The Perfect Storm: Why Now Is the Best Time to Enter Venture Capital Fund-of-Funds

The venture capital industry stands at an inflection point that occurs perhaps once per decade. As we enter 2026, a convergence of market forces—valuation normalization following the 2022 correction, unprecedented institutional demand, and structural market shifts—has created what I believe represents the most compelling entry point for venture capital fund-of-funds investing since the Global Financial Crisis.

For those unfamiliar with the structure, a venture capital fund-of-funds (VC FoF) is an institutional vehicle that invests across multiple underlying VC funds rather than directly into startups. This approach provides diversification across managers, vintages, stages, and geographies while solving the critical challenge of access to top-tier, capacity-constrained general partners.

What makes this moment exceptional isn't any single factor, but rather the alignment of multiple secular and cyclical forces that historically precede the highest-performing vintage years. The 2025–2027 window exhibits striking parallels to the post-dot-com era (2003–2004) and post-GFC period (2009–2011)—both of which generated extraordinary returns for disciplined capital allocators who recognized the opportunity.

Macro Tailwinds Creating a Prime Entry Point

The Post-2022 Valuation Reset

The market correction that began in late 2022 has fundamentally recalibrated startup valuations across every stage. Late-stage companies that commanded 40-50x revenue multiples in 2021 now trade at 8-12x, while even early-stage seed valuations have rationalized from inflated peaks. This repricing creates exactly the conditions that have historically preceded exceptional venture returns.

Cambridge Associates data demonstrates that funds deployed immediately after market corrections consistently outperform pre-crisis and peak-market vintages. The 2009 vintage generated median IRRs of 14.85% with 2.10x TVPI—among the strongest cohorts in modern VC history. Similarly, the 2010 vintage achieved a remarkable 25.36% pooled IRR, outperforming the S&P 500 by 1,322 basis points. Lower entry valuations combined with enforced capital discipline create systematic alpha generation opportunities.

Today's environment mirrors these conditions. Companies raising capital in 2023-2024 face substantially higher bars for metrics, burn rates are under intense scrutiny, and "growth at all costs" has been replaced by path-to-profitability requirements. These dynamics separate durable businesses from unsustainable growth stories.

Companies Staying Private Substantially Longer

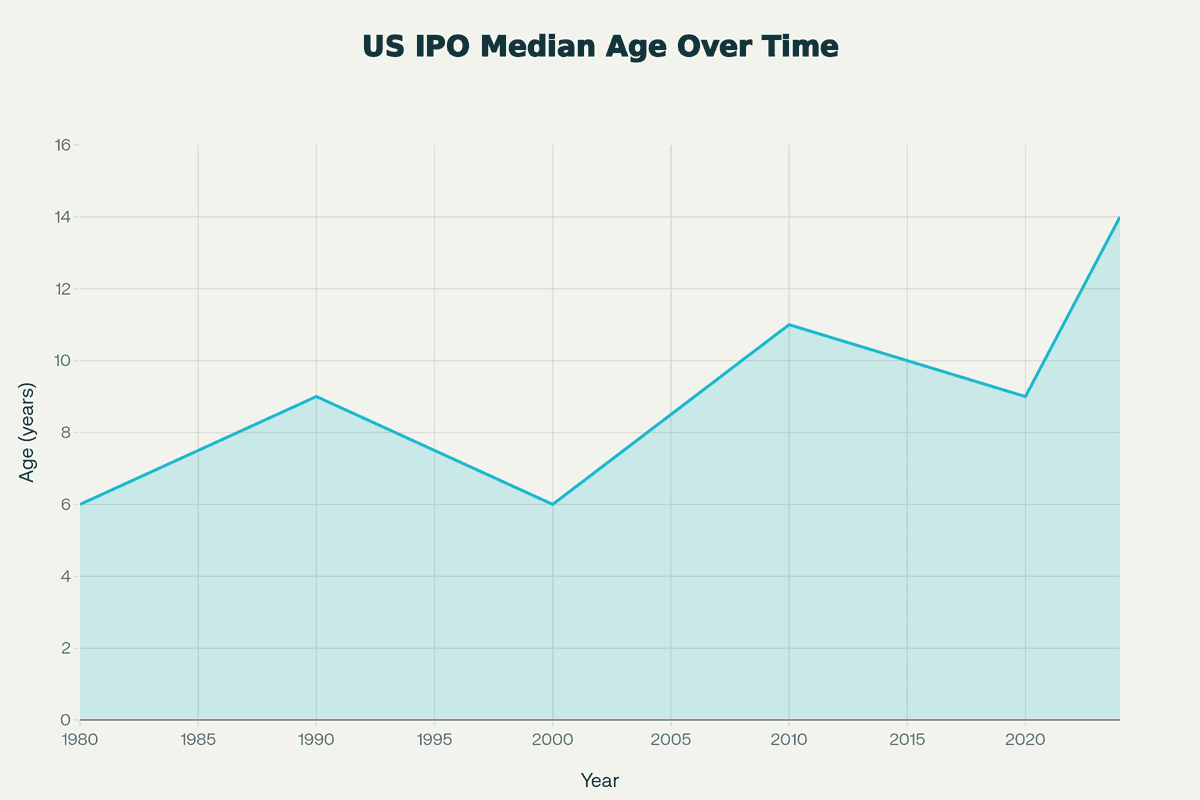

A structural shift has fundamentally altered the venture landscape: companies now remain private approximately twice as long as they did a decade ago. Research from Jay Ritter's comprehensive IPO database shows that the typical age of US IPO companies has more than doubled since the 1980s, from 6-7 years to 11-13 years at listing.

