Capital Concentration: Why Top-Tier VC Funds Are Actually Thriving While Others Struggle

The prevailing narrative about venture capital fundraising in 2024-2025 suggests a uniformly challenging environment. Industry commentary frequently emphasizes the difficulties facing established managers, pointing to slower fundraising cycles, reduced LP commitments, and general market malaise. The implication is clear: everyone is suffering in the current market.

Except the data tells a fundamentally different story.

When you examine actual fundraising results from 2024-2025, a far more nuanced picture emerges. Some veteran funds aren't just surviving—they're thriving at unprecedented levels, raising record amounts and closing oversubscribed rounds. Meanwhile, certain categories of managers face an existential crisis. The venture capital market hasn't cooled uniformly. Instead, it has bifurcated into two distinct markets operating under entirely different rules.

Understanding this bifurcation matters profoundly for anyone allocating capital, raising funds, or analyzing the venture ecosystem. The question isn't whether venture capital is hot or cold in 2025. The question is: which market are you in?

The Elite Exception: Veteran Funds Breaking Records

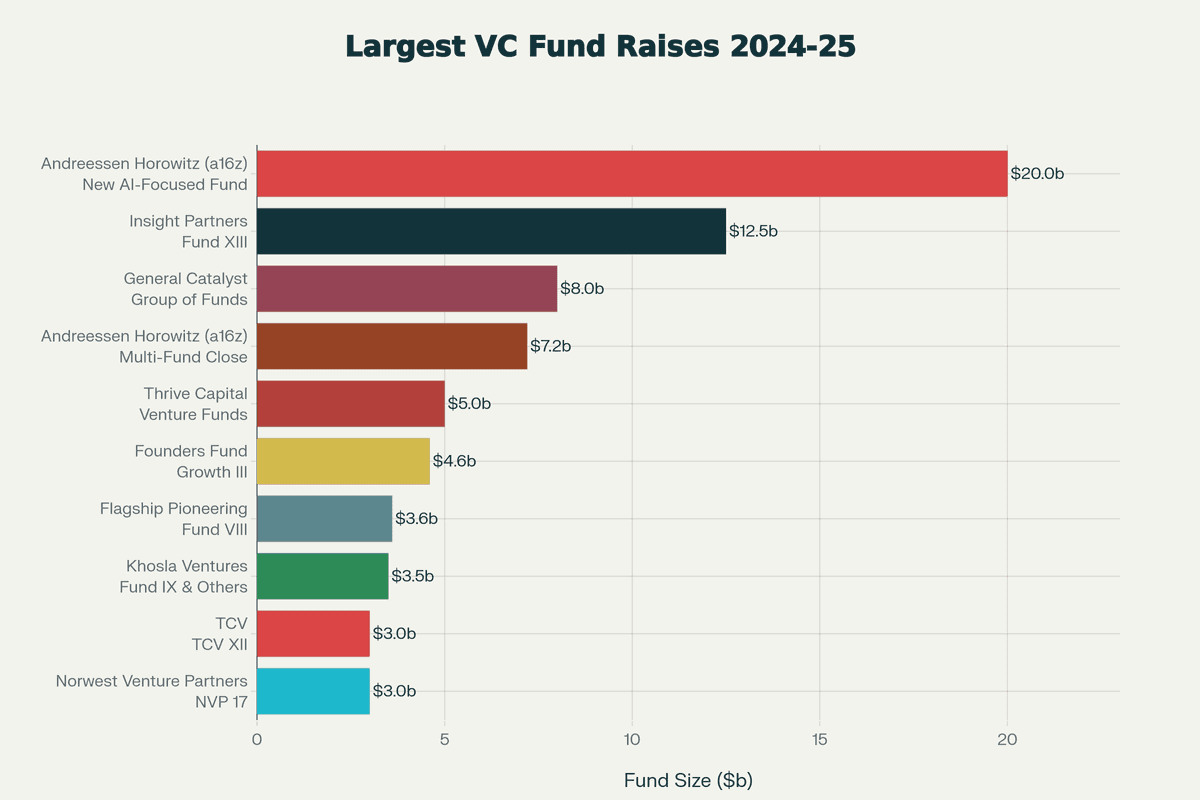

Andreessen Horowitz raised $7.2 billion across five distinct sub-funds in April 2024. The raise was oversubscribed, exceeding initial targets by approximately 4%. That same firm is now seeking to raise a $20 billion AI-focused megafund—what would be the largest fund in its history.

Founders Fund originally targeted $3 billion for its Growth III fund. Due to high LP demand, the firm closed at $4.6 billion in April 2025, significantly oversubscribed and representing a 53% increase over its original target.

Index Ventures reported being "really oversubscribed" when it raised $2.3 billion in July 2024, closing the funds in mere weeks from existing LPs. The firm deliberately kept fund sizes disciplined rather than maximizing assets under management, turning away capital that many emerging managers would desperately welcome.

