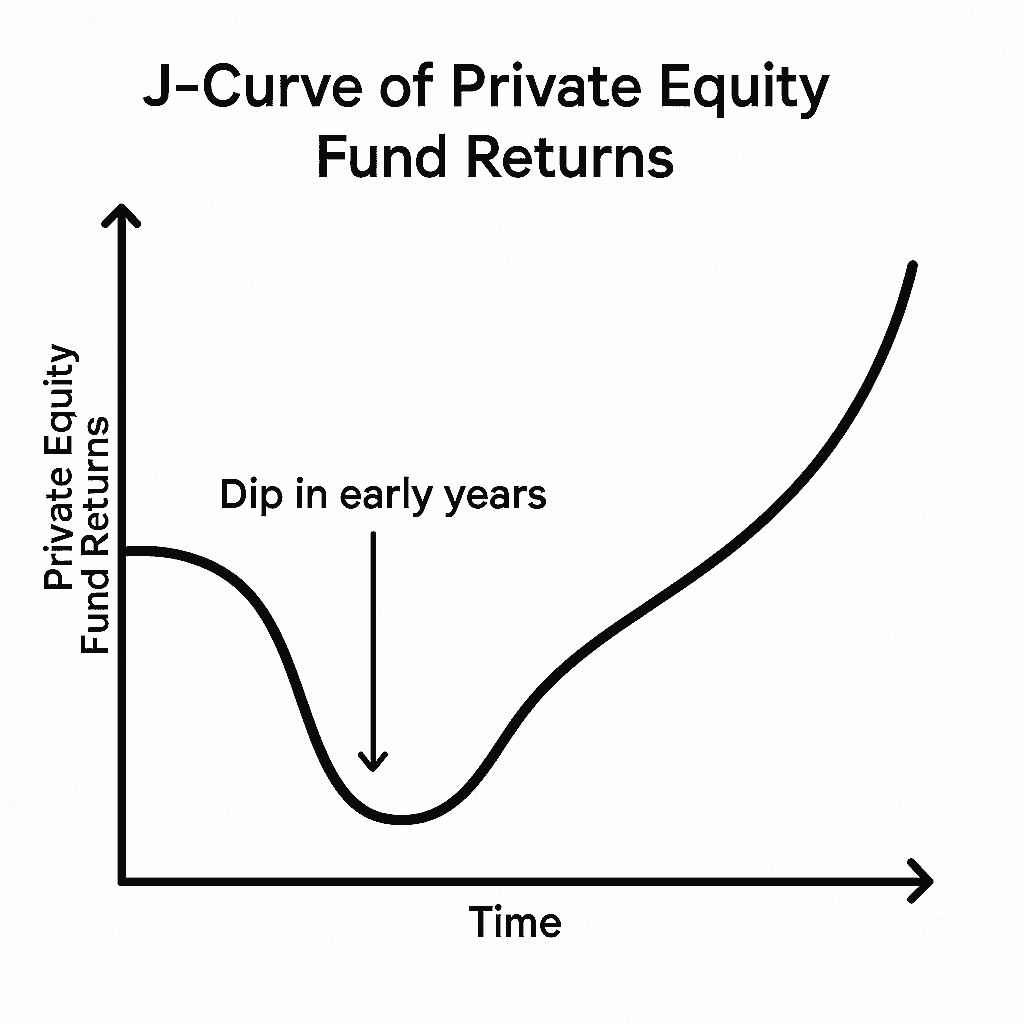

- The J-curve effect means early years show negative returns from fees before value creation generates positive returns

- Fund extensions of 1-3 years are common when market conditions or portfolio performance require additional time

- Each lifecycle stage carries unique implications for LPs, GPs, portfolio companies, employees, and broader stakeholders

What Is Fund Lifecycle?

Fund lifecycle refers to the predefined sequence of stages that an investment fund undergoes from its formation to its dissolution. This concept applies broadly to any fund with a finite term, distinguishing it from evergreen or open-ended vehicles. In private markets, the term encompasses everything from initial fundraising to final capital distributions.

The lifecycle framework applies across various fund types including:

- Private Equity Buyout Funds: Typically 10-year terms focusing on mature company acquisitions

- Venture Capital Funds: Average 10-13 years given startup maturation timelines

- Infrastructure Funds: Extended 12-15 year horizons for long-lived project development

- Real Estate Funds: Shorter 5-10 year terms aligned with property cycles

- Credit/Private Debt Funds: Mid-term 6-8 year horizons matching loan maturities

Investment funds operate as limited partnerships where general partners (GPs) manage capital committed by limited partners (LPs). This structure creates alignment between fund managers who invest expertise and time with investors who provide capital. While the exact number of stages varies by fund type, a typical closed-end fund follows four to six phases over its predetermined horizon.