Selected years showing the median age at IPO for US companies, illustrating the rise in company age at listing over the past decades based on Jay Ritter's IPO age data

Selected years showing the median age at IPO for US companies, illustrating the rise in company age at listing over the past decades based on Jay Ritter's IPO age data

For venture investors, this extended private tenure represents a profound opportunity. When companies defer IPOs for a decade or more, an increasing proportion of value creation occurs while they remain privately held. The NVCA data confirms this trend: nearly 45% of US unicorns are at least nine years old, with a median of 8.5 years since first venture funding.

Rather than investing in companies that go public at modest scale and capture appreciation in public markets, venture investors now participate in the entire growth trajectory from early product-market fit through mature, scaled operations. The result is dramatically higher IRRs concentrated in private markets rather than distributed between private and public holders.

Explosive Long-Term Market Growth

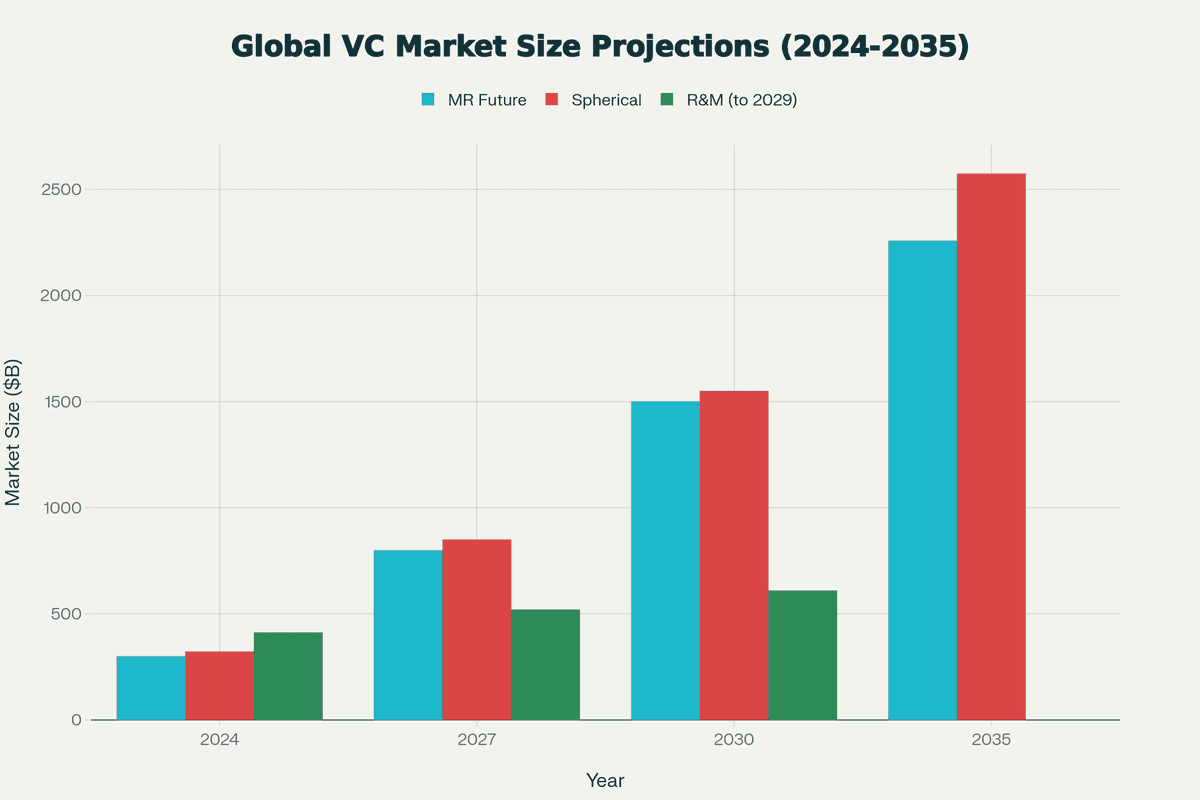

Despite short-term volatility, the global venture capital market is positioned for transformative expansion. Multiple credible forecasts converge around a market size of $2.3-2.6 trillion by 2035, representing a compound annual growth rate of 20-21% from current levels of approximately $300-450 billion.

Global venture capital market size is projected to reach $2.3-2.6 trillion by 2035, representing a 20%+ CAGR from 2024 baseline of $300-412 billion

Global venture capital market size is projected to reach $2.3-2.6 trillion by 2035, representing a 20%+ CAGR from 2024 baseline of $300-412 billion