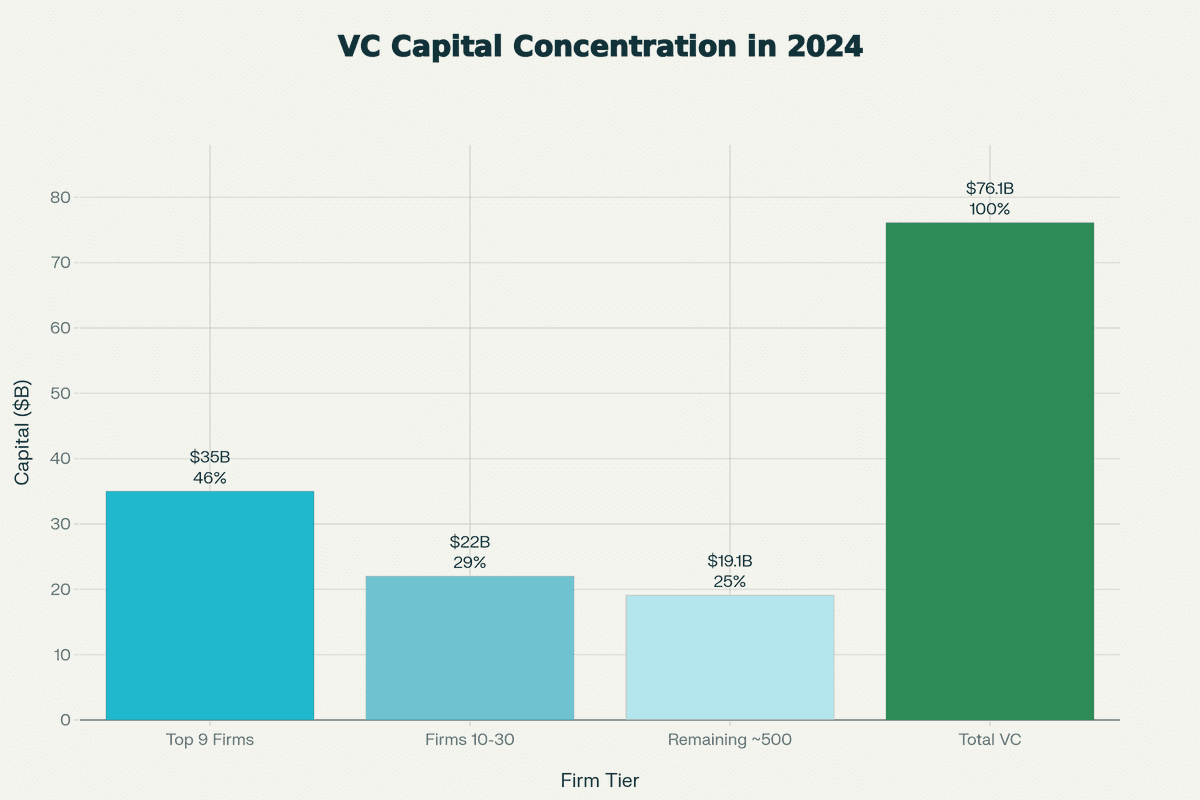

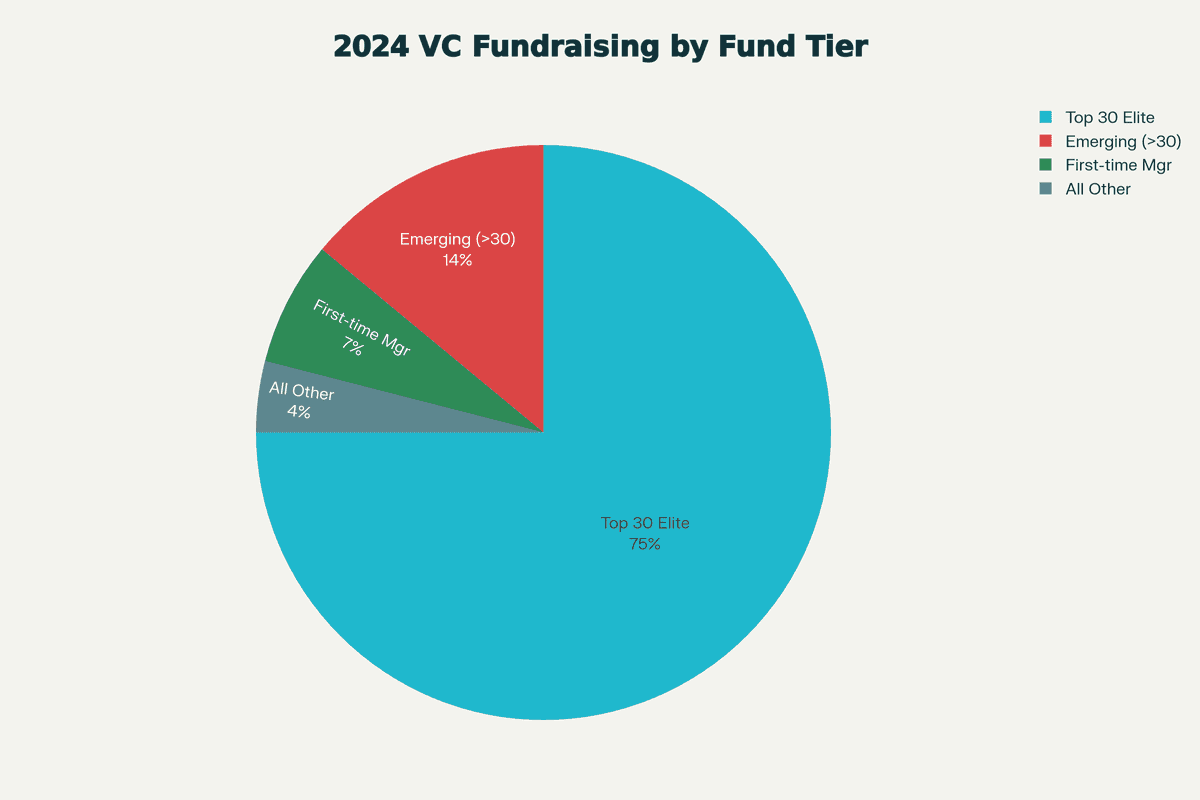

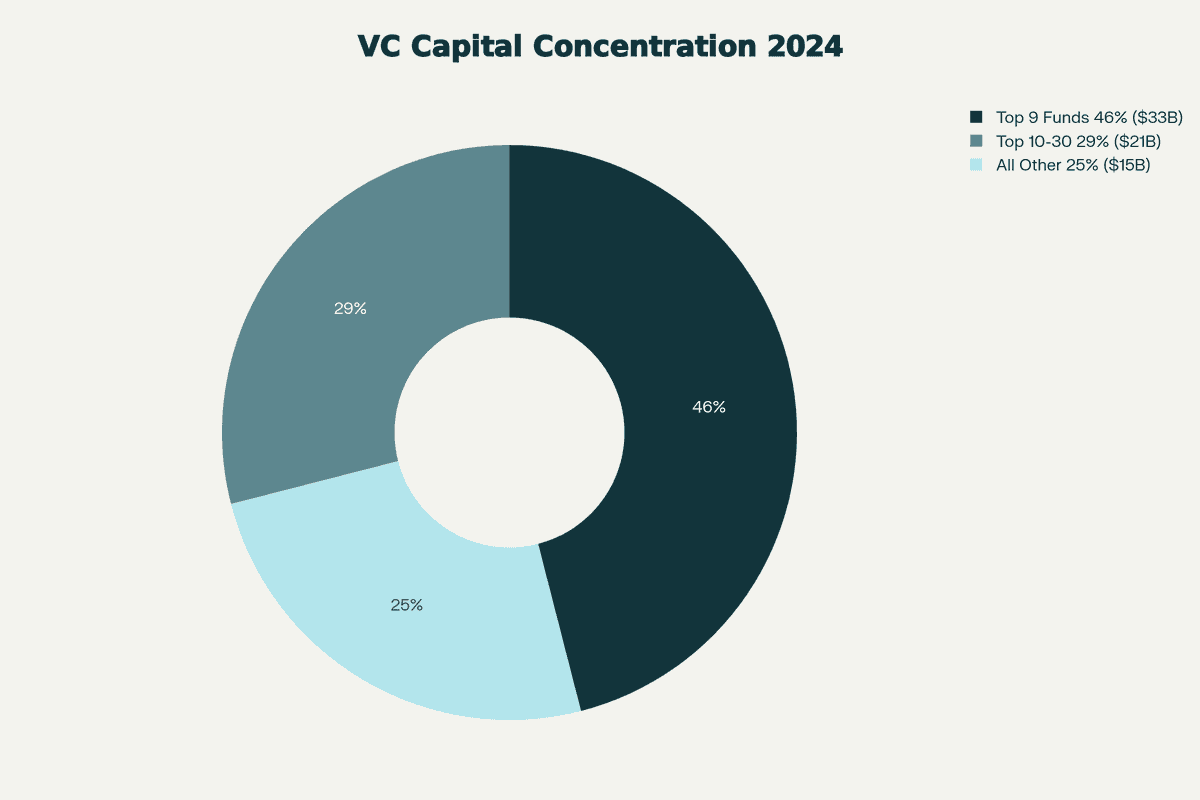

These aren't isolated anecdotes. The data reveals systematic concentration: the top 30 venture capital funds captured 75% of all fundraising in 2024, controlling approximately $57 billion out of $75.7 billion raised. Even more striking, just nine leading funds raised 46% of total capital—roughly $35 billion. Andreessen Horowitz alone captured approximately 10-11% of the entire year's venture capital.

Figure 1: Top 10 Largest Venture Capital Fund Raises (2024-2025) - Mega-funds commanding unprecedented capital commitments, with AI-focused strategies driving the largest raises in venture capital history.

Figure 1: Top 10 Largest Venture Capital Fund Raises (2024-2025) - Mega-funds commanding unprecedented capital commitments, with AI-focused strategies driving the largest raises in venture capital history.

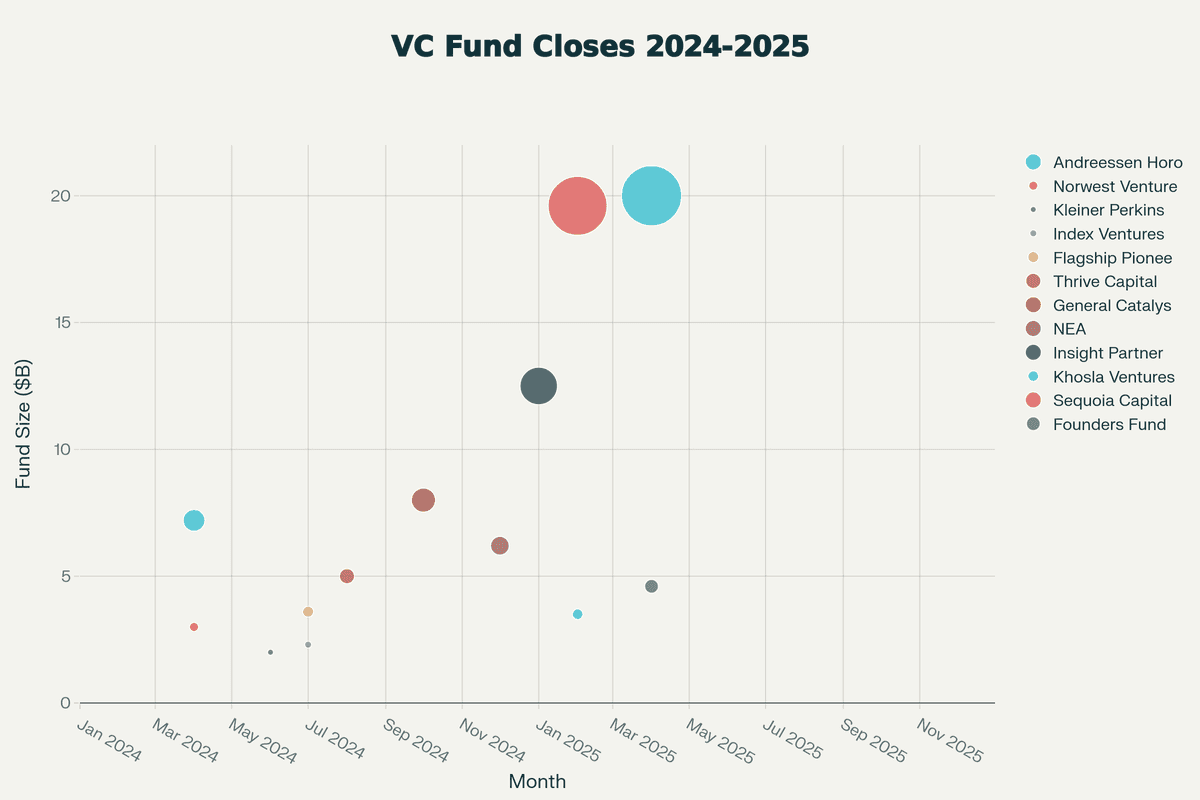

Figure 2: VC Fund Closing Timeline (2024-2025) - Dot size represents fund size, revealing strategic clustering around August-October 2024 and January-April 2025 as LP capital deployment windows aligned with sentiment recovery.

Figure 2: VC Fund Closing Timeline (2024-2025) - Dot size represents fund size, revealing strategic clustering around August-October 2024 and January-April 2025 as LP capital deployment windows aligned with sentiment recovery.