The Core Stages of Fund Lifecycle

Stage 1: Pre-Fund Formation and Fundraising (1-2 Years)

Before any capital is raised, prospective General Partners crystallize the fund's investment thesis and establish its legal structure. Key activities include defining sectoral, geographic, and risk-return targets, drafting offering documents (private placement memorandum, limited partnership agreement, subscription documents), and securing regulatory approvals.

The fundraising process involves multiple components:

Pre-Closing & Marketing: GPs develop detailed investment theses, present track records, and negotiate terms with potential LPs. This phase requires extensive relationship building and trust development.

Capital Commitment Structure:

- First Closing: Marks the initial round of commitments, allowing the fund to begin operations

- Subsequent Closings: Follow-up rounds to raise additional capital from investors

- Final Closing: Concludes the fundraising period, locking in total capital available

During fundraising, LPs conduct rigorous due diligence on:

- GP track record and team stability

- Investment strategy alignment

- Fee structure and governance terms

- Operational infrastructure and compliance

Successful fundraising requires demonstrating clear value proposition, proven execution capabilities, and alignment of interests. Capital commitments are legally binding but drawn down over the ensuing investment period through capital calls.

Stage 2: Investment Period (3-5 Years)

The investment period represents the active deployment phase when GPs put committed capital to work. Over the first 3-5 years, funds deploy 60-80% of committed capital into target companies or assets while maintaining reserves for follow-on investments.

Deal Sourcing and Screening: Fund managers leverage proprietary networks, investment banks, and intermediaries to identify potential investments. Effective sourcing requires:

- Extensive market coverage and relationship cultivation

- Clear investment criteria and thesis alignment

- Competitive positioning to access proprietary deals

Due Diligence Process: Comprehensive evaluation encompasses:

- Financial analysis and quality of earnings assessment

- Market dynamics and competitive positioning

- Operational capabilities and improvement opportunities

- Legal structure and risk factors

- Management team evaluation

Capital Calls and Deployment: As deals close, GPs issue capital calls to LPs, typically requiring fund transfers within 7-10 days. The deployment pace must balance:

- Market opportunity availability

- Selectivity and discipline

- Portfolio diversification goals

- Reserve requirements for follow-ons

This active investment period establishes the majority of portfolio positions that will drive fund returns.

Stage 3: Portfolio Management and Value Creation (5-7 Years)

The value creation phase represents the longest stage where funds actively work with portfolio companies to enhance performance. Following deployment, funds enter a management phase focused on operational improvements and strategic initiatives.

Governance and Oversight:

- Board representation and strategic guidance

- Performance monitoring and reporting systems

- Risk management and compliance oversight

- Stakeholder alignment and incentive structures

Operational Excellence Initiatives:

- Process optimization and efficiency improvements

- Technology implementation and digital transformation

- Supply chain enhancement and cost management

- Organizational restructuring and talent development

Strategic Growth Drivers:

- Market expansion and new customer acquisition

- Product innovation and service enhancement

- Buy-and-build strategies through add-on acquisitions

- International expansion and channel development

Financial Engineering:

- Capital structure optimization

- Working capital improvements

- Refinancing at favorable terms

- Financial controls and reporting enhancement

Active portfolio management bridges investment and harvest phases, with value creation directly impacting exit valuations and fund returns.

Stage 4: Harvest Period and Exit (Years 5-10)

Beginning around Year 5-7, GPs pursue liquidity events to realize gains and return capital to investors. The harvest period focuses on optimizing exit timing and execution to maximize returns.

Exit Strategy Options:

- Strategic Sales: Corporate buyers seeking synergies or market expansion

- Secondary Buyouts: Transfer to other private equity firms

- Initial Public Offerings (IPOs): Public market listings for continued growth

- Recapitalizations: Partial exits through dividends or refinancing

- Management Buyouts: Sale to existing management teams

Exit Preparation Requirements:

- Financial optimization and EBITDA maximization

- Growth acceleration and market positioning

- Risk mitigation and compliance enhancement

- Management team strengthening

- Investment banking engagement for sale processes

Exit timing considerations balance:

- Market conditions and valuation multiples

- Portfolio company readiness

- Fund maturity and LP expectations

- Competitive dynamics and buyer interest

Stage 5: Wind-Down and Termination (Years 10-12+)

At the end of the standard term, funds enter final liquidation or seek extensions. Key activities include:

- Liquidating remaining portfolio positions

- Settling all fund obligations

- Distributing final proceeds to LPs

- Completing regulatory and tax filings

- Archiving records and closing operations

Extension Considerations: When investments remain, funds may pursue:

- LP-Approved Extensions: Typically 1-3 one-year extensions requiring investor consent