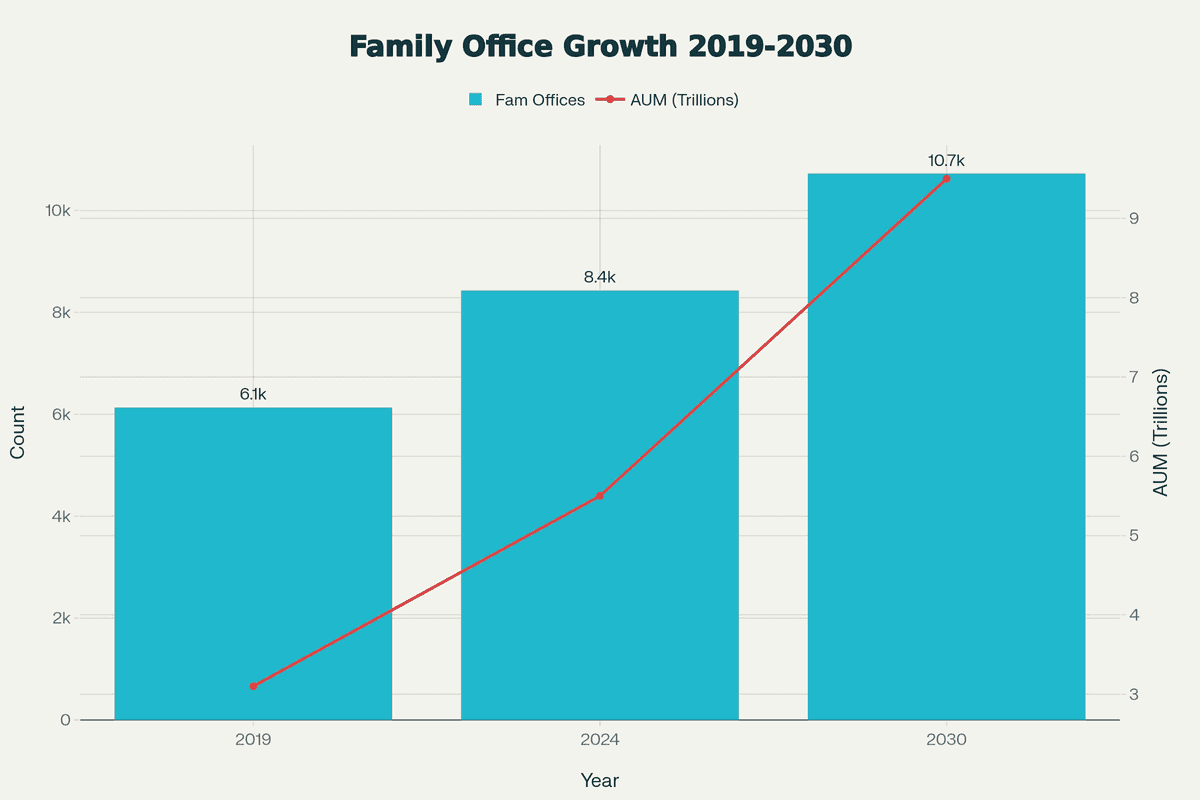

Measurable secular forces drive this projection. Artificial intelligence alone has fundamentally expanded the addressable market for venture investment, with AI companies capturing nearly 60% of combined venture deal value in Q1 2025. The democratization of venture access through regulatory changes is projected to increase U.S. retail investor private capital holdings from $80 billion to $2.4 trillion by 2030. Family office assets under management will grow 73% to $5.4 trillion by 2030, with private equity and venture representing an increasing allocation priority.

Family offices are projected to grow 75% in number (6,130 to 10,720) and 206% in assets under management ($3.1T to $9.5T) by 2030, becoming dominant alternative capital sources

Family offices are projected to grow 75% in number (6,130 to 10,720) and 206% in assets under management ($3.1T to $9.5T) by 2030, becoming dominant alternative capital sources

These trends represent permanent structural expansion of the venture asset class as it matures from niche alternative to core institutional allocation.

Institutional Demand Has Never Been Stronger

LP Appetite Is Surging Across Every Channel

The demand signals from limited partners are unambiguous. Goldman Sachs Asset Management's 2025 survey reveals that 83% of institutional investors expect to maintain or increase private market allocations compared to 2024. More telling is the granular data: 88% of LPs are actively pursuing co-investment opportunities, and 68% are increasing allocations specifically to emerging managers—the exact profile that fund-of-funds structures are optimally positioned to access.

Many institutional investors, particularly endowments and pension funds, face structural return requirements of 7-8% annually to meet obligations. With public market expected returns compressed by elevated valuations and low interest rates, achieving these targets increasingly requires meaningful private market exposure. The "denominator effect" that constrained allocations in 2022-2023 has largely resolved, freeing institutions to deploy capital into their strategic allocation targets.