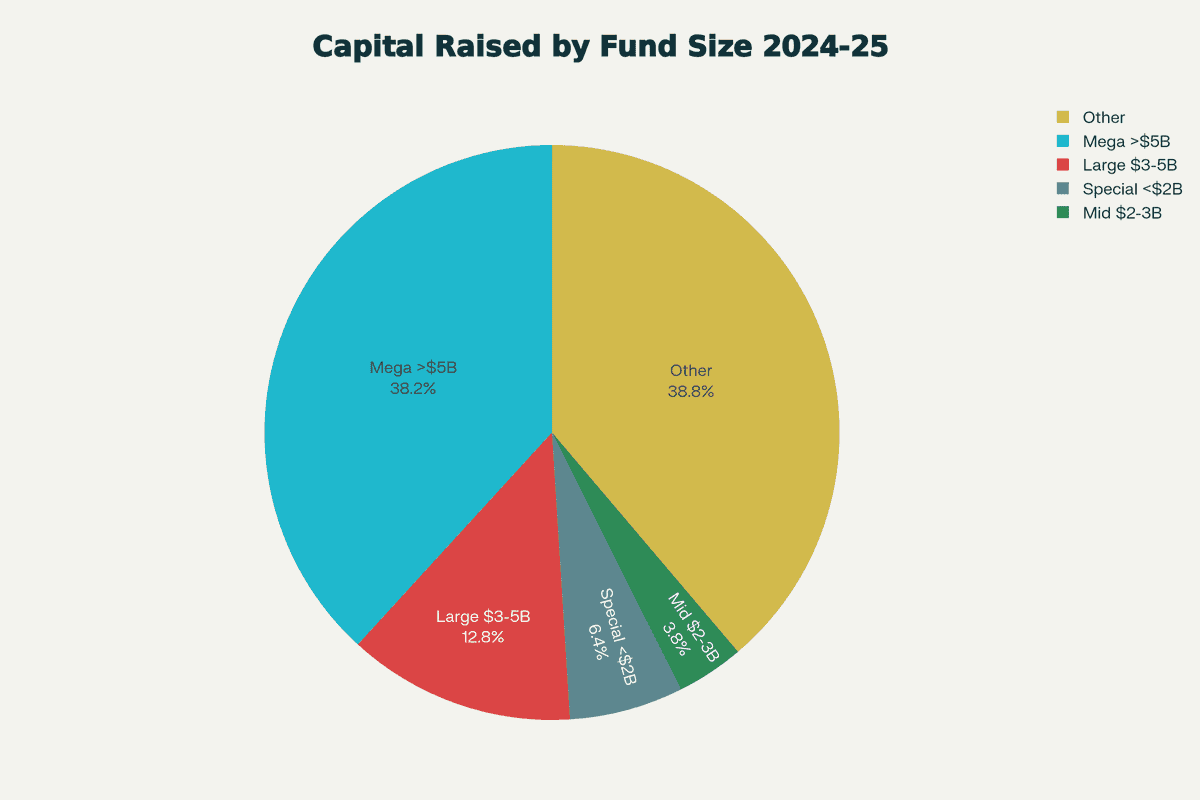

When measuring by fund size rather than firm ranking, funds larger than $500 million captured 67% of capital. The top 10% of firms by size controlled over 71% of capital, while the bottom 90% of firms combined controlled just 29%.

Figure 3: Capital Distribution Across Fund Categories (2024) - Mega-funds (>$5B) dominate with 38.2% of total capital, while mid-size and specialized funds capture only 9.2%, illustrating the "flight to quality" dynamic.

Figure 3: Capital Distribution Across Fund Categories (2024) - Mega-funds (>$5B) dominate with 38.2% of total capital, while mid-size and specialized funds capture only 9.2%, illustrating the "flight to quality" dynamic.

Figure 4: Market Bifurcation in 2024 VC Fundraising - The stark division: 75% to elite top 30 funds versus 25% distributed among all emerging managers, first-time funds, and others combined.

Figure 4: Market Bifurcation in 2024 VC Fundraising - The stark division: 75% to elite top 30 funds versus 25% distributed among all emerging managers, first-time funds, and others combined.

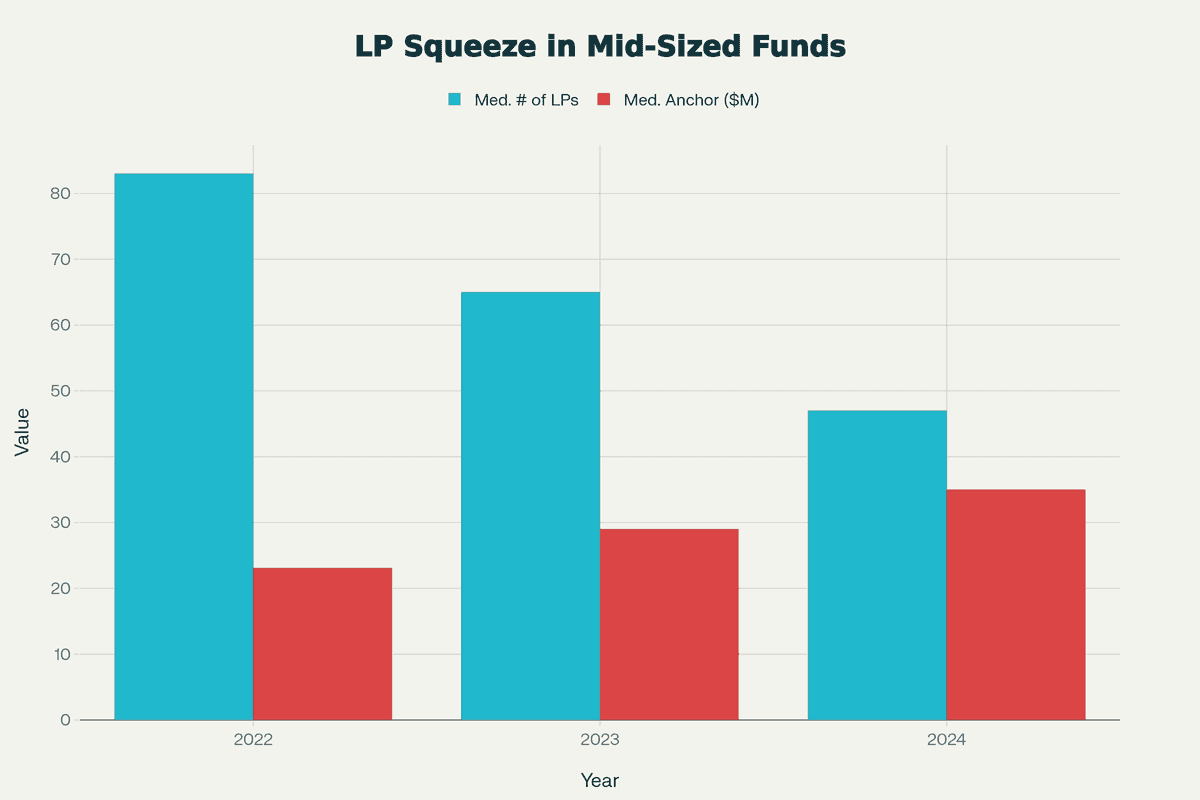

This concentration extends beyond raw dollars to LP relationships. For funds managing $100 million to $250 million in assets, the median number of LPs fell from 83 in 2022 to 47 in 2024—a 43% reduction in just two years. Mega-funds maintained or expanded their LP bases while mid-market managers saw their institutional backing evaporate.

LP Appetite Is Growing, Not Shrinking

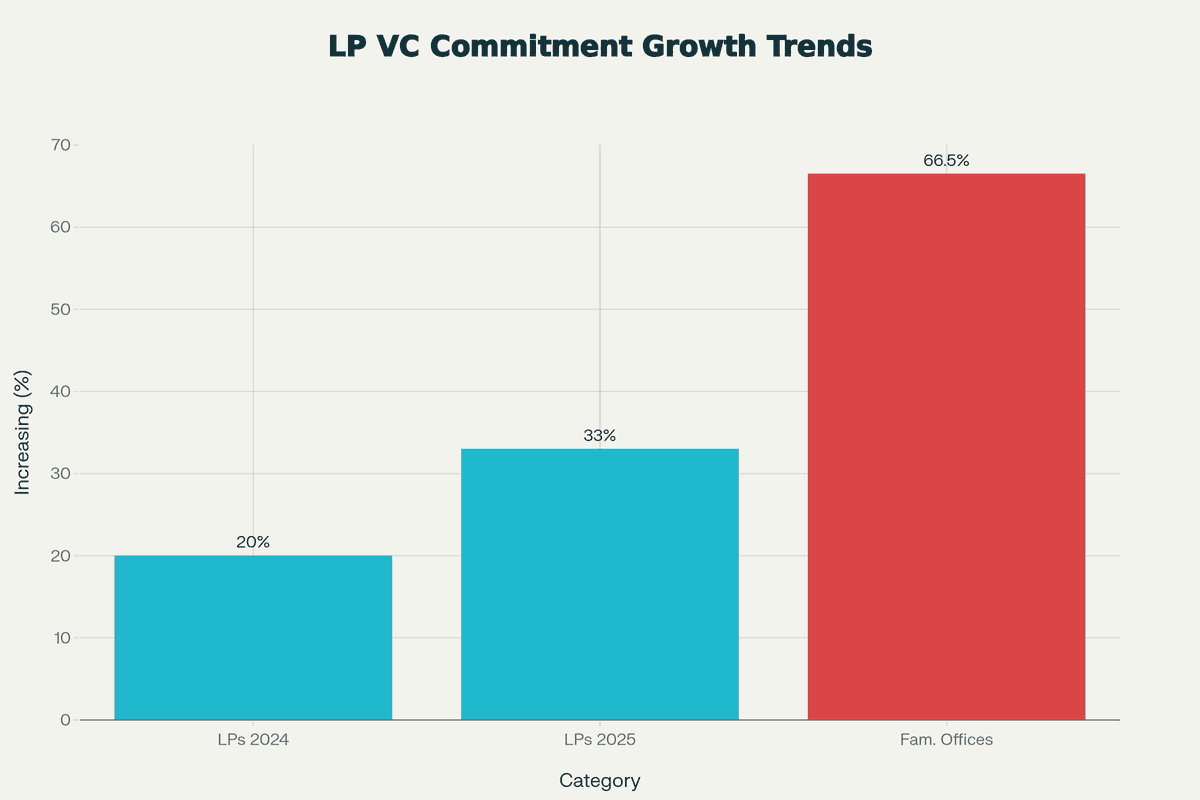

The narrative of universal LP retrenchment doesn't match institutional behavior. According to Venture Capital Journal's 2025 LP Perspectives Study, 33% of institutional investors plan to invest more in venture funds in the next 12 months—a notable increase from just 20% in 2024. That represents a 65% year-over-year increase in positive sentiment.