- Secondary Sales: Transfer of remaining assets to continuation vehicles

- In-Kind Distributions: Direct distribution of portfolio securities to LPs

Variations in Fund Lifecycle Duration

Fund lifecycle durations exhibit significant variation across asset classes, reflecting underlying investment strategies and liquidity profiles:

| Asset Class | Typical Initial Term | Extension Provisions | Key Duration Drivers |

|---|---|---|---|

| Infrastructure | 12-15 years | 2-3 one-year extensions | Long-lived projects with extended development and monetization periods |

| Private Equity | 10 years | 2 one-year extensions | Corporate transformation timelines and exit market dependency |

| Venture Capital | 10-13 years | 2-3 one-year extensions | Startup maturation uncertainty and IPO market volatility |

| Real Estate | 5-10 years | 2 one-year extensions | Property repositioning cycles and market liquidity |

| Credit/Private Debt | 6-8 years | 1-2 one-year extensions | Loan maturity profiles and regulatory requirements |

Duration Variance Drivers:

- Asset Liquidity: Infrastructure and real assets require longer holds versus liquid credit

- Control Dynamics: Majority control enables predictable exits; minority positions face uncertainty

- Market Cyclicality: Economic cycles impact optimal exit timing across asset classes

- Regulatory Constraints: Tax optimization and compliance requirements influence term structures

Impact of Fund Lifecycle on Stakeholders

Limited Partners (LPs)

- Capital Planning: Must manage illiquidity and plan for 10+ year commitments

- J-Curve Management: Face negative cash flows early before distributions exceed contributions

- Portfolio Construction: Balance vintage year diversification with liquidity needs

- Fee Drag: Pay management fees on committed capital regardless of deployment pace

General Partners (GPs)

- Resource Allocation: Balance current fund management with successor fund fundraising

- Incentive Alignment: Management fees fund operations while carried interest drives performance

- Reputation Building: Each lifecycle stage impacts track record and future fundraising ability

- Team Retention: Long lifecycles require stable teams and succession planning

Portfolio Companies

- Strategic Alignment: Must synchronize business plans with fund investment horizons

- Governance Evolution: Experience increasing professionalization and reporting requirements

- Exit Preparation: Face accelerating value creation pressure as fund maturity approaches

- Capital Access: Benefit from patient capital but face eventual exit mandates

Employees and Communities

- High-Skilled Workers: Often benefit from training, technology investments, and career advancement

- Low-Skilled Workers: May face automation risks and cost reduction initiatives

- Local Communities: Experience varying impacts based on fund strategy and portfolio company changes

- Innovation Ecosystems: Benefit from venture capital but face disruption from buyout strategies

Common Questions About Fund Lifecycle

How do fund managers handle investments that cannot be exited within the standard fund term? When investments remain at fund term end, managers typically pursue three options: negotiate fund extensions with LP approval (most common), sell positions to secondary funds or continuation vehicles at potentially discounted valuations, or distribute shares directly to LPs who then manage exit timing independently. Extension decisions balance value maximization against LP liquidity needs.

What determines the optimal length of each fund lifecycle stage? Stage duration depends on multiple factors: fundraising length varies with GP track record and market conditions (6-24 months), investment periods balance deployment pace with selectivity (3-5 years), value creation timelines reflect operational complexity and market dynamics (4-7 years), and exit timing weighs market valuations against fund maturity constraints. Asset class characteristics and economic cycles significantly influence optimal stage lengths.

How does fund lifecycle affect management fees and carried interest structures? Management fees typically start at 2% of committed capital during investment periods, then step down to 1-1.5% during harvest periods, often shifting from committed to invested capital basis. Carried interest (typically 20% of profits above hurdle rates) crystallizes during the harvest period as exits generate realized gains, creating strong alignment between GP compensation and LP returns throughout the lifecycle.

Can funds make new platform investments after the investment period ends? Generally no—funds cannot make new platform investments after the investment period expires, though they may deploy reserved capital for follow-on investments in existing portfolio companies to protect or enhance positions. This restriction ensures funds focus on value creation and exits rather than perpetual investing, maintaining discipline and LP alignment.

How do regulatory changes impact fund lifecycle management? Regulatory evolution affects multiple lifecycle aspects: fundraising compliance and marketing restrictions, investment period limitations in certain sectors, portfolio company governance requirements, and exit timing constraints for tax optimization. Funds must continuously adapt strategies to navigate changing regulatory landscapes while maintaining returns, particularly in highly regulated sectors like healthcare, financial services, and infrastructure.

Conclusion

The fund lifecycle provides essential structure for alternative investment vehicles, creating clear phases for capital formation, deployment, value creation, and realization. This framework enables systematic execution while providing transparency and accountability across all stakeholders. Understanding lifecycle dynamics proves crucial for optimizing decisions throughout each stage—from initial fundraising through final distributions.

As markets evolve and investment strategies adapt, mastery of lifecycle management becomes increasingly vital. Whether evaluating fund commitments as an LP, managing portfolio strategy as a GP, or partnering with funds as an entrepreneur, comprehensive lifecycle knowledge enables better alignment, risk management, and value creation. The structured progression from fundraising through exit creates predictability within inherently uncertain investment activities, ultimately driving superior outcomes for all participants in the alternative investment ecosystem.