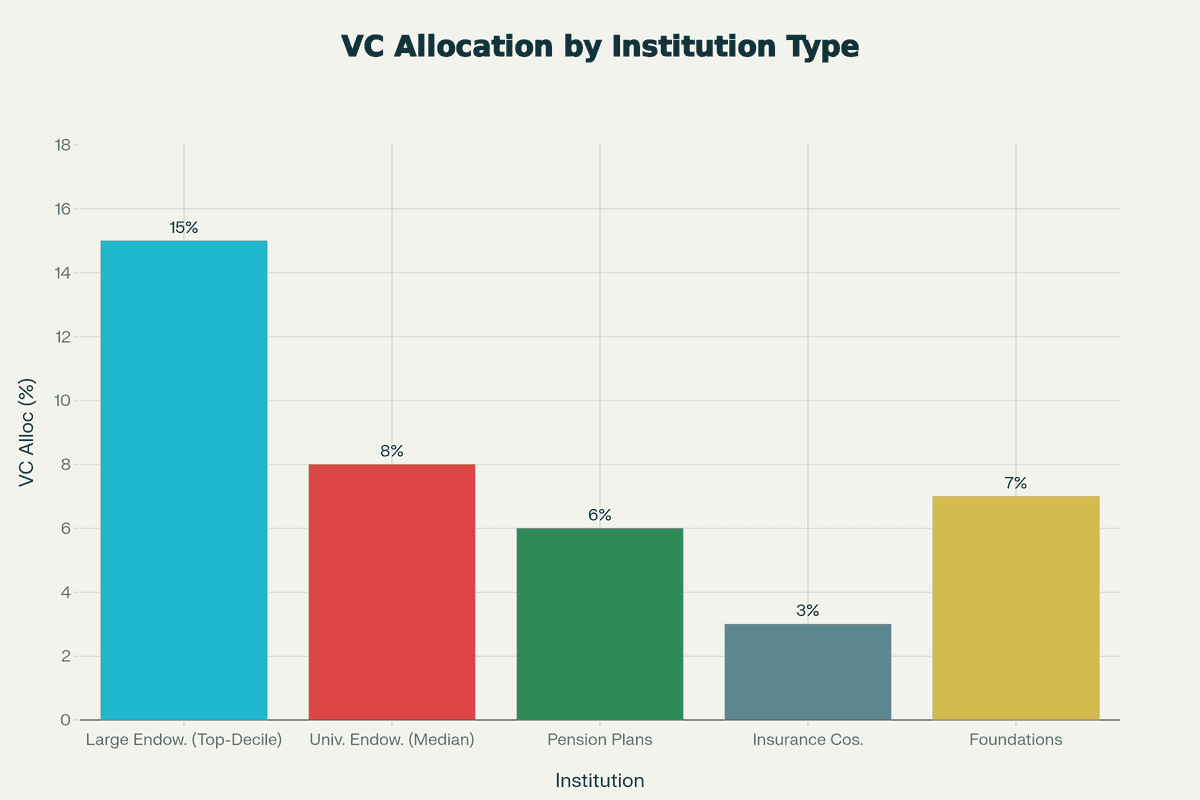

Top-performing endowments maintain significantly higher venture capital allocations (15%) compared to median institutional peers (6–8%), reflecting the strategic importance of VC exposure for long-term portfolio outperformance

Top-performing endowments maintain significantly higher venture capital allocations (15%) compared to median institutional peers (6–8%), reflecting the strategic importance of VC exposure for long-term portfolio outperformance

Venture Allocation Directly Correlates with Superior Performance

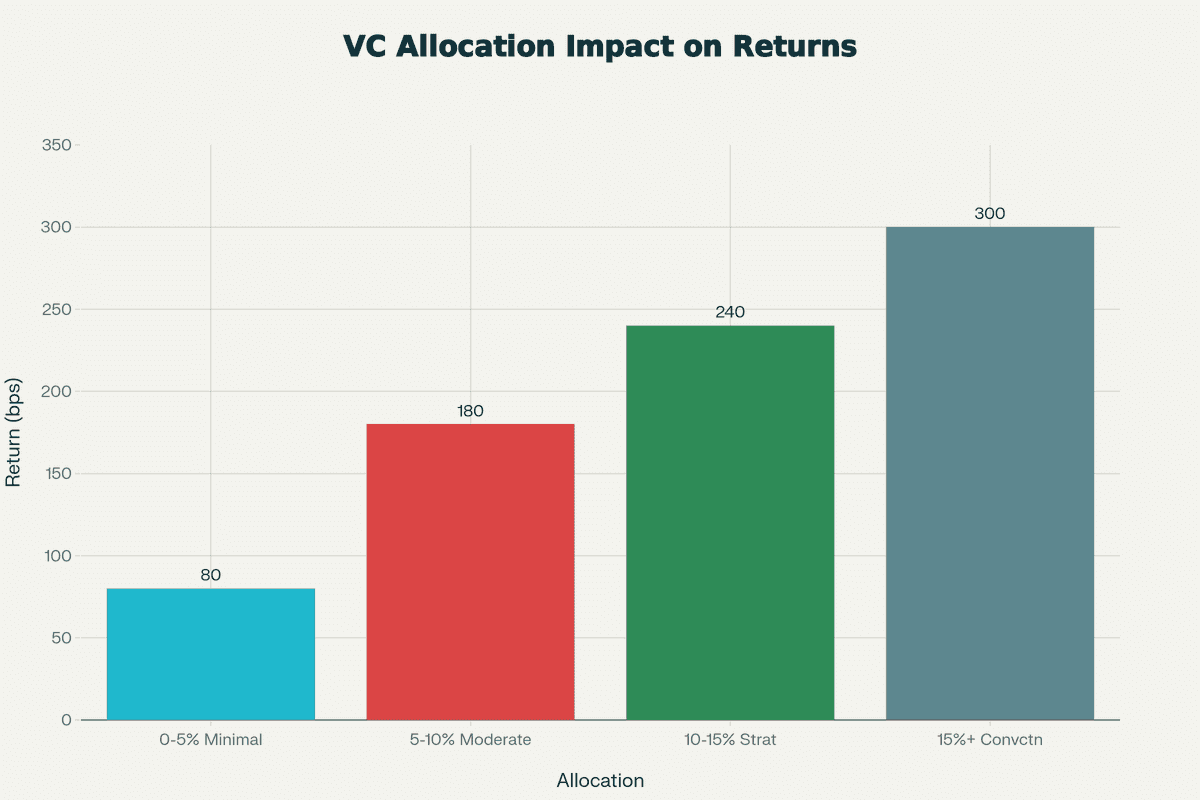

The performance advantage of venture capital allocation is empirically validated across multiple studies. Research from Cambridge Associates analyzing endowment performance reveals that institutions maintaining 15% or greater venture allocation generated median returns approximately 300 basis points higher annually than peers with sub-5% VC exposure over comparable 10-year periods.