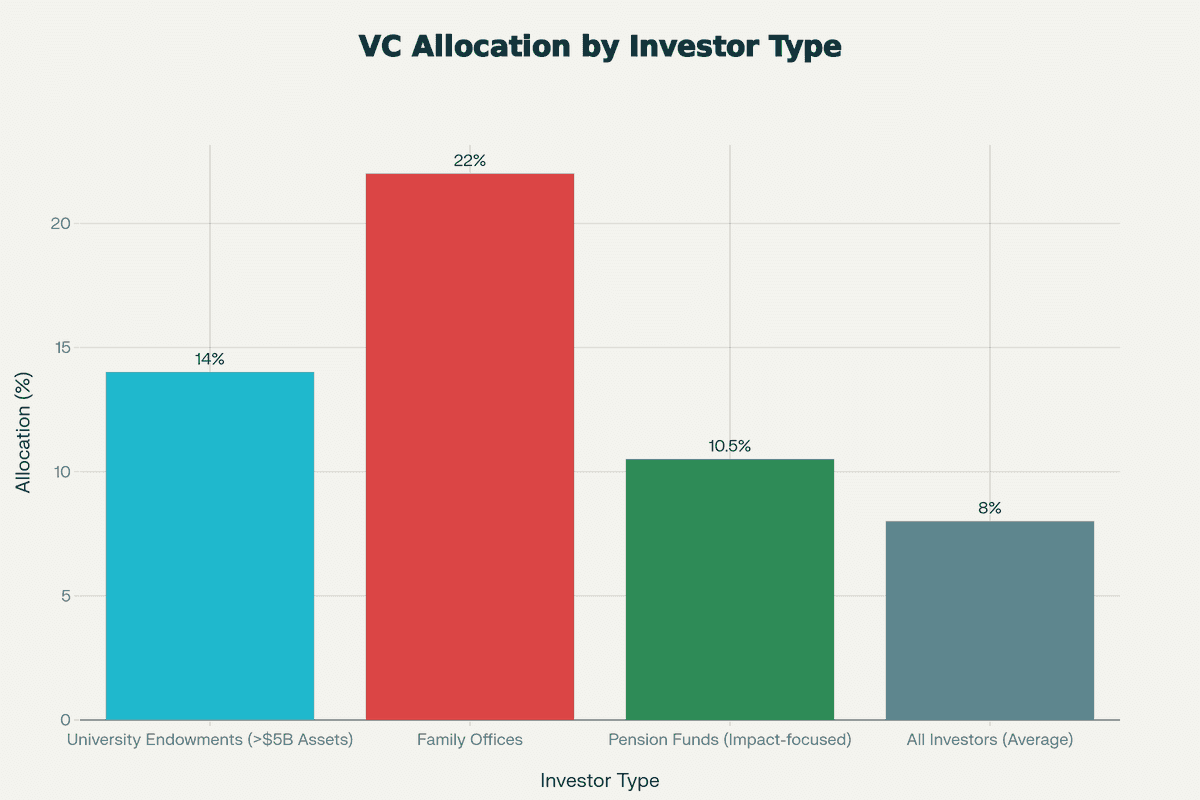

Figure 5: VC Allocation by Investor Type (2024-2025) - Family offices allocate 22% to VC, more than double the broader market average of 8%, demonstrating sophisticated allocators' continued commitment.

Figure 5: VC Allocation by Investor Type (2024-2025) - Family offices allocate 22% to VC, more than double the broader market average of 8%, demonstrating sophisticated allocators' continued commitment.

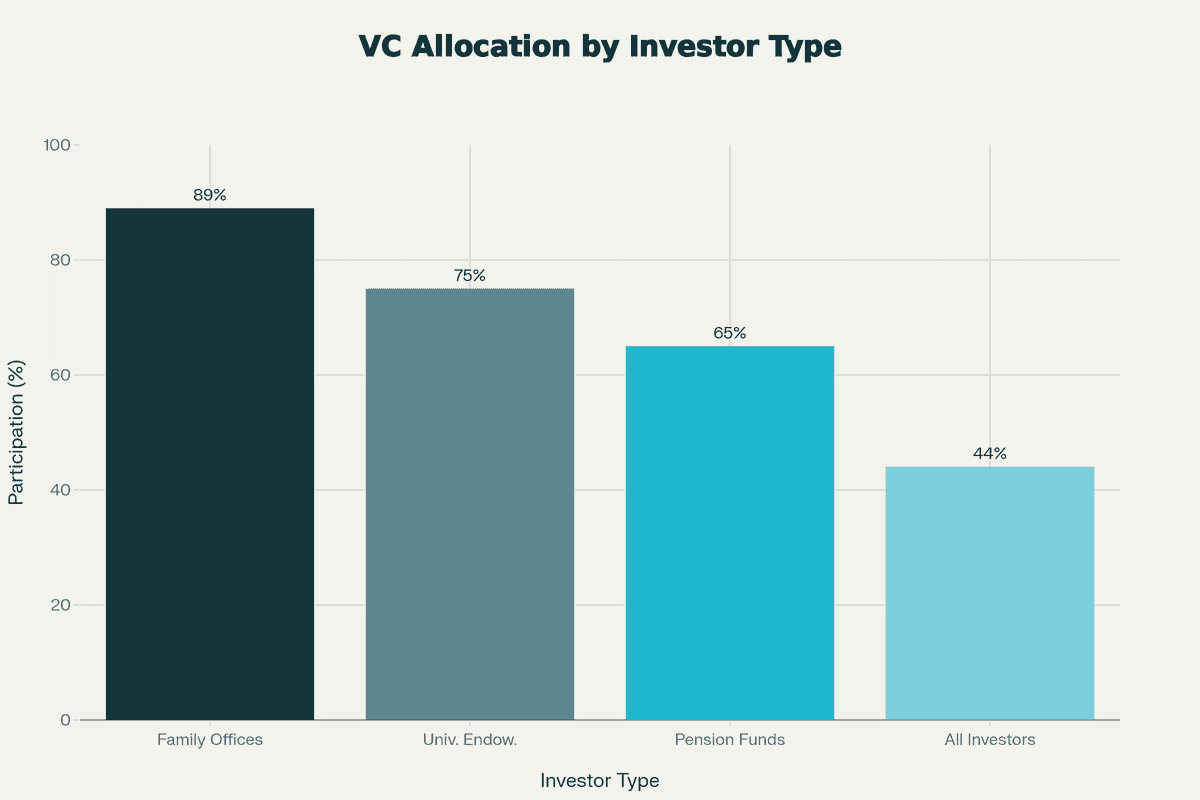

Figure 6: VC Participation Rates by Investor Type - 89% of family offices invest in VC compared to just 44% of all investors, highlighting participation concentration among sophisticated capital sources.

Figure 6: VC Participation Rates by Investor Type - 89% of family offices invest in VC compared to just 44% of all investors, highlighting participation concentration among sophisticated capital sources.

University endowments have strategically increased their venture capital exposure. Mega endowments with over $5 billion in assets now allocate 14% to venture capital and 20% to other private equity investments. Northwestern University's endowment increased its overall equity allocation from 57% in 2020 to a 65% target in 2023, with expected allocations implying that over 57% of total equity investments would be made via private market investments, including substantial VC exposure.

Family offices emerge as the most bullish institutional allocators. 89% of family offices invest in venture capital compared to just 44% of the broader investor universe. Family offices allocate an average of 22% to private equity overall—the highest allocation of all alternative asset classes. Looking forward, two-thirds of larger family offices (those with over $1 billion in assets) plan to increase exposure to private equity funds over the next 12 months, representing a nearly 70% increase relative to last year's figure.

Figure 7: LP Sentiment Trends - Growing intention to increase VC allocations, with large family offices at 66.5% planning increases, signaling improved confidence in venture capital asset class.

Figure 7: LP Sentiment Trends - Growing intention to increase VC allocations, with large family offices at 66.5% planning increases, signaling improved confidence in venture capital asset class.