Venture capital's 10-year horizon return of 15.06% substantially exceeds both private equity (12.8%) and real estate (7.7%), while exhibiting only 0.3 correlation with public equities. This combination of superior absolute returns and portfolio diversification benefits creates demonstrable risk-adjusted value. Vanguard's research confirms that investors allocating 10-30% of equity exposure to private equity improve Sharpe ratios from 0.25x to 0.31x while increasing nominal annual returns by 14.2% with only 10.5% incremental volatility.

For institutional allocators, venture capital separates top-decile portfolios from median performers.

Higher venture capital allocations correlate with greater portfolio return premiums. A strategic 10–15% allocation delivers approximately 240 basis points of annualized outperformance, while conviction-level allocations (15%+) reach 300 basis points

Higher venture capital allocations correlate with greater portfolio return premiums. A strategic 10–15% allocation delivers approximately 240 basis points of annualized outperformance, while conviction-level allocations (15%+) reach 300 basis points

Placement Agents and Wealth Managers Need Institutional-Quality VC Access

The demand for venture exposure extends beyond traditional institutional investors. Registered investment advisors, multi-family offices, and high-net-worth wealth managers face increasing client demand for thematic technology exposures—artificial intelligence, deep tech, cybersecurity, climate technology—that simply cannot be accessed through public markets.

Yet these intermediaries face a structural challenge: top-tier venture funds maintain closed LP bases with minimum commitments of $5-10 million and multi-decade relationship requirements. A single-family office or RIA with $500 million AUM cannot feasibly build a diversified 20-fund venture portfolio requiring $100-200 million in commitments.

Fund-of-funds structures solve this access problem by aggregating capital and leveraging established GP relationships to provide institutional-quality exposure at accessible minimums. Wealth management platforms seek to offer private market "shelves" to increasingly sophisticated clients.

Structural Advantages Unique to This Environment

Access Bottlenecks Are Temporarily Opening

The venture capital industry operates on cyclical patterns of access constraint and expansion. During boom periods like 2020-2021, top-tier funds become severely oversubscribed, often closing within days to existing LPs exercising pro-rata rights. Conversely, market corrections create natural re-entry points as fund sizes reset and managers selectively expand LP bases.

We're currently in such an expansion window. Emerging managers who raised initial funds during 2021-2022 are returning to market with second and third funds, offering new LPs the opportunity to establish "series zero" relationships with potential future top-quartile performers. Even established platforms are recalibrating, with some mega-funds reducing target sizes and others creating specialized vehicles targeting specific stages or sectors.

This access window is inherently temporary—historically lasting 18-36 months before capacity constraints re-emerge as performance materializes and LP demand intensifies. Early movers who establish positions during 2025-2026 will benefit from preferential access as these relationships mature.

Technology Has Dramatically Reduced Operating Costs

The infrastructure required to operate institutional-quality fund-of-funds has undergone transformation. Fund administration platforms now deliver automated NAV calculation, LP reporting, and compliance monitoring at 25-60% lower cost than manual processes. AI-driven due diligence tools reduce document analysis time by 60-90%, enabling more thorough evaluation across larger manager universes without proportional staff expansion.

These operational efficiencies fundamentally alter the economics of fund-of-funds management. Where traditional structures required 10-15 basis points of the fee layer simply to cover administrative overhead, modern platforms can deliver comprehensive services at 4-6 basis points. This cost compression enables more competitive fee structures while maintaining superior service delivery—creating value both for fund sponsors and underlying LPs.

Local Innovation Ecosystems Are Outperforming Generalist Global Strategies

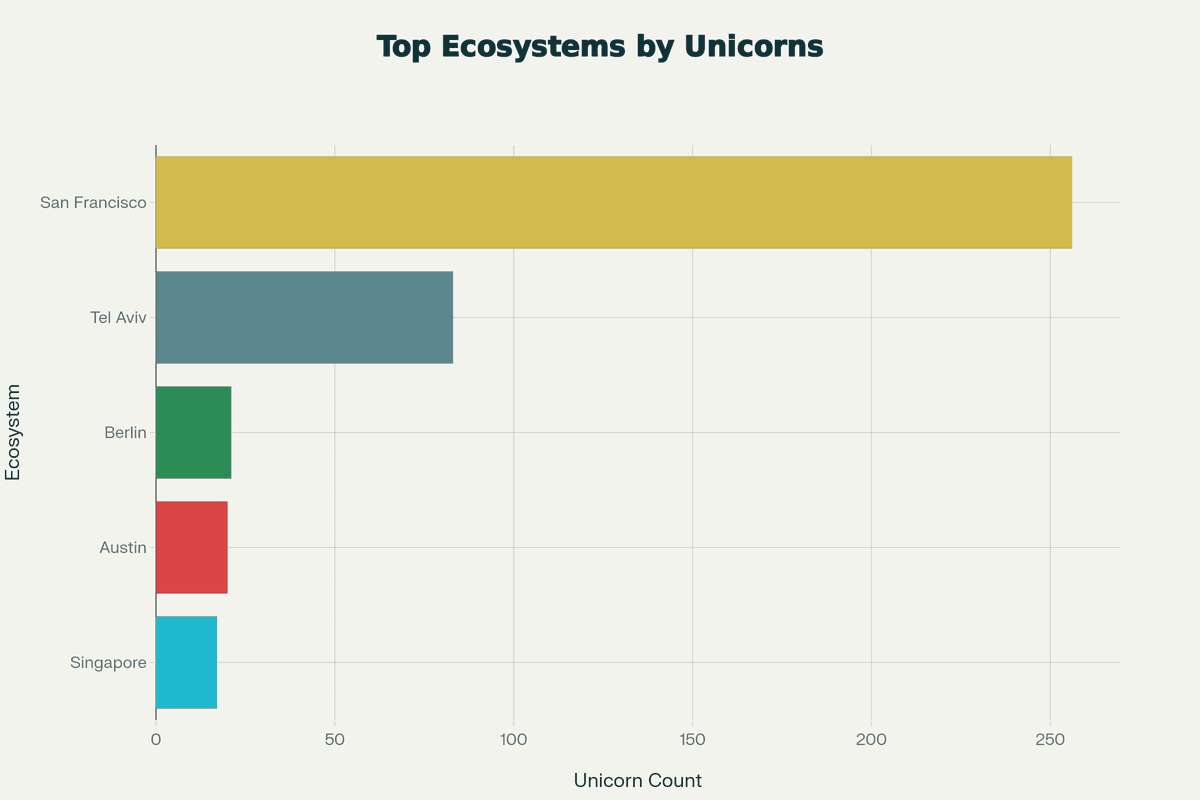

A critical insight emerging from performance data is that geographic specialization substantially outperforms broad global diversification. Tel Aviv produces 4.8% of seed-funded startups as unicorns—nearly double Silicon Valley's conversion rate—while demonstrating 40% exit premiums versus global benchmarks. Austin's ecosystem has generated 20 unicorns valued at $54.4 billion despite receiving a fraction of coastal capital deployment. Singapore's deep tech specialization and Berlin's enterprise software clusters show similar patterns of concentration effects.

Absolute Unicorn Production: Total Active Unicorns by Ecosystem

Absolute Unicorn Production: Total Active Unicorns by Ecosystem

Network density drives this outperformance. Tel Aviv's 180+ multinational R&D centers and military intelligence unit alumni networks create talent moats and acquisition demand that cannot be replicated through dispersed global presence. These specialized ecosystems generate superior founder recycling rates, domain expertise accumulation, and strategic buyer concentration.

For fund-of-funds managers, portfolio construction around 2-3 specialized innovation clusters with deep GP relationships and ecosystem expertise generates meaningfully higher returns than attempting broad geographic diversification across 15+ markets. This insight fundamentally challenges traditional "global venture" positioning.

Why Fund-of-Funds Specifically Win in This Environment

Diversification Provides Dramatic Risk Reduction

The single most compelling advantage of fund-of-funds structures is quantifiable risk mitigation. NBER research analyzing extensive performance data demonstrates that VC FoFs reduce return volatility by 68%—from a standard deviation of 1.78 for direct funds to just 0.57 for diversified fund portfolios. More importantly, bottom-quartile FoFs maintained positive TVPI multiples above 1.0x across all studied vintages, while bottom-quartile direct VC funds frequently posted negative returns.