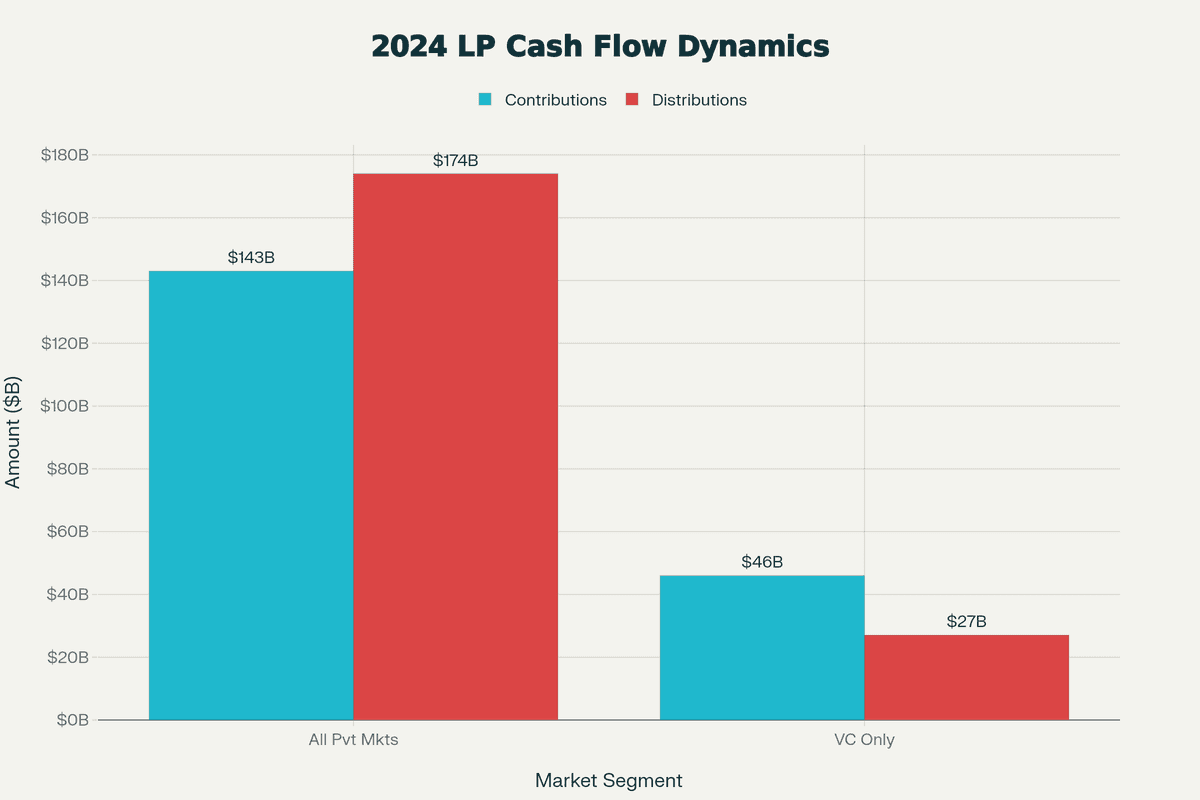

Even aggregate deployment data contradicts the cooling narrative. Cambridge Associates' 2024 data shows LP cash flows improved significantly, with distributions ($174 billion) outpacing contributions ($143 billion) for the first time in three years. For venture capital specifically, managers called $46 billion from LPs—the second highest for any year on record.

Figure 8: LP Cash Flow Dynamics (2024) - While overall private equity distributions ($174B) exceeded contributions ($143B), VC specifically called $46B but distributed only $27B, constraining LP capacity for new commitments.

Figure 8: LP Cash Flow Dynamics (2024) - While overall private equity distributions ($174B) exceeded contributions ($143B), VC specifically called $46B but distributed only $27B, constraining LP capacity for new commitments.

The AI sector alone attracted $131.5 billion in venture capital investment in 2024, accounting for 35.7% of all dollars allocated to venture globally. This represents unprecedented capital concentration in a single thematic area, suggesting that LP appetite for the right opportunities remains robust.

Who's Actually Struggling?

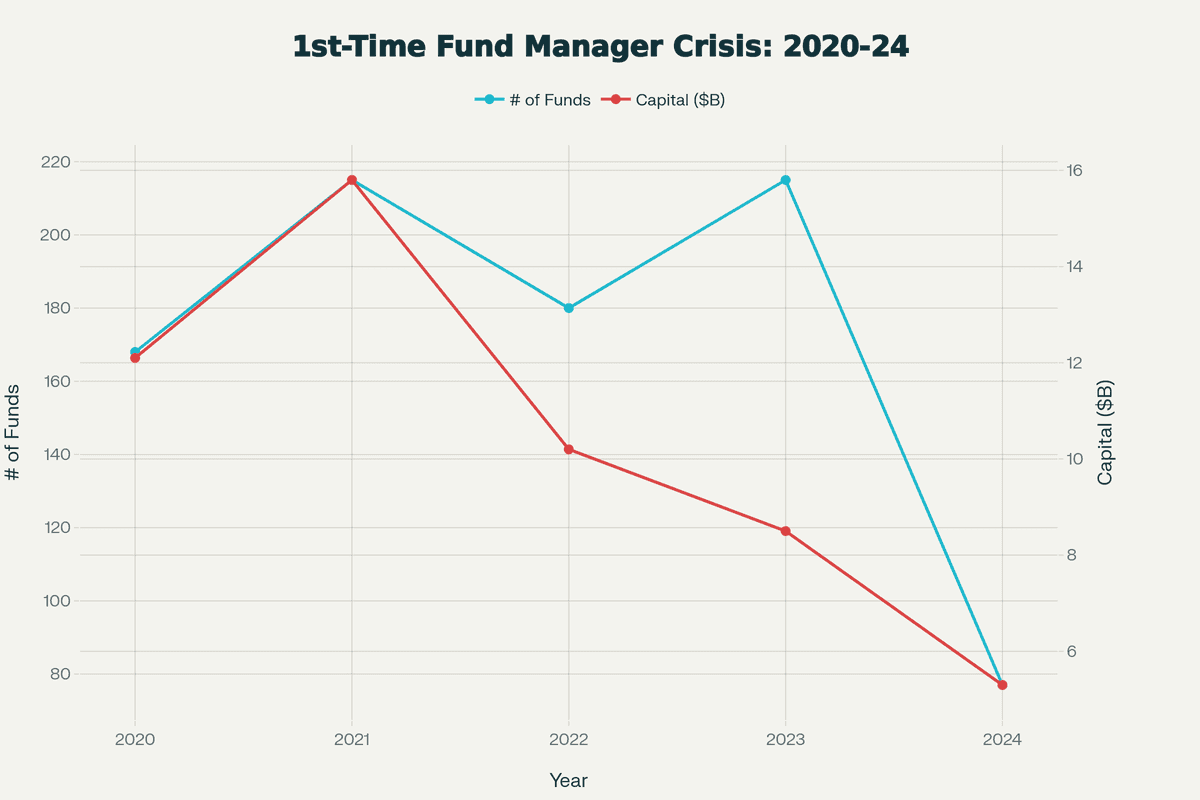

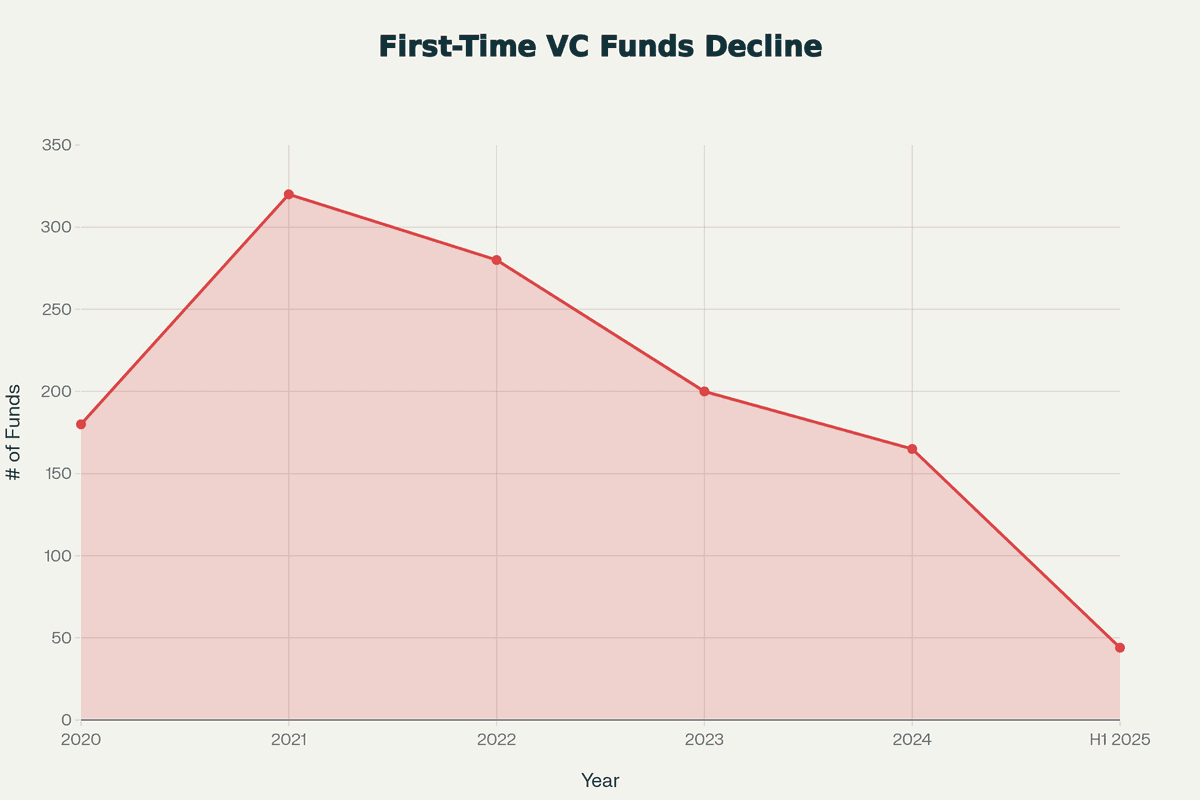

The bifurcation becomes clear when examining which managers are shut out of capital. First-time fund managers raised just $5.3 billion in 2024, representing a 66% year-over-year decline and marking the lowest capital availability for new managers in the past decade. Only 77 first-time funds closed in 2024, compared to 215 in 2023.

Figure 9: Concentration by Fund Category - Progressive concentration from Top 9 funds (46%) to Top 30 (75%), leaving all other 500+ funds competing for just 25% of capital.

Figure 9: Concentration by Fund Category - Progressive concentration from Top 9 funds (46%) to Top 30 (75%), leaving all other 500+ funds competing for just 25% of capital.

Figure 10: First-Time Manager Crisis (2023-2024) - Dramatic 64% decline in number of first-time funds, with capital raised falling 66% year-over-year to decade-low $5.3 billion.

Figure 10: First-Time Manager Crisis (2023-2024) - Dramatic 64% decline in number of first-time funds, with capital raised falling 66% year-over-year to decade-low $5.3 billion.

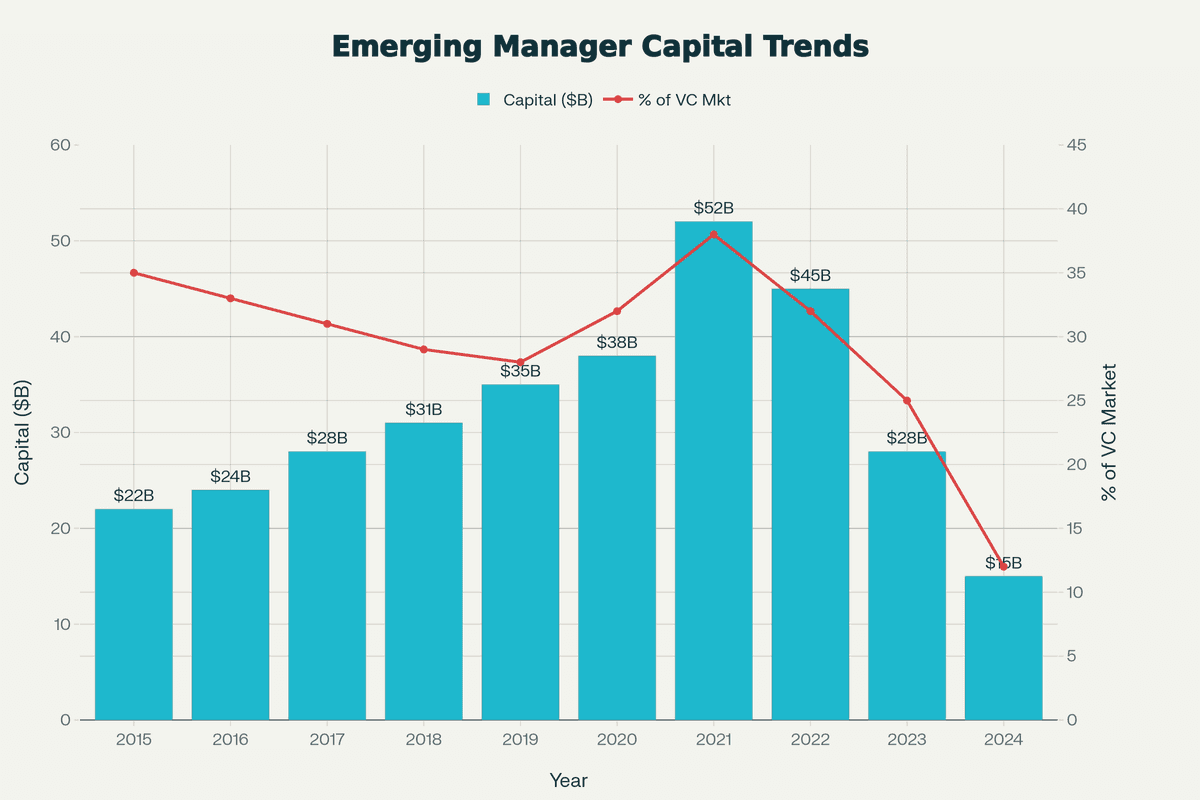

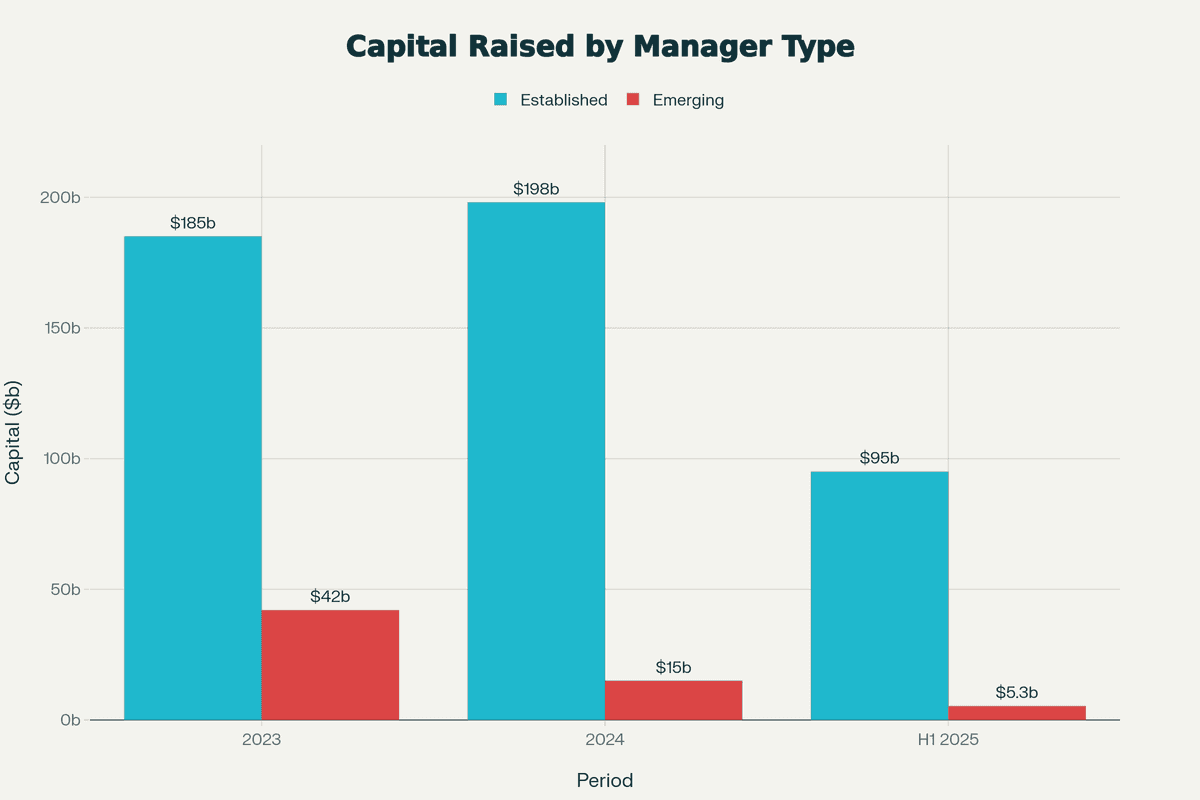

Emerging managers outside the top 30 raised only 14% of total capital ($9.1 billion)—the lowest share in a decade. This represents a dramatic reversal: emerging managers raised only 20% of 2024's capital ($15 billion) across 245 funds, whereas established managers collectively raised far more despite launching fewer funds.

The decline in first-time and emerging fund formations has been precipitous. Between 2021 and 2024, the number of new venture funds fell by 68%, with a 46% annual decline in 2024 alone. Of the top 30 firms raising $500+ million funds, only 4 were emerging managers, while 26 were experienced firms with established track records.

Figure 11: First-Time VC Fund Formation - 86% collapse over four years, from 320 funds in 2021 peak to just 44 in H1 2025, representing structural crisis for emerging managers.

Figure 11: First-Time VC Fund Formation - 86% collapse over four years, from 320 funds in 2021 peak to just 44 in H1 2025, representing structural crisis for emerging managers.

Figure 12: Capital Raised by Manager Type - Emerging managers' fundraising collapsed 66% while established managers maintained significantly higher volumes, demonstrating LP flight-to-quality.

Figure 12: Capital Raised by Manager Type - Emerging managers' fundraising collapsed 66% while established managers maintained significantly higher volumes, demonstrating LP flight-to-quality.