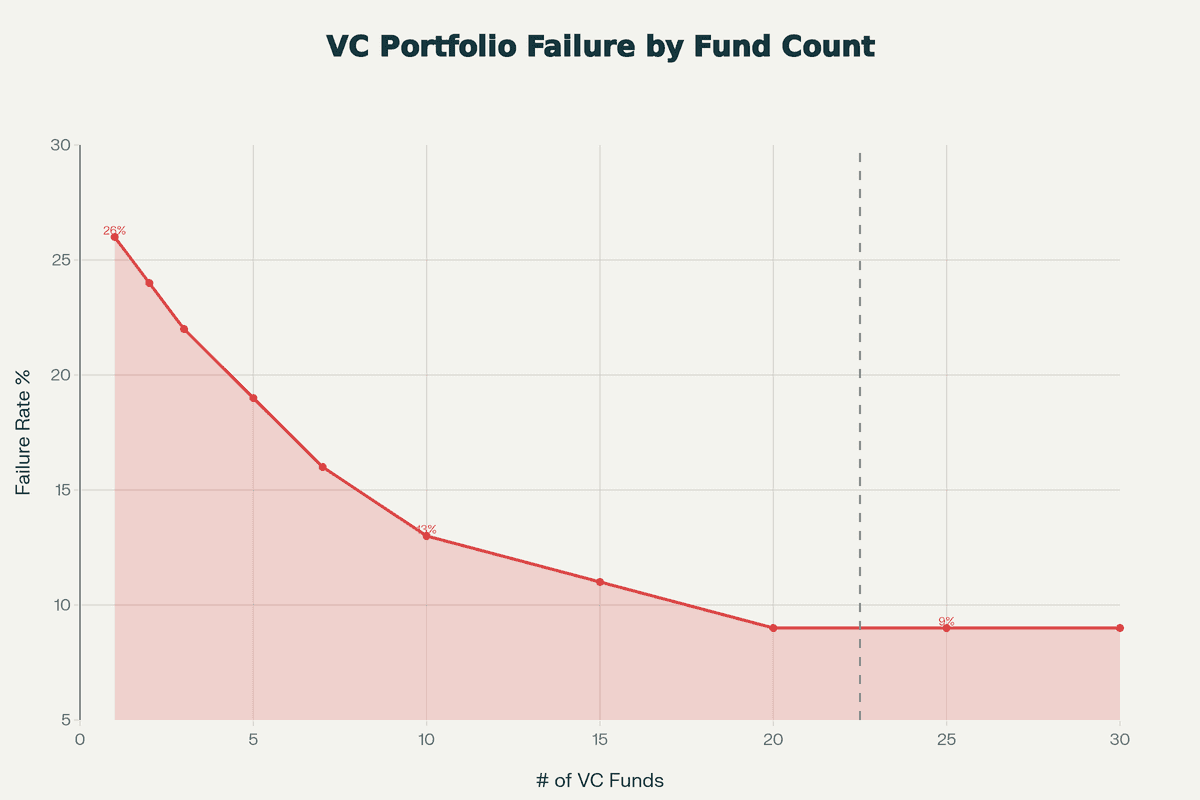

Diversification across 20-30 underlying funds and 400-600 portfolio companies eliminates single-manager risk and substantially reduces vintage-year timing risk. Research from Vanguard confirms that diversified private equity portfolios reduce failure probability from 26% to just 9%—an outcome that is particularly valuable for institutional allocators with defined return requirements and limited risk tolerance.

Portfolio failure probability decreases from 26% to 9% as fund count increases to 20-25 funds, with minimal additional benefit beyond this range

Portfolio failure probability decreases from 26% to 9% as fund count increases to 20-25 funds, with minimal additional benefit beyond this range

This risk-adjusted return profile creates compelling value even after accounting for the management fee layer. While FoFs underperform median direct VC by approximately 6-7 percentage points on an absolute return basis, the volatility reduction and downside elimination provide risk-adjusted value equivalent to 570-1,550 basis points annually when measured by Sharpe ratio improvement.

Access to Relationship-Dependent and Capacity-Constrained Managers

Perhaps the most underappreciated advantage of established fund-of-funds platforms is systematic access to top-quartile venture managers. Academic research confirms that VC exhibits substantial performance persistence—managers with prior top-quartile funds maintain a 45% probability of repeating top-quartile performance and nearly 70% chance of generating above-median returns in subsequent funds.

Yet these precisely are the funds that new LPs cannot access. Sequoia, Benchmark, Andreessen Horowitz, and other top-decile performers maintain effectively closed LP bases with retention rates exceeding 90%. When allocation opportunities arise, they're typically reserved for sovereign wealth funds, major endowments, and long-standing relationships.

Fund-of-funds platforms that have invested across multiple vintages with these managers possess relationship capital that individual LPs cannot replicate. This access premium translates directly to performance: when LP portfolios are constrained to exclude top-decile funds, VC FoFs outperform direct strategies by 10-20%—more than sufficient to justify the fee structure.