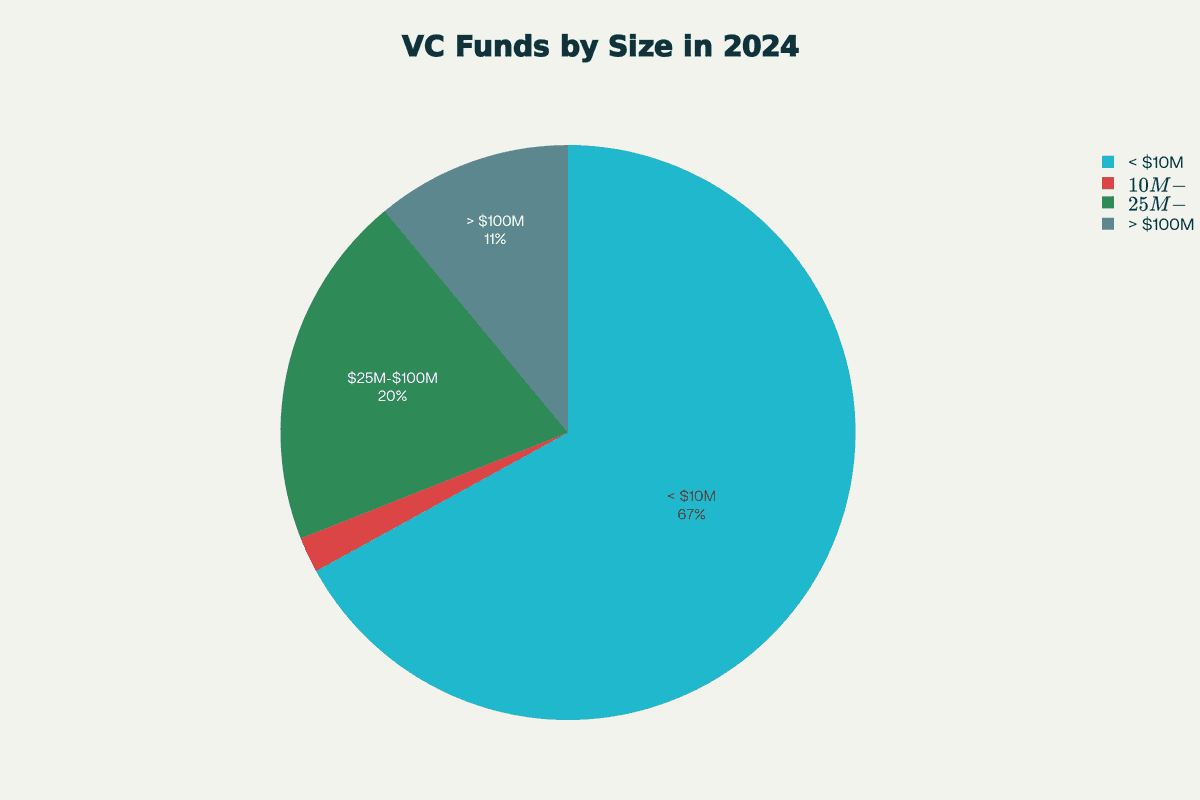

The mid-market segment faces particular pressure. The number of funds between $25-100 million dropped sharply from 36% of the 2020 vintage to just 22% of the 2024 vintage. Meanwhile, 42% of all funds closed in 2024 were between $1-10 million in size, up from 25% in 2020. The middle is being squeezed out, leaving only mega-funds at the top and micro-funds at the bottom.

Figure 13: Extreme Capital Concentration in 2024 - Just 9 firms raised $35B (46% of total), while remaining 500+ firms collectively raised only $19.1B, demonstrating unprecedented winner-take-all dynamics.

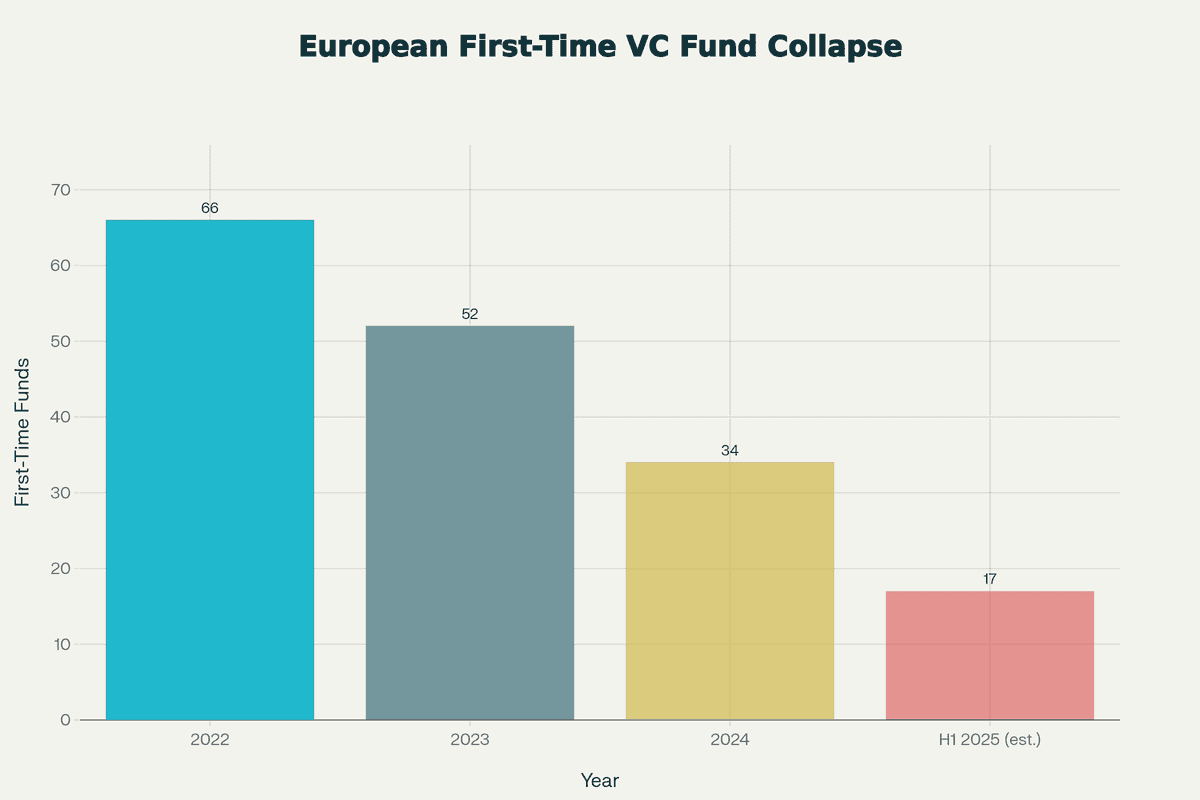

Figure 14: European First-Time VC Funds - 48% collapse from 2022 peak, signaling global weakness in emerging manager formation extends beyond US markets.

Figure 14: European First-Time VC Funds - 48% collapse from 2022 peak, signaling global weakness in emerging manager formation extends beyond US markets.

Figure 15: Fund Size Distribution for New 2024 Funds - 69% targeting under $25M reflects "minimal viable fund" strategy as emerging managers adapt to capital scarcity.

Figure 15: Fund Size Distribution for New 2024 Funds - 69% targeting under $25M reflects "minimal viable fund" strategy as emerging managers adapt to capital scarcity.

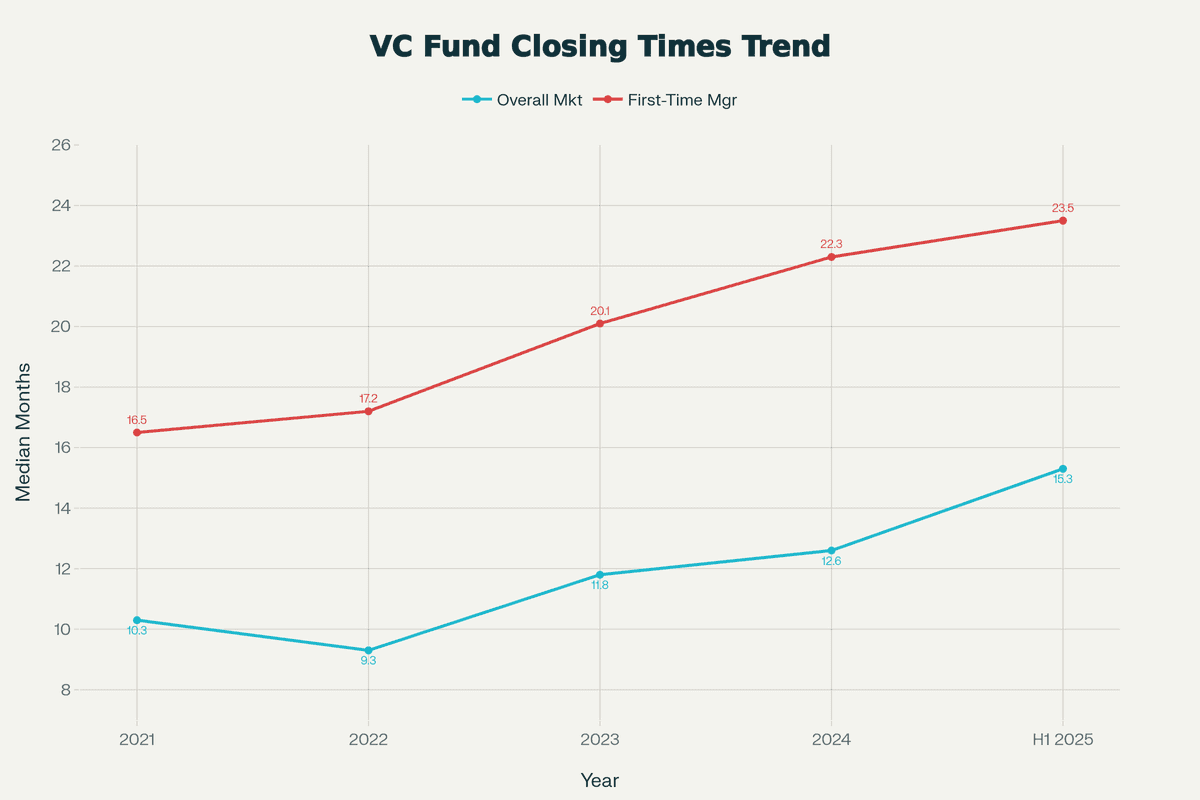

Fundraising timelines have extended dramatically for those outside the elite tier. The median time to close a VC fund rose to 15.3 months in the first half of 2025, up from 12.6 months in 2024. First-time fund managers typically encounter fundraising timelines of 18 to 24 months in the current environment, compared with 12-month cycles common during favorable markets.