Superior Risk-Adjusted Returns Through Professional Construction

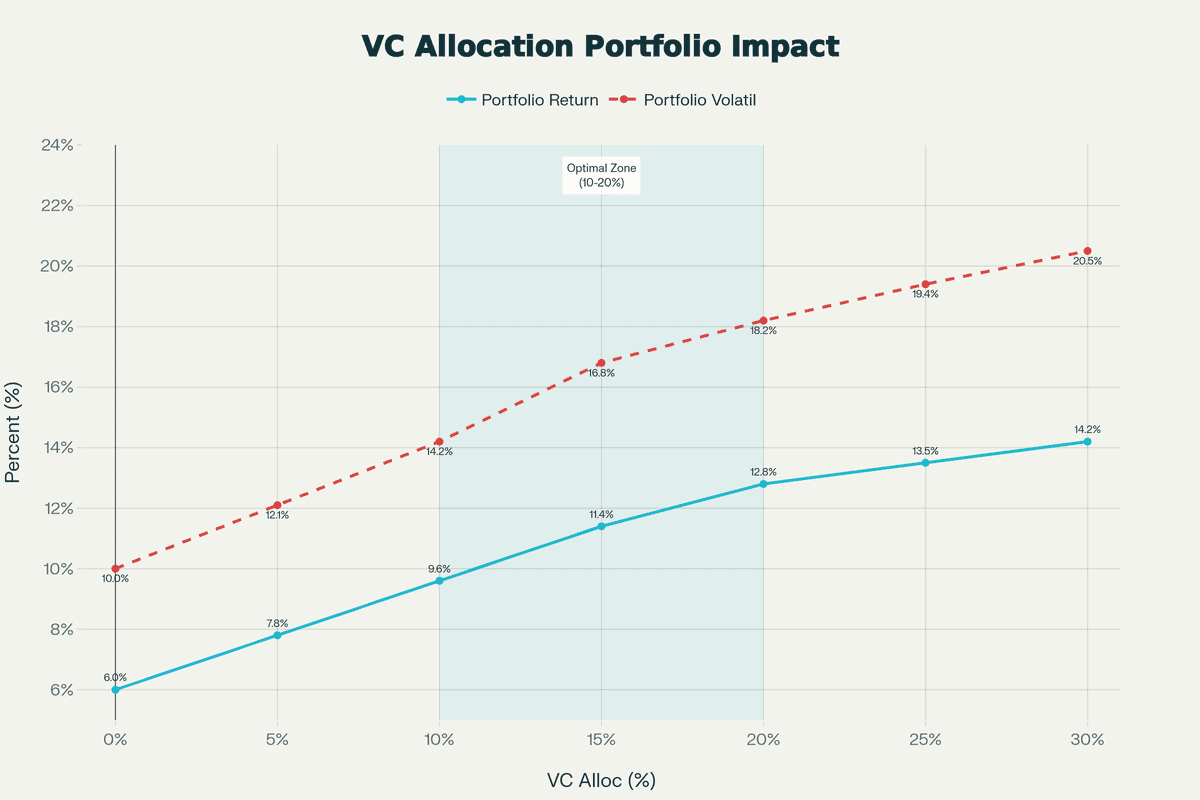

The performance data validates the fund-of-funds value proposition. Well-constructed VC FoFs targeting 20-25 underlying managers across diversified vintages have historically generated net IRRs in the 13-17% range—exceeding private equity (12.8%), real estate (7.7%), and public markets while delivering substantially lower volatility than concentrated direct portfolios.

Increasing VC allocation from 0% to 30% boosts annual returns from 6% to 14.2% while volatility rises modestly from 10% to 20.5%, demonstrating favorable risk-adjusted return enhancement

Increasing VC allocation from 0% to 30% boosts annual returns from 6% to 14.2% while volatility rises modestly from 10% to 20.5%, demonstrating favorable risk-adjusted return enhancement

This return profile reflects professional portfolio construction implementing academic insights around optimal diversification, vintage-year selection, stage allocation, and geographic exposure. Research from Cambridge Associates demonstrates that diversification benefits diminish beyond 25-30 funds, while portfolios below 15-20 funds retain excessive idiosyncratic risk. Systematic implementation of these principles by experienced fund-of-funds managers generates consistent outperformance of ad hoc or under-diversified approaches.

Why This Vintage Window Is Exceptional

Historical Precedent: Best Vintages Follow Market Corrections

The strongest predictor of future vintage-year performance is valuation discipline at deployment. Comprehensive analysis across multiple market cycles confirms that funds invested during or immediately after corrections consistently outperform peak-market vintages by substantial margins.

During the dot-com correction, 2002-2003 vintages improved 3.45 percentage points over crisis-era 1999-2001 funds, with the 2003 cohort posting 9.41% IRR and 1.78x TVPI. Post-GFC, the pattern intensified: 2010 vintage funds achieved 25.36% IRR and 3.21x TVPI—the highest of any vintage between 2005-2018—outperforming pre-crisis 2005-2007 vintages by 14.83 percentage points.

The current environment exhibits the same structural characteristics: valuation reset, enforced capital discipline, talent availability from tech layoffs, and exit of non-traditional "tourist" capital that inflated 2021 pricing. While 2023-2024 vintages remain early in their lifecycle, the parallel to historically exceptional cohorts is striking and methodologically sound.

Early LP Commitments Capture Structural Advantages

Within any vintage window, timing of commitment carries meaningful implications. Fund-of-funds that secure allocations during the initial closing of underlying managers benefit from several mechanisms: priority access before capacity fills, ability to negotiate terms including co-investment rights, and relationship establishment that facilitates access to subsequent funds.

Analysis of fund performance shows that later-stage closings often include LPs with weaker access who accept less favorable terms to gain exposure. Early committed capital additionally benefits from immediate deployment into the most attractive valuation environment rather than delayed deployment into potentially recovered pricing.

For institutional allocators evaluating 2025-2027 vintage exposure, the implication is actionable urgency. The performance differential between systematic early-vintage deployment and delayed entry attempting to time perfect bottoms consistently favors disciplined commitment programs that accept modest deployment risk to capture sustained structural advantage.

The Window Is Open, But Not Forever

Market dislocations that create exceptional vintage opportunities are inherently temporary. As portfolio company fundamentals improve, exit markets normalize, and early-vintage performance begins materializing, both valuation discipline and access windows compress. The historical pattern suggests optimal entry periods last 18-30 months before competition for allocations intensifies and pricing power shifts back to general partners.

We are approximately 12-18 months into what appears to be a multi-year favorable deployment window. Institutional investors, wealth management platforms, and family offices exploring venture capital exposure face a strategic choice: establish systematic allocation programs now to capture 2025-2027 vintages at favorable terms and disciplined valuations, or delay and potentially face renewed capacity constraints and compressed pricing.

For fund-of-funds specifically, the value proposition has never been more compelling. The combination of structural risk reduction, professional access to top-tier managers, and deployment into what historical precedent suggests may prove an exceptional vintage cohort creates unusually favorable risk-adjusted return prospects. The institutional demand signals are unambiguous, the secular market expansion is underway, and the cyclical correction has reset valuations to sustainable levels.

This convergence represents what we might call a perfect storm—not of crisis, but of opportunity. For sophisticated allocators who recognize these patterns and act decisively, the 2025-2027 window may well be remembered as one of the defining entry points of the decade.