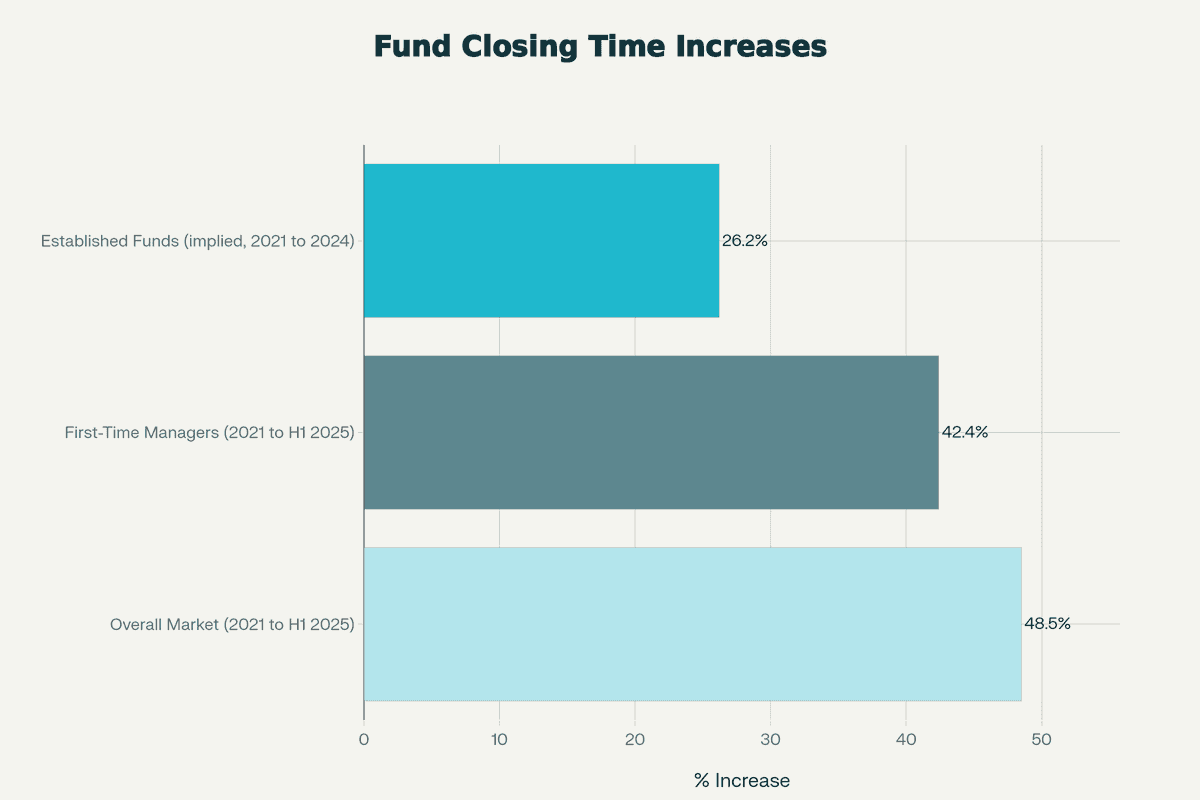

Figure 16: Median VC Fund Closing Timeline Trends - Overall market timelines rose 49% from 2021, while first-time managers face 43% longer cycles, demonstrating structural disadvantage for emerging managers.

Figure 16: Median VC Fund Closing Timeline Trends - Overall market timelines rose 49% from 2021, while first-time managers face 43% longer cycles, demonstrating structural disadvantage for emerging managers.

Figure 17: Percentage Increase in Closing Timelines (2021 Baseline) - Emerging managers face disproportionate impact with 42.4% timeline extensions versus 26.2% for established funds.

Figure 17: Percentage Increase in Closing Timelines (2021 Baseline) - Emerging managers face disproportionate impact with 42.4% timeline extensions versus 26.2% for established funds.

Figure 18: The LP Squeeze - Median LP count fell 43% (83 to 47) while median anchor checks jumped 51% ($23.1M to $35M), creating funding dependency and concentration risk for mid-market managers.

Figure 18: The LP Squeeze - Median LP count fell 43% (83 to 47) while median anchor checks jumped 51% ($23.1M to $35M), creating funding dependency and concentration risk for mid-market managers.

Figure 19: Emerging Manager Capital Trends - Fundraising collapsed to $15B in 2024 (lowest since 2015), with market share declining from 2021 peak of 38% to just 12%, visualizing the systematic exclusion from institutional capital.

The Real Story: Flight to Quality

Limited Partners aren't reducing venture capital allocations—they're reallocating them toward proven performers. This "flight to quality" dynamic has intensified during uncertain market periods when LPs focus on fulfilling existing commitments rather than deploying capital to unproven managers.

Three structural factors drive this concentration.

First, subdued exit markets have depressed distributions to LPs. With distributions remaining constrained due to limited IPO and M&A activity, LPs have insufficient capital to recycle into emerging managers. The median DPI (distributions to paid-in capital) for the 2017 vintage stands at just 0.27x as of Q1 2025, far below the historical benchmark of 1.0x+ by fund maturity. LPs are deferring new commitments until distributions normalize, creating a self-reinforcing cycle.

Second, return expectations have shifted. Emerging managers face heightened skepticism because venture capital returns have fallen below 2000s-2010s benchmarks. LPs, burned by poor recent performance from 2021-2022 vintage funds, seek safety in mega-funds rather than taking bets on emerging talent. Essentially all capital (98%) in 2024 went to experienced fund managers, with 40% directed to funds raising $5 billion or more.

Third, the AI premium has created a winner-take-all dynamic. The largest raises of 2025—a16z's potential $20 billion fund, Insight Partners' $12.5 billion Fund XIII, Thrive Capital's $5 billion—are explicitly linked to the capital requirements of the AI wave. Firms are securing war chests to fund compute-heavy startups and compete for deals in the generative AI space. LPs believe that only established platforms with deep pockets and extensive networks can capture the most promising AI opportunities.

Sector focus matters profoundly. Funds with clear AI, cybersecurity, or biotech mandates have found receptive LP audiences, while generalist funds face skepticism. Specialized sub-funds have proliferated: Andreessen Horowitz split its $7.2 billion raise into five specific strategies (Gaming, Apps, American Dynamism, AI, and Growth). General Catalyst allocated distinct buckets for "creation" (incubation) versus core VC. Sequoia continues to separate strict early-stage vehicles from its massive evergreen growth vehicle, which reached $19.6 billion in assets by February 2025.

Geographic variations reinforce this pattern. North America attracts 67% of deployment activity, benefiting from concentration of innovation networks, regulatory clarity regarding crypto and fintech, and depth of exit markets. European VC fundraising faces headwinds, with first-half 2025 raising only €3.6 billion despite stronger 2024 performance overall.

What This Means for the Industry

Two completely different venture capital markets are operating simultaneously, each with distinct rules, participants, and outcomes.

The first market consists of elite mega-funds and established platforms. These firms control 74-75% of all capital, command deal access in hot sectors like AI, enjoy institutional LP commitments at scale, and benefit from established networks and brand signaling. They demonstrate confidence in their ability to navigate extended deployment timelines and market cycles. Fundraising timelines remain manageable (12-15 months), oversubscription is common, and LP relationships are deep and enduring.

The second market consists of emerging and first-time managers. These participants access 20-26% of capital, face structural constraints in raising beyond first or second funds, depend on individual and family office capital, are limited to narrower sectors and earlier stages, and struggle with extended fundraising cycles and LP constraints. Yet paradoxically, this tier delivers higher median IRRs and top-quartile performance more frequently than established peers. Among top-performing VC firms in recent years, 60% were led by emerging managers, particularly in seed and early-stage investing.

The middle class of venture capital is disappearing. Funds between $25-100 million—once the backbone of the industry—are being squeezed out. This category represented 36% of 2020 vintage funds but just 22% of 2024 vintages. These mid-market managers lack the scale advantages of mega-funds and the nimbleness of micro-funds, leaving them vulnerable to LP consolidation.

This bifurcation creates profound implications for innovation. Emerging managers historically drive breakthrough returns by backing unconventional founders, pursuing contrarian theses, and operating outside consensus. If only 20% of capital flows to this segment, the industry risks becoming dominated by consensus thinking and follow-on rounds rather than early-stage risk-taking. High-net-worth individuals and wealth managers are stepping into the void left by institutional LPs, presenting opportunities for emerging managers to access non-traditional capital, but this substitution is incomplete.

The performance paradox remains stark: emerging managers achieve top-quartile performance 34% of the time, compared to 25% for all funds, and deliver returns that are 250 basis points higher on average. Top-decile TVPI (total value to paid-in capital) is often highest in smaller funds. For the 2018 vintage, the 90th percentile TVPI among funds with $1 million to $10 million in assets was 4.03x, while for funds with $100 million or more in assets, it was 1.67x. Yet LPs continue allocating disproportionately to established firms, reflecting institutional constraints and perceived stability over return optimization.

Conclusion: Nuance Matters

Some veteran funds struggle mightily in the current fundraising environment. Others are raising record amounts and closing oversubscribed rounds with unprecedented speed. The determining factor isn't vintage or experience per se, but rather track record, sector focus, LP relationships, and market positioning.

Understanding bifurcation is crucial for all ecosystem participants. Limited Partners must recognize that blanket allocation strategies based on "vintage year" or "fund size" miss the point entirely. The relevant question is whether a manager operates in the elite tier with demonstrable distribution track records or in the emerging tier requiring patient, committed capital.

Fund managers must understand which market they're in. Established platforms should lean into their advantages: scale, brand, operational resources, and multi-stage capabilities. Emerging managers should embrace their differentiation: specialized expertise, access to unconventional deal flow, and alignment of interests through meaningful GP co-investment.

The future belongs to those who recognize which market they're in and operate accordingly. Industry sentiment often captures widespread feelings about market conditions, but sentiment and reality diverge sharply when capital concentration reaches unprecedented levels. Some veteran funds aren't just surviving in 2024-2025. They're thriving at historic scale while others face existential challenges.

The VC market hasn't cooled. It has bifurcated. That distinction matters profoundly for anyone seeking to understand where capital is flowing, why certain managers succeed while others fail, and what the future holds for an industry defined increasingly by concentration at the top and opportunity at the edges.